Multi-Collateral System: How Stablecoins Stay Stable with Multiple Assets

When you hold a stablecoin like DAI, it’s supposed to be worth exactly $1 — no matter what’s happening in crypto. That stability doesn’t come from magic. It comes from a multi-collateral system, a structure where a stablecoin is backed by a mix of different digital assets instead of just one. Also known as multi-collateralized stablecoin, this approach reduces risk by spreading it across Bitcoin, Ethereum, and even Treasury-backed tokens. If one asset crashes, the others can hold things together. That’s why DAI, the biggest multi-collateral stablecoin, survived the 2022 Terra collapse when single-collateral coins like UST went belly up.

Here’s how it works: you lock up more valuable crypto than the stablecoin you want to mint. Say you want $100 in DAI. You might need to deposit $150 worth of ETH or WBTC. The extra 50% is your safety buffer — called overcollateralization. If ETH drops 30%, your $150 becomes $105, but you still have enough to cover your $100 DAI. If it drops too far, your position gets liquidated. This keeps the system from collapsing. The collateral, the assets locked up to back the stablecoin’s value can include anything from Bitcoin to real-world assets like USDC. Some systems even use interest-bearing tokens like rETH or USDN to boost returns without adding risk.

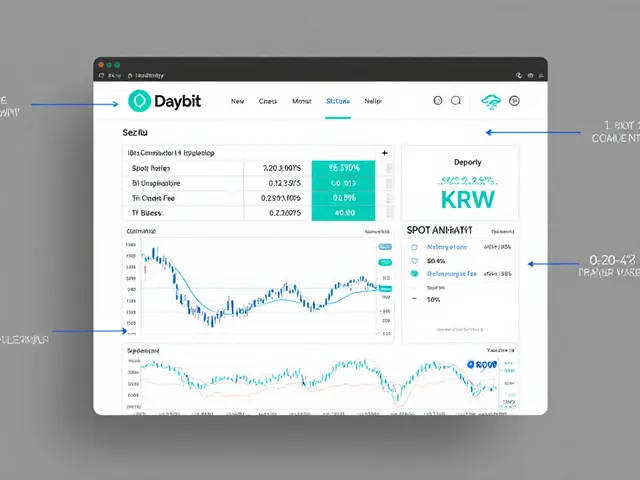

This system isn’t perfect. It’s complex, requires constant monitoring, and depends on smart contracts that can be hacked. But compared to single-collateral models — like the ones tied only to fiat reserves — multi-collateral systems are far more resilient. They’re the backbone of DeFi lending, borrowing, and yield farming. You’ll see them in action in platforms like MakerDAO, where users generate DAI by locking assets. You’ll also see what happens when they break: when collateral values spike too fast, or when a token like USDC gets frozen, the whole chain of trust can shake. That’s why the DeFi, decentralized finance ecosystem built on open protocols and smart contracts world watches collateral ratios like hawk eyes.

What you’ll find in the posts below isn’t just theory. It’s real-world examples — from the rise of Treasury-backed stablecoins like USDN to the collapse of fake DeFi protocols that pretended to use multi-collateral systems. Some posts show how users got burned by undercollateralized loans. Others reveal how regulators are starting to盯住 these systems, especially when they start replacing bank deposits. You’ll see how Iran’s crypto miners are forced to sell to the state, how CBDCs could change everything, and why a no-KYC exchange like ZoomEx still needs to manage collateral behind the scenes. This isn’t just about crypto. It’s about how money itself is being rebuilt — piece by piece, asset by asset.

Multi-Collateral vs Single-Collateral Systems in DeFi: What You Need to Know

Multi-collateral systems let you use Bitcoin, Ethereum, and other cryptos together as collateral for loans, while single-collateral systems only allow one asset. Learn which one suits your DeFi needs in 2025.

View More