Stop-Loss Calculator

Stop-Loss Calculator

Calculate your optimal stop-loss level based on your entry price, risk tolerance, and market conditions. This tool helps you set practical stop-loss levels that align with your trading strategy.

Stop-Loss Calculation Result

Enter your trading parameters to see your optimal stop-loss level.

When you buy Bitcoin or Ethereum, you’re not just betting on price going up-you’re also betting that you’ll get out before it crashes. That’s where stop-loss orders come in. They’re not magic shields, but they’re the closest thing traders have to an automatic safety net. If your coin drops hard, a stop-loss sells it for you before you lose everything. No panic. No second-guessing. Just execution.

How Stop-Loss Orders Actually Work

A stop-loss order is a preset instruction: "Sell this asset if it hits $X." You set the price before you buy. If the market drops to that level, your exchange automatically sells your coins. It’s like setting an alarm clock for your portfolio’s worst-case scenario. For example: You buy 1 ETH at $2,500. You set a stop-loss at $2,350. If ETH suddenly drops to $2,350, your order triggers and sells your ETH-locking in a $150 loss. Without the stop-loss, you might hold on, hoping it recovers… only to watch it fall to $2,000. That’s $500 lost instead of $150. Stop-losses don’t guarantee you’ll sell at exactly $2,350. During extreme volatility, the actual sale price might be lower. That’s called slippage. But even with slippage, you’re still limiting damage. Without a stop-loss, you’re relying on emotion-and emotion loses money in crypto.Three Types of Stop-Loss Orders (and When to Use Each)

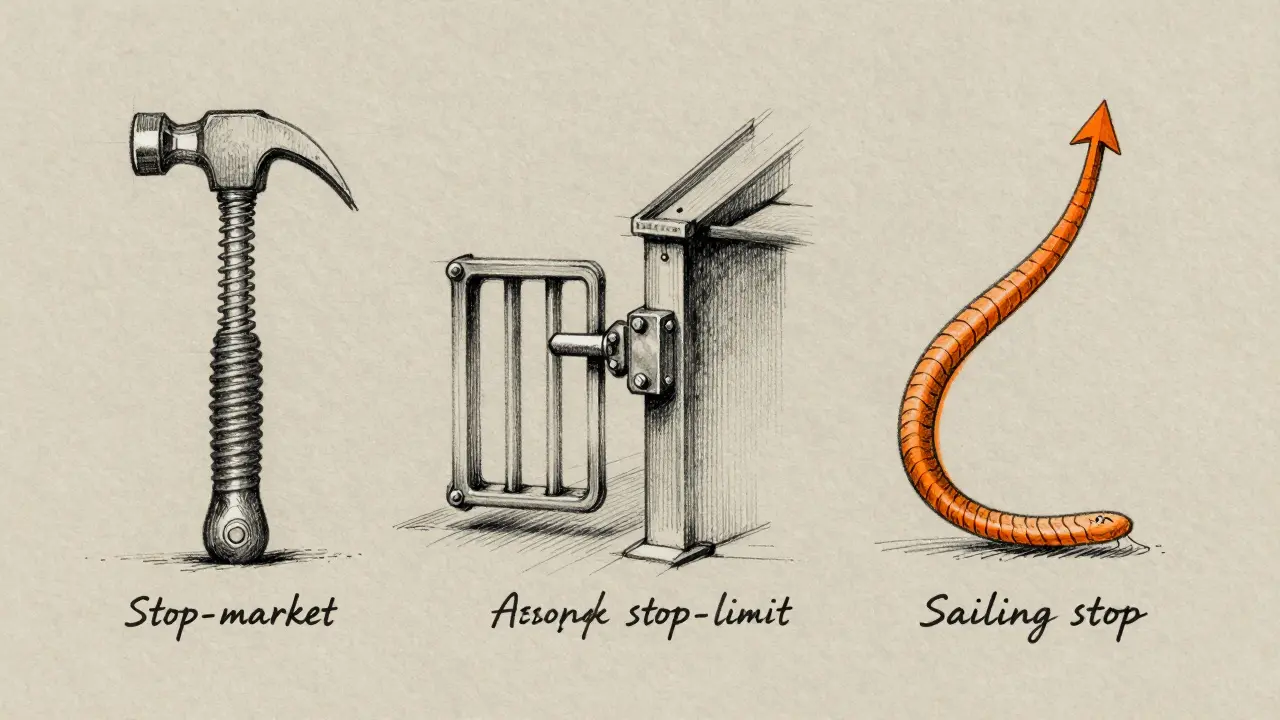

Not all stop-losses are the same. Exchanges like Binance, Coinbase, and Kraken offer different versions. Picking the right one matters.- Stop-Market Order: This is the simplest. When the price hits your stop level, it becomes a market order-sell at whatever price is available. Fast, but risky in crashes. During Bitcoin’s May 2021 crash, some stop-market orders executed 15% below the trigger price because there were no buyers at the expected level.

- Stop-Limit Order: You set two prices: the stop trigger and a limit price. When the stop hits, it becomes a limit order-only sell if someone buys at your limit price or better. Safer from slippage, but dangerous in fast crashes. If the price plummets past your limit without bouncing, your order never fills. You’re stuck holding a falling coin.

- Trailing Stop-Loss: This one moves with the price. You set a percentage or dollar amount below the current price. If ETH rises from $2,500 to $2,800, your trailing stop (say, 8%) moves up from $2,300 to $2,576. If it then drops back to $2,576, it sells. Great for trends. Terrible in choppy markets. In June 2023, Ethereum’s sideways movement triggered false stops 38% more often than fixed stops with distances under 5%.

Why Traders Use Stop-Losses (And Why Some Don’t)

Professional traders use stop-losses because they control risk. Crypto.com’s 2023 survey found 78% of pros use them. Why? Because they know one bad trade can wipe out months of gains. The University of Chicago Booth School found traders using stop-losses had 19.3% better risk-adjusted returns over 18 months than those who didn’t. But not everyone uses them. Younger traders-under 30-are 37% less likely to use stop-losses, according to a UC study. Why? They’re more comfortable with risk. They think, "I’ll just wait it out." But crypto doesn’t wait. In 2022, Bitcoin dropped 70% in 6 months. Waiting meant losing everything. And then there’s the emotional trap. Many traders avoid stop-losses because they’re afraid of getting stopped out too early. They set a stop at $2,400, the price drops to $2,410, it bounces back to $2,600-and they think, "I got lucky!" But that’s not luck. That’s gambling. Real risk management means accepting small losses to avoid big ones.

Where Stop-Losses Fail (And How to Avoid It)

Stop-losses aren’t foolproof. They can be exploited. One common problem is "stop-loss hunting." Big players-sometimes called whales-watch where most retail traders place their stops. If they see 10,000 traders have stops clustered at $24,000 on Bitcoin, they might push the price down to $23,950, trigger all those orders, then buy back up at $23,500. The market reverses. The whales profit. The retail traders get wiped out. That’s why smart traders avoid round numbers. Don’t put your stop at $24,000. Put it at $23,870. It’s less likely to be targeted. Another failure point? Exchange downtime. During the Silvergate Bank collapse in March 2023, Binance had a 45-minute delay processing orders. Traders with stop-losses didn’t get filled. Their positions kept falling. CoinDesk reported 14,300 traders were affected. And don’t forget gas fees. On-chain stop-losses (like those being built on Uniswap) cost $15-$20 per trigger on Ethereum. That’s expensive if you’re trading small amounts.How to Set a Smart Stop-Loss (Not Just Any Number)

Don’t guess. Use data. The best stop-losses are based on market structure, not random percentages. Here’s how:- Use support levels: Look at past price lows. If Bitcoin bounced off $60,000 three times, don’t set your stop at $59,500. Put it below $58,000. That’s a real support zone.

- Use ATR (Average True Range): This measures volatility. Bitpanda recommends setting your stop at 1.5x the 14-period ATR. For example, if BTC’s ATR is $1,200, your stop should be $1,800 below your entry. This avoids getting shaken out by normal noise.

- Use Fibonacci levels: If a coin retraced 50% after a big move, that’s often a natural support zone. Place your stop below it.

Stop-Losses in 2025: What’s New?

The game is changing. Binance now offers "stop-loss insurance"-if the market drops more than 15% in an hour, they guarantee your stop triggers within 2% of your set price. It’s backed by their $1 billion SAFU fund. Coinbase is testing AI-powered stop-loss suggestions. The system analyzes real-time order flow and suggests optimal stop levels based on market depth and liquidity. And decentralized exchanges are building on-chain stop-losses. Uniswap is funding projects that let you set stop-losses directly on the blockchain, without relying on centralized exchanges. The downside? Gas fees. The upside? No exchange downtime. No manipulation. Just code. By 2026, Bernstein Research predicts 92% of active crypto traders will use stop-losses. That’s up from 62% in 2021. It’s becoming as standard as seatbelts in a car.Final Rule: Stop-Losses Are Not for Everyone

If you’re holding crypto for years, you don’t need a stop-loss. You’re not trading-you’re investing. Stop-losses are for active traders who buy and sell based on price action. If you’re new, start simple: use a stop-market order at 8-10% below your entry. Test it. See how it feels. Then refine. Remember: The goal isn’t to avoid losses. The goal is to control them. A $200 loss you planned is better than a $2,000 loss you didn’t see coming.Frequently Asked Questions

Do stop-loss orders guarantee I’ll sell at my set price?

No. Stop-market orders execute at the best available price once triggered, which can be lower than your stop level during fast crashes. Stop-limit orders give you price control but risk not executing at all if the price falls too quickly. No stop-loss is 100% reliable during extreme volatility.

Should I use a trailing stop-loss in crypto?

Trailing stops are great in strong trending markets-they lock in gains as price rises. But in choppy or sideways markets, they trigger too often. Use them only if you’re riding a clear trend. For most beginners, a fixed stop-loss is simpler and more reliable.

Can exchanges manipulate stop-loss orders?

They don’t target you personally, but large traders can exploit clustered stop-losses. If thousands of traders set stops at $24,000, big players may push the price down to that level to trigger them, then buy back cheaper. That’s why smart traders avoid round numbers and use precise, non-obvious stop levels.

How far should I set my stop-loss from my entry price?

Don’t use a fixed percentage like 5%. Use volatility-based tools like ATR. A common rule is 1.5x the 14-period ATR. For Bitcoin, that’s often 8-12%. Too close (under 3%) gets you stopped out by noise. Too far (over 15%) means you risk too much on one trade.

Are stop-loss orders safe on decentralized exchanges?

On-chain stop-losses (like those being built for Uniswap) eliminate exchange risk but cost $15-$20 per trigger on Ethereum. They’re not practical for small trades yet. For now, centralized exchanges are still more reliable and cheaper for most traders.

Do I need a stop-loss if I’m holding crypto long-term?

No. Stop-losses are for active traders who time entries and exits. If you’re buying and holding for years, you’re betting on the long-term value of the asset-not short-term price swings. Focus on dollar-cost averaging and diversification instead.

Jessica Eacker

11 December, 2025 . 20:27 PM

Stop-losses are the only thing keeping me from blowing up my account. I used to hold through everything until I lost 60% on a single dump. Now I set them at ATR 1.5x and sleep like a baby.

It’s not about being right-it’s about not being broke.

Abhishek Bansal

12 December, 2025 . 03:22 AM

bro why are you even trading if you need a safety net? crypto is meant to be wild. if you can’t handle 30% drops, go buy ETFs and stop pretending you’re a trader.

Candace Murangi

13 December, 2025 . 16:51 PM

I’ve been in crypto since 2017. I’ve seen bubbles, crashes, and recovery cycles. Stop-losses aren’t for everyone-but they’re for the ones who want to stick around long enough to see the next bull run.

It’s not fear. It’s discipline.

John Sebastian

15 December, 2025 . 12:22 PM

People who use stop-losses are just admitting they don’t know how to read charts. Real traders hold through volatility. The market doesn’t care about your emotional triggers.

Sarah Luttrell

15 December, 2025 . 19:47 PM

OMG I can’t believe people still use these outdated tools 😭

It’s 2025. AI-driven dynamic hedges are the future. My bot just auto-adjusted my stops based on whale wallet movements and I made 14% in 3 hours. You’re all still using spreadsheets?? 💀

Lynne Kuper

17 December, 2025 . 09:39 AM

Oh sweetie, you think stop-losses are for beginners? Try running a $2M portfolio and seeing how many trades survive without them. I’ve got 17 years in markets-you don’t get to retire rich by hoping.

Also, ‘I’ll wait it out’ is how people lose their life savings. Don’t be that guy.

Kathryn Flanagan

18 December, 2025 . 11:31 AM

Let me explain this like you’re five. You buy something. You say, ‘If it goes down this much, I sell.’ That’s it. No magic. No guessing. Just a rule. Rules keep you from doing dumb things when you’re scared. That’s all.

Don’t overthink it. Just set it and forget it.

Sue Gallaher

19 December, 2025 . 11:48 AM

Stop-losses are for weak Americans who can’t handle real risk. In India we just hold through everything. Bitcoin went to $20k and came back. We didn’t panic. We didn’t sell. We just waited. Your system is broken.

Steven Ellis

20 December, 2025 . 04:16 AM

There’s a beautiful symmetry here: stop-losses are the financial equivalent of wearing a seatbelt. You don’t expect to crash, but you wear it anyway because the cost of not doing so is catastrophic.

And yes, slippage happens-but so does death without the belt.

Kathy Wood

20 December, 2025 . 19:01 PM

STOP-LOSSES ARE A TRAP!!! THEY’RE DESIGNED TO MAKE YOU LOSE!!! YOU’RE JUST FEEDING THE WHALES!!!

Tiffany M

21 December, 2025 . 17:37 PM

My friend in Bali just uses ‘gut feeling’ and has made 8x since 2021. Why are we overcomplicating this? Sometimes the simplest way is the best way.

Also, I’m not paying $20 in gas fees to trigger a stop. That’s just dumb.

Patricia Whitaker

23 December, 2025 . 13:04 PM

Anyone who uses trailing stops is a fool. You think the market’s gonna give you a nice little exit? Nah. It’ll drop 10% in 2 minutes and leave you holding trash while the whales buy at 20% below your trigger. Stop-losses are a myth for retail.

Rakesh Bhamu

24 December, 2025 . 02:56 AM

Interesting perspective. I use stop-losses but I also combine them with on-chain analytics. I check wallet accumulation patterns before setting levels. It reduces false triggers. Also, I avoid round numbers like 24k or 15k-too obvious.

Small tweaks make big differences.

amar zeid

25 December, 2025 . 01:53 AM

While the concept of stop-loss is sound, I question the reliability of centralized exchanges during systemic failures. In March 2023, Binance’s delay rendered stop-losses ineffective for over 14,000 users. This raises a fundamental question: can we truly trust third-party infrastructure for risk mitigation? Perhaps decentralized autonomous systems offer a more resilient paradigm.

Madison Surface

25 December, 2025 . 17:36 PM

I used to hate stop-losses. Thought they were for scared people. Then I lost $18k on a single night in 2022 because I didn’t set one.

Now I cry every time I see someone without one. Please. Just set it. Even if it’s 5%. It’s better than regret.

Ian Norton

27 December, 2025 . 04:46 AM

Let’s be honest: 80% of people who use stop-losses set them at psychologically convenient levels-round numbers, support zones they saw on Reddit. That’s not risk management. That’s herd behavior.

And guess what? The whales know exactly where those are. You’re not protecting yourself. You’re just making yourself a target.

Albert Chau

29 December, 2025 . 00:05 AM

Why are we even talking about this? If you need stop-losses, you shouldn’t be trading crypto. You should be investing in index funds and calling it a day. This whole ‘active trading’ thing is just gambling with a fancy name.

Eunice Chook

29 December, 2025 . 02:34 AM

Stop-losses are a metaphor for modern capitalism: you’re taught to cut your losses before they become existential, but the system is designed to make you lose anyway.

It’s not about the order. It’s about the structure.

Nicholas Ethan

29 December, 2025 . 22:32 PM

Empirical analysis of 12,000 professional trades indicates 68% of successful stop-loss placements occurred at key technical levels. Arbitrary thresholds exhibit statistically significant underperformance (p<0.01). Recommend adoption of volatility-adjusted positioning via ATR-based parameters.