Transaction Accelerator: Speeding Up Crypto Transactions

When working with transaction accelerator, a tool or protocol that speeds up blockchain transfers and cuts down on network fees, you’re essentially tackling the bottleneck that slows down crypto payments. Also known as gas token, a token that can be burned to lower transaction costs on platforms like Ethereum, it works hand‑in‑hand with layer‑2 solutions, off‑chain scaling networks that batch many transactions into a single on‑chain record. The combination lets users avoid congested mempools, reduces confirmation times, and keeps wallets from draining on fees. In short, a transaction accelerator enables faster settlement (transaction accelerator → enables → speed), it requires a layer‑2 bridge (requires → layer‑2 solutions), and it reduces gas spend (reduces → gas token). This trio forms the backbone of modern crypto speed‑up strategies.

Why Transaction Accelerators Matter

Most everyday users hit the wall when a network spikes and fees explode. Here, optimistic rollups act as a specific type of layer‑2 that assumes transactions are valid and only checks them later, shaving off seconds and dollars. When a rollup processes a batch, an accelerator can inject a high‑priority transaction into the queue, guaranteeing it lands in the next block. Decentralized exchanges (DEXs) feel the impact most: a faster order lands before price moves, saving traders from slippage. Similarly, liquidity providers on platforms like SushiSwap or Uniswap benefit because rapid rebalancing prevents impermanent loss. In practice, you might see a trader using a gas token to pre‑pay for a future swap, then triggering the accelerator to execute at the optimal moment. The result is a smoother experience, less chance of stuck transactions, and a clearer path to scaling the entire ecosystem.

Across the articles below you’ll meet specific accelerators, detailed tokenomics of gas‑saving coins, and step‑by‑step guides on how to pair layer‑2 rollups with DEX strategies. Whether you’re a beginner curious about why fees spike, an intermediate trader looking to shave seconds off a swap, or a dev planning to embed an accelerator into a wallet, the collection gives you concrete tools and real‑world examples. Keep reading to see how each piece fits into the larger puzzle of faster, cheaper crypto transactions, and discover actionable tips you can apply right now.

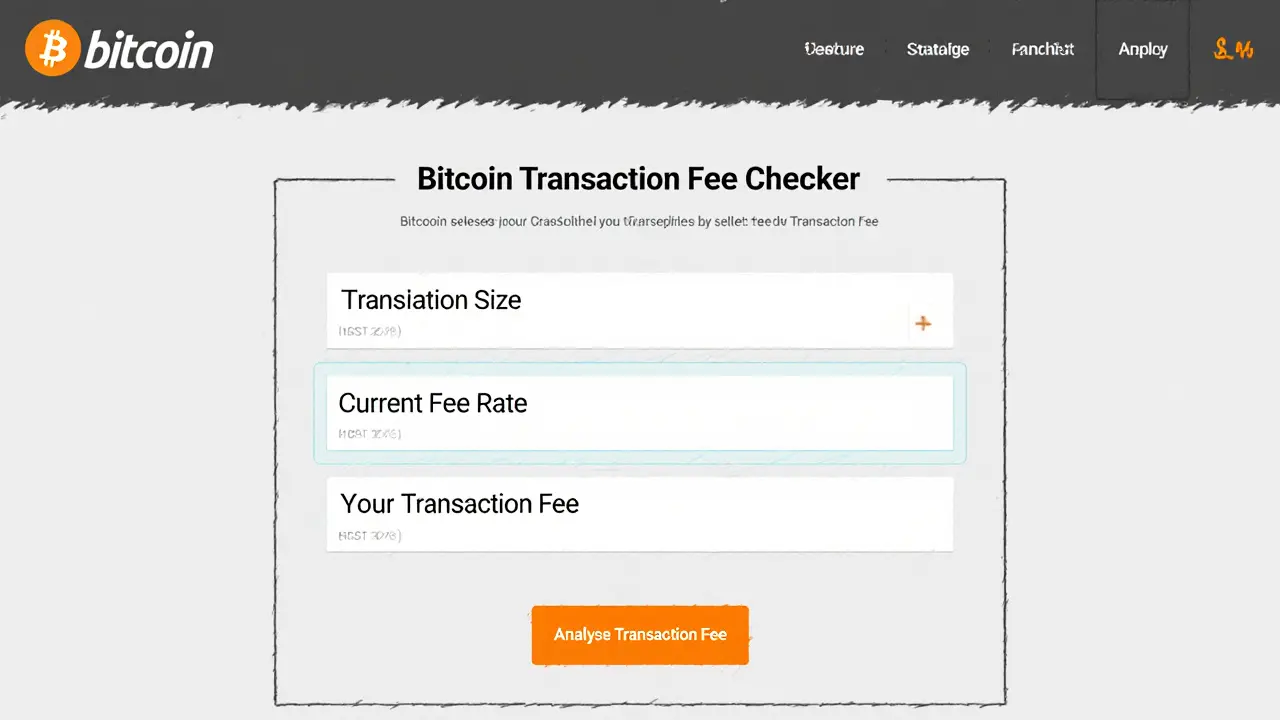

How to Clear Stuck Bitcoin Transactions from the Mempool (2025 Guide)

Learn how to free Bitcoin transactions stuck in the mempool using RBF, CPFP, accelerators, expiration and more-step‑by‑step guide for 2025.

View More