Real Estate Blockchain

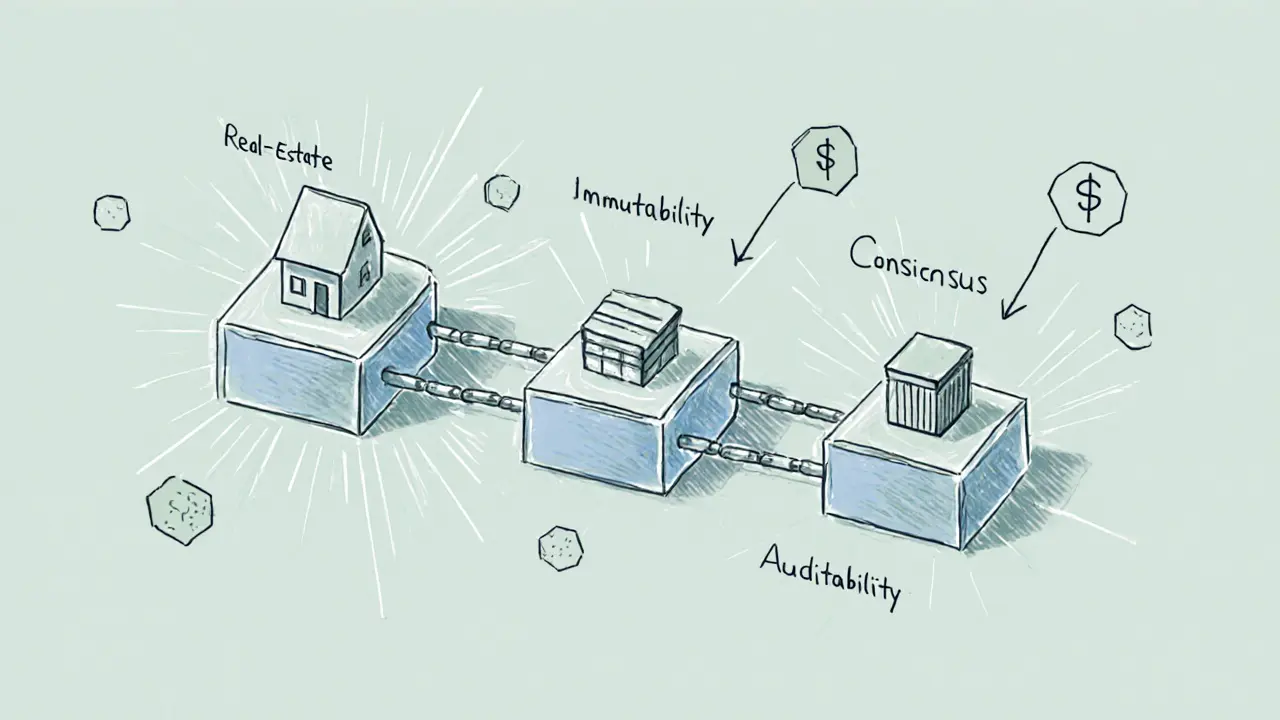

When working with real estate blockchain, the integration of blockchain tech into property ownership, transfer, and financing. Also known as proptech blockchain, it enables immutable records and peer‑to‑peer transactions. One of its core pillars is tokenization, the process of converting real‑world assets into digital tokens on a ledger. Tokenization turns a building or a parcel of land into fractional shares that anyone can buy or sell, opening up liquidity that traditional markets never had.

Another game‑changing concept is asset‑backed cryptocurrency, digital coins whose value is tied to physical assets like real estate. These tokens give investors a crypto‑style experience while preserving the underlying property’s value. Because the crypto is linked to a tangible asset, price swings are often steadier than pure speculative coins, and regulators find them easier to classify.

To make these systems trustworthy, digital identity, a verifiable, tamper‑proof representation of a person or entity on blockchain plays a vital role. When you sign a property deed on chain, your digital ID proves you’re the rightful owner without exposing personal data. This reduces fraud and speeds up escrow, making the whole process smoother for buyers, sellers, and lenders.

Beyond ownership, blockchain improves the supply chain, the network that moves goods and information from source to consumer for construction materials. By tracking every brick, steel beam, or timber piece on an immutable ledger, stakeholders can verify provenance, ensure compliance, and cut disputes. This transparency feeds back into the real estate blockchain ecosystem, reinforcing trust in the built environment.

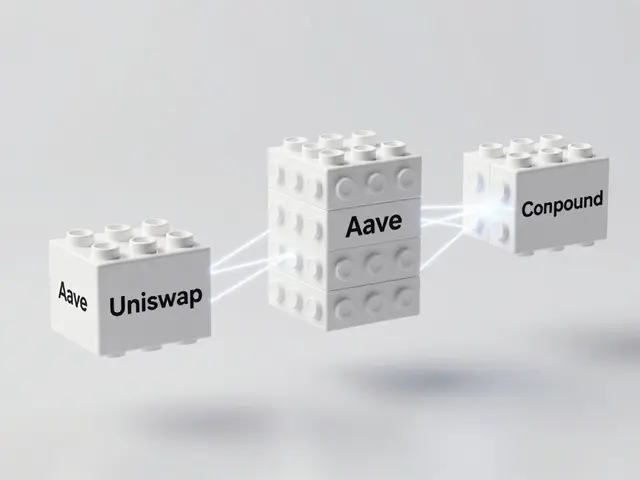

The RealToken ecosystem illustrates these ideas in practice. Its REG token powers governance for a platform that tokenizes commercial properties, lets holders vote on upgrades, and distributes rental income directly to token owners. This showcases how a dedicated governance token can tie community decisions to real‑world cash flow, marrying DeFi principles with brick‑and‑mortar assets.

On the ground, developers are using these tools to list property shares on secondary markets, automate mortgage approvals with smart contracts, and even enable cross‑border purchases without a bank intermediary. Investors can now diversify with a slice of a downtown office tower the same way they’d buy a share of a tech stock, all while enjoying the security of blockchain’s audit trail.

Regulators are catching up, too. Many jurisdictions now require token issuers to register their offerings and provide clear asset disclosures, which aligns well with the transparency that real estate blockchain provides. This regulatory clarity encourages institutional participation, further boosting liquidity and credibility for tokenized property assets.

Below you’ll find a curated collection of articles that dive deeper into each of these topics— from AI‑driven crypto coins to detailed exchange reviews—giving you actionable insights and up‑to‑date analyses to help you navigate the fast‑moving world of real estate blockchain.

How Blockchain Transparency Stops Fraud

Explore how blockchain's transparent, immutable ledger stops fraud across real estate, supply chains, finance, and crypto, with real‑world examples and implementation tips.

View More