Payment Services Act: Crypto Regulation Explained

When dealing with Payment Services Act, Singapore's legal framework that governs payment services, digital tokens and crypto‑related activities. Also known as PSA, it sets the rules for who can offer payment services, how they must safeguard customer funds, and what reporting duties they face. This law is the backbone for anyone wanting to run a crypto business in the region.

The Virtual Asset Service Provider (VASP), any entity that deals with the exchange, transfer or custody of crypto assets. VASPs are directly under the PSA's scope, meaning they must obtain a licence, meet capital requirements and submit ongoing compliance reports. In practice, getting a VASP licence is the first big hurdle for crypto exchanges, wallet providers and custodians looking to operate legally.

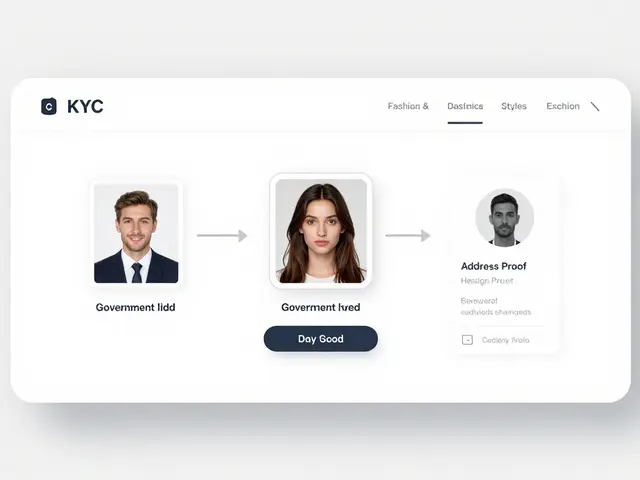

Compliance doesn't stop at licensing. The PSA enforces strict Anti‑Money Laundering (AML), rules designed to prevent illicit funds from flowing through financial services. Every VASP must implement KYC checks, transaction monitoring and suspicious activity reporting. Failing AML standards can lead to hefty fines or licence revocation, which is why many crypto firms now embed AML tools right from the onboarding stage.

Cryptocurrency Exchange Licensing, the process of securing official permission to run a trading platform for digital assets follows the same PSA guidelines. Applicants need to prove robust risk management, secure custody solutions and transparent fee structures. The licensing checklist mirrors what you see in our reviews of exchanges like Korbit, BitFriends and IncrementSwap, where fees, security and regulatory standing are all weighed. Understanding the PSA's licensing steps helps you compare platforms and choose a reputable service.

Why the PSA matters for crypto innovators

To nurture fintech growth, the PSA also offers a Regulatory Sandbox, a controlled environment where new payment solutions can be tested with regulatory oversight. Start‑ups can pilot tokenised payment systems, stablecoins or DeFi protocols without meeting the full suite of compliance requirements right away. Successful sandbox participants often graduate to full licences, gaining market credibility and investor confidence. This pathway explains why countries like the UAE and Nigeria are rolling out similar sandbox programs alongside their own VASP licensing schemes.

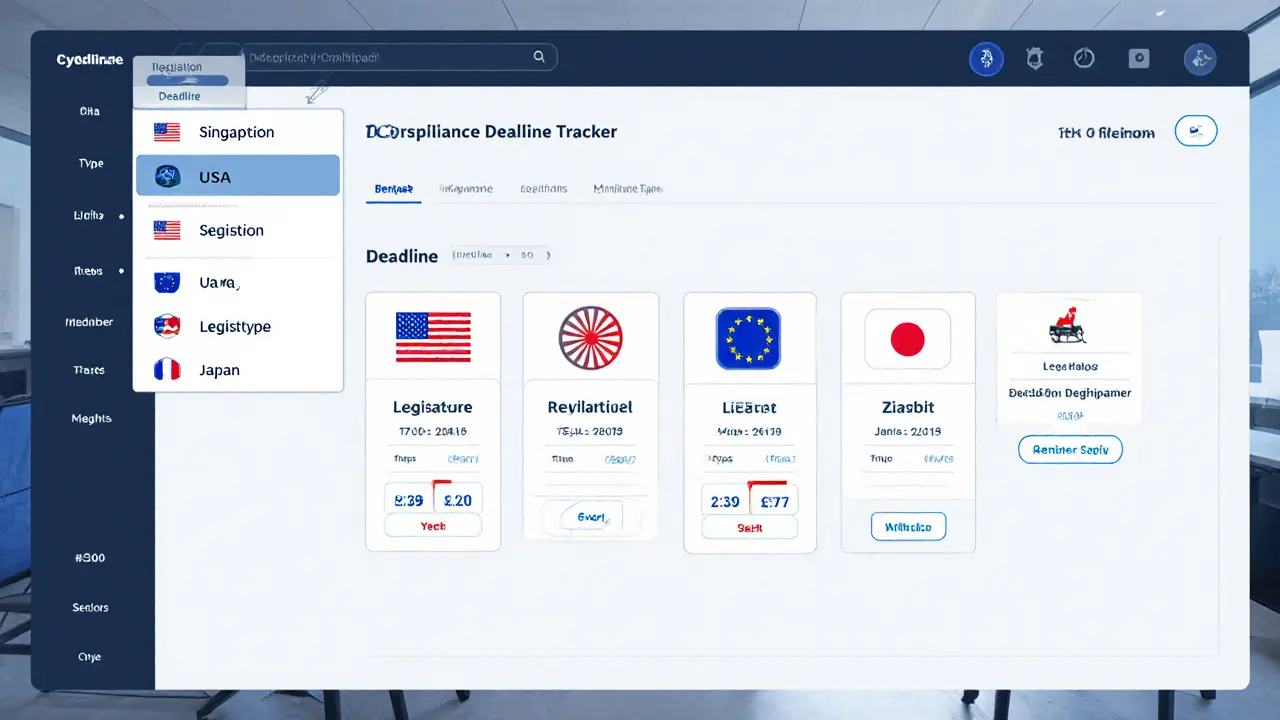

Across the region, the PSA's influence shows up in real‑world cases. Norway's temporary mining ban, the UAE's 2025 crypto licensing rules, and Indonesia's shift from Bappebti to OJK oversight all echo the same themes: clear licensing, AML enforcement and a sandbox for innovation. By keeping an eye on these examples, you can see how the PSA fits into a global move toward tighter, yet supportive, crypto regulation.

Below you’ll find a curated list of articles that break down each piece of the puzzle – from deep dives on specific coins to exchange reviews and licensing guides. Use them to sharpen your compliance knowledge, compare platforms, and stay ahead of regulatory changes as they unfold.

Payment Services Act Crypto Rules: Key Requirements for 2025

A clear guide to the Payment Services Act crypto provisions across Singapore, the US, EU, and Japan, covering key deadlines, licensing, technical duties, and a practical compliance checklist.

View More