MASAK Compliance Turkey: What You Need to Know

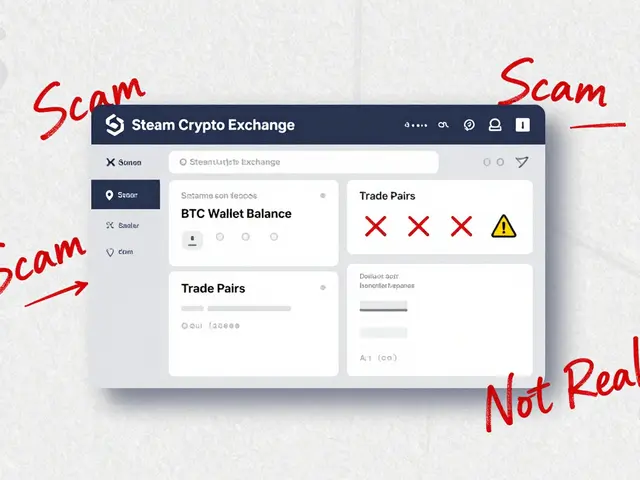

When navigating MASAK compliance Turkey, the regulatory framework set by Turkey’s Financial Markets Authority (MASAK) for crypto‑related businesses. Also known as Turkish crypto regulatory framework, it determines how exchanges, wallets, and service providers must operate within the country.

The backbone of this framework is Anti‑Money‑Laundering (AML) regulations, rules that require thorough customer verification, transaction monitoring, and reporting of suspicious activity. Virtual Asset Service Provider (VASP) licensing, the formal approval process that crypto exchanges, custodians, and payment processors must obtain from MASAK works hand‑in‑hand with AML to ensure the market stays clean. Finally, cryptocurrency exchange regulation, specific requirements such as capital reserves, security audits, and consumer protection measures rounds out the compliance puzzle, shaping everything from fee structures to data‑privacy policies.

These three pillars create a clear semantic chain: MASAK compliance Turkey encompasses AML requirements, which in turn drive VASP licensing, and that licensing directly influences how exchanges meet regulatory standards. In practice, a Turkish exchange that wants to list a new token must first pass MASAK’s AML checks, then secure a VASP license, and finally adjust its internal controls to match exchange‑specific rules. This cascade mirrors global trends—many jurisdictions, like the EU and the UAE, are adopting similar layered approaches, making the Turkish model a useful reference point for anyone operating internationally.

Why This Matters for Crypto Players

If you’re a trader, investor, or developer, understanding MASAK compliance saves you from costly fines and operational delays. The collection of articles below dives into real‑world examples: a review of Korbit’s security practices, an analysis of Norway’s mining ban, and step‑by‑step guides on VASP licensing in Nigeria and Indonesia. Each piece highlights how regulatory nuances affect token listings, exchange fees, and compliance costs. By seeing how other countries handle similar rules, you can gauge the impact of Turkey’s specific requirements on your business strategy.

Below, you’ll find detailed breakdowns of tokenomics for emerging coins, exchange reviews that score platforms against MASAK standards, and practical advice on meeting AML obligations. Whether you’re just starting out or looking to expand an existing operation into Turkey, the content offers actionable insights to keep you ahead of the regulatory curve.

Ready to see how these regulations play out across different projects and markets? Scroll down to explore the full range of guides, reviews, and compliance checklists that will help you navigate MASAK compliance Turkey with confidence.

Crypto Exchange Licensing in Turkey: Requirements, Costs & Compliance Guide

Discover Turkey's 2025 crypto exchange licensing rules, capital needs, compliance costs, foreign restrictions, and practical steps to launch a legal crypto platform.

View More