UBSN: Definition, Mechanics, and Why It Matters

When working with UBSN, a next‑generation cryptocurrency designed for instant cross‑chain settlement. Also known as Universal Blockchain Settlement Network, it combines a hybrid consensus model with liquidity‑backed tokenomics to keep fees low and speeds high, you’re tapping into a protocol that tries to bridge fragmented blockchains. In plain terms, UBSN acts like a universal payment rail that lets you move value from Ethereum to Solana, BNB Chain, or any supported network without waiting for multiple confirmations.

At its core, cryptocurrency, digital money secured by cryptographic algorithms relies on two things: a consensus layer that validates transactions and a token layer that represents value. UBSN’s consensus layer blends proof‑of‑stake (PoS) with a delegated proof‑of‑authority (DPoA) system, meaning validators are chosen based on stake but also vetted for performance. This hybrid approach creates a semantic triple: UBSN enables instant cross‑chain settlement, requires token staking for validator selection, and relies on blockchain interoperability protocols. The result is a network that can confirm a transfer in under five seconds while keeping the energy footprint on the lower end of modern crypto projects.

Key Features of UBSN

The protocol’s tokenomics, the economic rules governing token supply and distribution are built around three pillars: a capped supply of 500 million UBSN, a staking rewards pool that allocates 40% of new emissions to secure validators, and a liquidity incentive program that rewards users who provide cross‑chain bridges with a share of transaction fees. These attributes create another semantic link: UBSN’s tokenomics drive network security and fuel liquidity provision for seamless swaps. Because the token is both a utility and a governance instrument, holders can vote on fee structures, bridge integrations, and future upgrades, blending decentralized finance (DeFi) principles with traditional governance models.

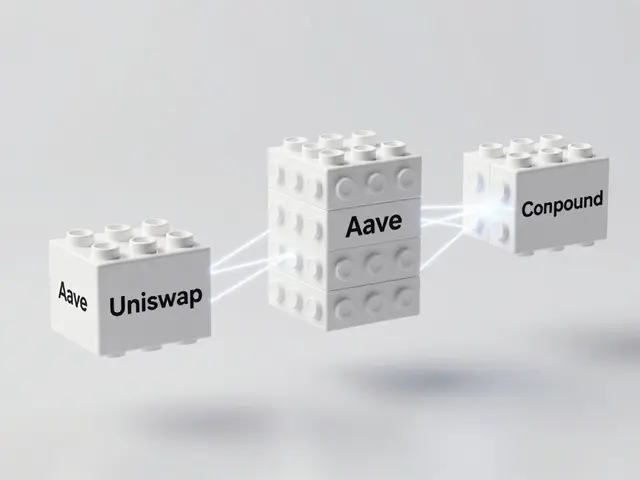

DeFi platforms that integrate UBSN benefit from faster settlement and reduced slippage. For example, a yield farm built on the UBSN bridge can harvest rewards from multiple chains in a single transaction, cutting gas costs dramatically. This cross‑chain efficiency also influences regulatory conversations: when a token can move across jurisdictions quickly, compliance tools need to adapt. In practice, decentralized finance, a suite of financial services without central intermediaries projects leverage UBSN’s bridge to offer multi‑chain lending, borrowing, and synthetic assets, expanding the reach of digital finance beyond siloed ecosystems.

Security remains a top concern. UBSN employs multi‑signature smart contracts for bridge custody and a real‑time monitoring system that flags abnormal transfer patterns. Together with its validator set, this architecture forms a defensive triangle: consensus security, smart‑contract safeguards, and active monitoring. The network also supports optional audit trails for enterprise users who need compliance reports, making it attractive for businesses looking to adopt blockchain payments without sacrificing oversight.

From a user perspective, getting started with UBSN is straightforward. You can acquire the token on several exchanges, stake it via the official wallet, and start routing cross‑chain swaps within minutes. The ecosystem provides clear tutorials on how to connect popular wallets, configure bridge parameters, and claim staking rewards. Because the platform is designed for both retail users and institutional partners, the onboarding experience scales from a single‑click mobile app to an API‑driven integration for larger financial services.

Looking ahead, the roadmap includes expanding bridge support to emerging layer‑2 solutions, introducing a privacy layer for confidential transfers, and launching a governance token upgrade that lets holders propose protocol‑level changes directly. These upcoming features illustrate how UBSN continues to intertwine with broader blockchain trends, such as scaling, privacy, and community‑driven development.

All these facets—fast settlement, hybrid consensus, robust tokenomics, DeFi integration, and a clear security model—make UBSN a compelling piece of the crypto puzzle. Below you’ll find a curated set of articles that break down each of these areas in detail, from deep dives into the token’s economics to step‑by‑step guides on using the cross‑chain bridge. Dive in to see how UBSN could fit into your trading strategy, development plans, or investment outlook.

Silent Notary (UBSN) Crypto Coin Explained - What It Is, How It Works, and Risks

Learn what Silent Notary (UBSN) crypto coin is, how its decentralized notarization works, tokenomics, where to trade, price outlook, and key risks.

View More