Back in November 2021, BitOrbit (BITORB) launched its token on BSCPad with a promise: a structured, multi-phase IDO and airdrop designed to reward early supporters. But today, the project sits at a market cap of just $2.83K - a far cry from the $290K it raised. So what really went down? And why did an IDO that looked solid on paper end up as a cautionary tale?

How the BitOrbit Airdrop Actually Worked

The BitOrbit token sale wasn’t a wild, free-for-all giveaway. It was methodical. Six separate fundraising rounds ran over weeks, each with specific rules. The airdrop component wasn’t just for random Twitter followers - it was tied to participation in earlier stages like private sales and whitelist registrations. To qualify, users had to complete KYC, connect their wallets, and hold a minimum amount of BSCPad’s native token. This wasn’t a spammy “join our Telegram” scam. It was a real, vetted process - the kind that was considered standard back then.At launch on November 4, 2021, at 21:25 UTC+3, 10% of the total BITORB supply was released to participants. The rest? Locked up. A one-month cliff period followed, meaning no one could sell anything for 30 days. After that, the remaining 90% was released linearly over four months - about 22.5% per month. This wasn’t meant to pump prices. It was meant to keep people invested in the long term.

Why BSCPad Was the Right Choice (At the Time)

BitOrbit didn’t pick a random platform. It chose BSCPad, one of the top 10 IDO launchpads on Binance Smart Chain in 2021. Why does that matter? Because BSCPad had a reputation for filtering out outright scams. Projects had to pass basic checks: team transparency, whitepaper clarity, and a working prototype. For users, that meant less risk than jumping into a random CoinMarketCap listing.But even the best launchpad can’t save a weak project. BSCPad’s system worked as designed - it distributed tokens fairly, locked them properly, and ensured smart contract security. The problem wasn’t the platform. It was what happened after.

The Hidden Flaw: No Real Use Case

Here’s where BitOrbit fell apart. The tokenomics were smart. The distribution was fair. The launchpad was reputable. But what was BITORB actually for?No one could answer that clearly. There was no dApp. No game. No DeFi protocol. No utility beyond trading. Investors weren’t buying into a product - they were betting on hype. And when the initial excitement faded, so did the price. Compare that to successful 2021 IDOs like those on Polkastarter or DAO Maker. Those projects had working products, active communities, and real roadmaps. BitOrbit had a whitepaper and a token contract.

That’s why the market cap collapsed. $290K raised. $2.83K left. That’s a 99% drop. Not because the market crashed - because the project had no reason to exist.

What’s Changed Since 2021?

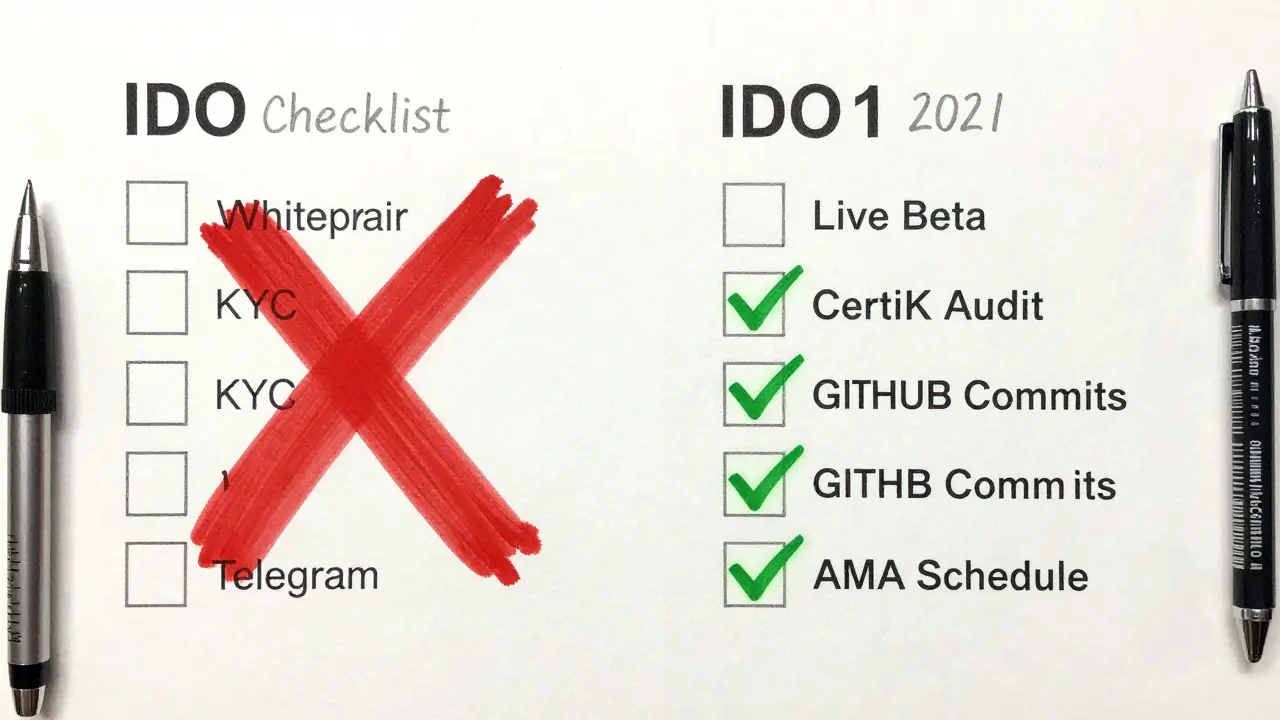

If BitOrbit launched today, it wouldn’t have made it past the first gate.Modern IDO launchpads like DAO Maker, GameFi, or Bybit Launchpad don’t just check KYC - they demand proof of product. They require:

- Live beta versions of the platform

- Third-party audits from firms like CertiK or Hacken

- Clear token utility (e.g., staking rewards, governance voting, fee discounts)

- Active social media with real engagement, not just bots

And the financial bar is higher too. Entry fees for top launchpads now average $72.29. You’re not just paying to join - you’re paying to prove you’re serious. BitOrbit’s 2021 model would never pass today’s standards.

Also, investors aren’t playing guessing games anymore. They check GitHub commits. They look at team LinkedIn profiles. They track on-chain activity. A token with no code updates, no community calls, and zero development activity? It’s dead on arrival.

Lessons from BitOrbit’s Failure

BitOrbit’s story isn’t about bad luck. It’s about a classic mistake: confusing fundraising success with product success.Here’s what you can learn from it:

- Token distribution ≠ value creation. Locking tokens sounds smart, but if no one uses the product, the lock-up is meaningless.

- Launchpad reputation doesn’t guarantee success. Even BSCPad couldn’t save a project with no purpose.

- Airdrops need utility. If your airdrop doesn’t lead to real usage, it’s just a giveaway that burns your credibility.

- Post-launch execution is everything. The moment the token goes live, the real work begins. No updates? No community? No future.

Projects that thrive today aren’t the ones with the flashiest marketing. They’re the ones with daily code commits, weekly AMAs, and transparent roadmaps. BitOrbit had none of that.

Is BITORB Still Active?

As of early 2026, there’s no evidence of ongoing development. The official website is down. The GitHub repo hasn’t been updated since 2022. Social channels are silent. The token trades on a few low-volume DEXs, but daily volume is under $50. It’s effectively a ghost project.Some holders still cling to it, hoping for a revival. But without a team, a roadmap, or any activity, that’s just wishful thinking.

What Should You Do If You Still Hold BITORB?

If you’re sitting on BITORB tokens:- Don’t wait for a miracle. The odds are near zero.

- Check if you can swap it for any other token on decentralized exchanges - even if it’s worth pennies.

- Learn from the mistake. Next time, ask: What does this token actually do? If you can’t answer in one sentence, walk away.

The crypto space moves fast. Projects that don’t evolve die. BitOrbit didn’t fail because of bad luck. It failed because it was never built to last.

Was the BitOrbit airdrop real?

Yes, the BitOrbit airdrop was real and part of its official IDO process on BSCPad. Participants who completed KYC, held the required BSCPad tokens, and joined whitelist rounds received BITORB tokens at launch. However, the airdrop was not a free giveaway - it was tied to active participation in the fundraising rounds. Tokens were distributed via smart contract and subject to vesting schedules.

Why did BitOrbit’s price crash so hard?

BitOrbit’s price crashed because it had no real utility. The token had no use case - no dApp, no staking, no governance, no product. Investors bought in hoping for quick gains, but once the initial hype faded, there was nothing to hold value. The $290K raised didn’t translate into development, marketing, or community growth. Without ongoing work, the token became worthless.

Could BitOrbit have succeeded if it launched today?

No. Today’s launchpads require far more than just a whitepaper. Projects must show live beta versions, third-party audits, active GitHub commits, and clear token utility. BitOrbit had none of that. Even if it had raised the same amount, modern platforms would have rejected it before listing. The bar for legitimacy has risen dramatically since 2021.

Is BitOrbit still trading?

BitOrbit (BITORB) still trades on a few low-volume decentralized exchanges, but daily volume is under $50. The official website is offline, the GitHub repo is inactive since 2022, and social media channels are abandoned. It’s not listed on any major exchanges. For all practical purposes, it’s a dead project.

What’s the difference between an IDO and an airdrop?

An IDO (Initial DEX Offering) is when a new token is sold directly to the public via a decentralized exchange, usually through a launchpad like BSCPad. Participants pay to buy tokens, often with crypto like BNB or USDT. An airdrop is when tokens are given for free - usually to users who complete tasks like joining Telegram, holding a specific token, or referring friends. BitOrbit’s airdrop was part of its IDO process - not a separate free giveaway.

How do you avoid projects like BitOrbit in the future?

Always check three things before investing: 1) Is there a working product? Look at GitHub commits and beta access. 2) Is the team real? Search LinkedIn profiles and past projects. 3) Is there ongoing community activity? Look for weekly updates, AMAs, and honest Q&As - not just hype posts. If you can’t answer these clearly, it’s not worth your money.

Anandaraj Br

18 February, 2026 . 08:57 AM

lol this is why i stopped trusting idos after 2021

they all look like legit projects on paper until you realize they have zero code commits and a team that vanished after the airdrop

bitorbit was just another crypto meme with a whitepaper and a discord server full of bots