Mandatory Crypto Sales: What They Are and Why They Matter

When you hear mandatory crypto sales, legal obligations that force crypto holders to sell or report assets under specific regulatory conditions. Also known as forced crypto disposals, it's not about market timing—it's about legal deadlines set by governments and tax agencies. This isn’t a suggestion. It’s a rule. And if you’re holding crypto on foreign exchanges, earning rewards from DeFi, or even getting airdrops, you might already be in the crosshairs.

These rules aren’t just about taxes. They connect to FBAR requirements, U.S. reporting rules for foreign financial accounts over $10,000. Also known as FinCEN Form 114, it’s how the government tracks crypto held overseas—even if you never cashed out. If you’ve ever used ZoomEx, SithSwap, or any non-U.S. exchange and held more than $10k in crypto, you’re potentially subject to this. Miss the filing? Penalties can hit $10,000 per violation. And yes, that includes tokens like rETH, USDN, or even meme coins like DADDY if they’re sitting in a foreign wallet.

Then there’s the flip side: crypto airdrop scams, fake distributions that trick users into paying fees to claim non-existent tokens. Also known as forced claim scams, they mimic mandatory sales by pretending you’re required to pay to receive crypto. BitcoinAsset X and NFTP scams on Heco Chain are perfect examples. They don’t force you to sell—they force you to pay. And if you fall for it, you’re out your money, not your crypto. These scams thrive because people confuse legal compliance with fraud.

What ties all this together? Control. Governments want to know where your crypto is. Exchanges want to avoid liability. Scammers want your wallet. And you? You just want to keep what you earned without getting fined, flagged, or fooled. The posts below cut through the noise. You’ll find real reviews of exchanges like Independent Reserve and SwapSpace that help you stay compliant. You’ll see how projects like Sterling Finance and Lead Wallet died because they ignored regulation. You’ll learn why airdrops like BunnyPark and DAR Open Network are safe to watch—but never pay for. This isn’t theory. It’s what’s happening right now. And if you’re holding crypto, you need to know it.

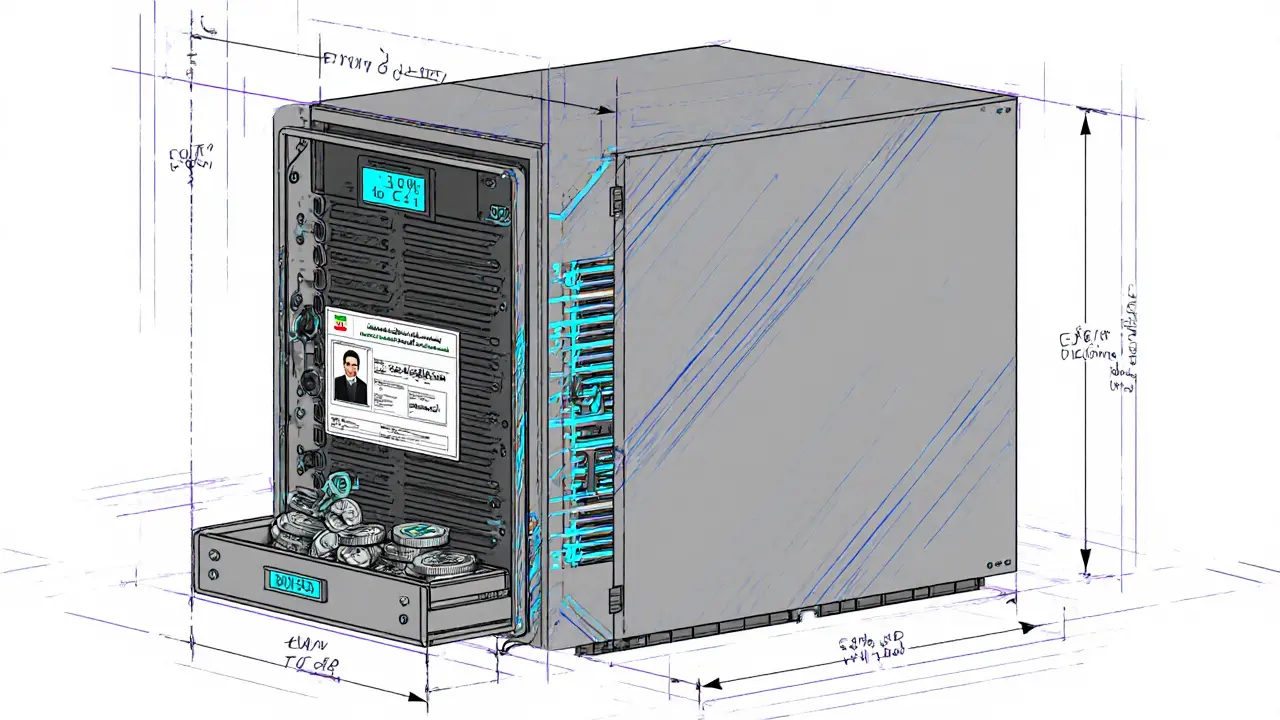

Iranian Central Bank Mandates Crypto Sales from Miners Under New 2025 Regulations

Iran's Central Bank now requires all crypto miners to sell 30% of their output directly to the state under new 2025 regulations. This mandatory sales policy is part of a broader effort to control digital assets, bypass sanctions, and manage energy use.

View MoreIranian Central Bank Mandates Crypto Sales from Miners Under New 2025 Regulations

Iran's Central Bank now requires crypto miners to sell 30% of their output to the state under new 2025 regulations. This move controls energy use, funds imports, and suppresses private crypto markets.

View More