The U.S. finally has a federal law for stablecoins. The GENIUS Act - short for the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025 - became law on July 18, 2025. It’s the first time Washington has stepped in to create a clear, nationwide rulebook for digital dollars. Before this, stablecoins operated in a legal gray zone. Some companies issued them with little oversight. Others claimed they were fully backed, but no one was checking. Now, that changes. And it changes everything.

Who Can Issue Stablecoins Now?

Under the GENIUS Act, only certain institutions can issue payment stablecoins. That means no more random crypto startups printing digital dollars from their basement servers. Only insured depository institutions - like banks, credit unions, or nonbank financial firms approved by the Federal Reserve - are allowed to issue them. These entities already have to follow strict rules for handling deposits. Now, they’ll have to handle stablecoins the same way.

Why this restriction? Because trust matters. If you’re using a stablecoin to pay for groceries or send money to family, you need to know it’s as safe as cash in a bank. The law forces issuers to prove they’re financially sound before they can even begin. It’s not about stopping innovation. It’s about stopping scams.

1:1 Reserves - No Exceptions

One of the biggest problems with stablecoins in the past? Nobody knew if they were really backed. TerraUSD collapsed in 2022 because it wasn’t. The GENIUS Act shuts that door forever. Every stablecoin issued must be backed 1:1 by assets that are safe, liquid, and transparent.

The approved assets? U.S. dollars, U.S. Treasury bills, repurchase agreements, and other low-risk instruments approved by regulators. No corporate bonds. No crypto. No complex derivatives. Just what you’d find in a government money market fund.

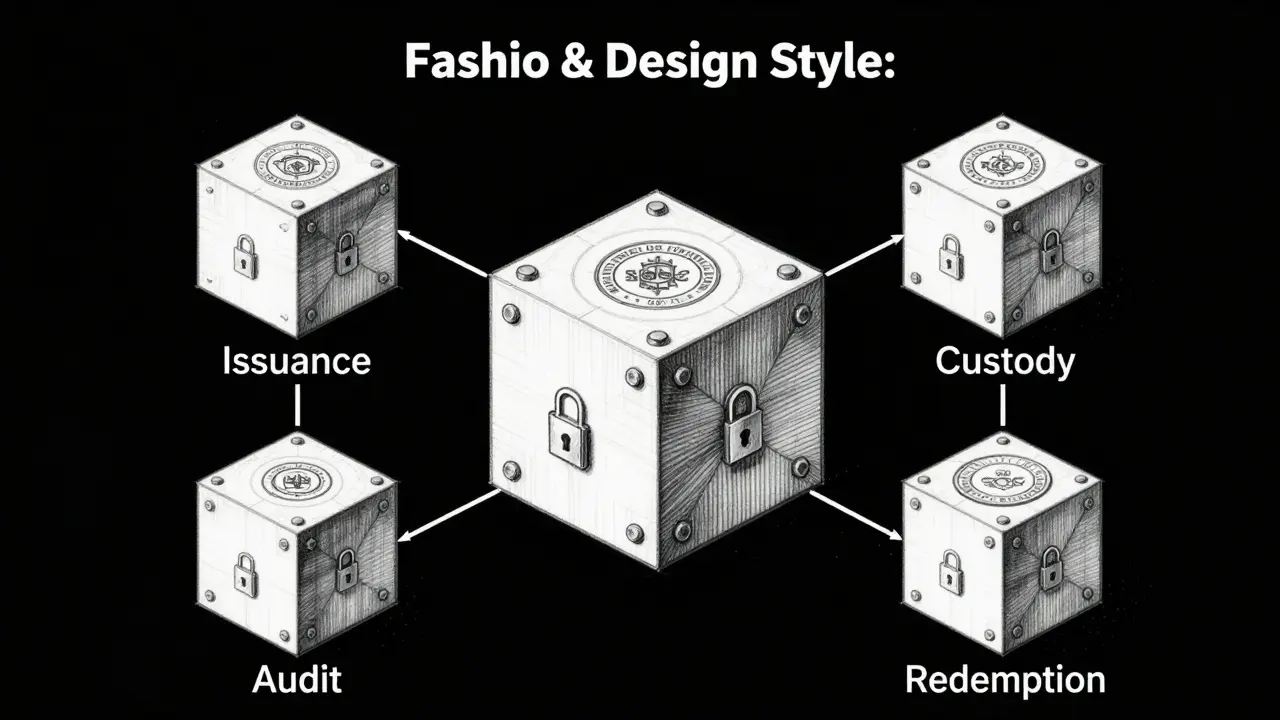

And it’s not enough to just hold the assets. Issuers must report exactly what they’re holding - weekly. Plus, every year, an independent public accounting firm must audit their reserves. If you’re holding $10 billion in stablecoins, auditors will check every dollar behind it. No guesswork. No opacity.

Anti-Money Laundering and Consumer Protection

The GENIUS Act also forces issuers to follow the Bank Secrecy Act. That means knowing who you’re dealing with. If you want to buy or redeem stablecoins, you’ll need to verify your identity. No anonymous wallets. No shell accounts.

This isn’t just about stopping criminals. It’s about protecting regular users. If a stablecoin issuer goes under, or if your funds get frozen because of a hack, you have legal recourse. The law requires clear terms of service, refund policies, and dispute resolution processes. You can’t be left hanging because a company’s terms were buried in 50 pages of legal jargon.

What Can Issuers Actually Do?

The law is very clear about what stablecoin companies can and can’t do. They can issue stablecoins. They can redeem them. They can hold the reserves. And they can offer custody services - like keeping your private keys safe.

But here’s what they can’t do:

- Comingle your reserve assets with their own money

- Rehypothecate your collateral (except to create short-term liquidity through approved repurchase agreements)

- Use your stablecoin reserves as collateral for risky bets

- Offer lending, trading, or yield farming services

That last point is huge. It means companies like Circle or Tether can’t turn your stablecoin into a gambling tool. You’re not buying a stablecoin to earn 15% APY. You’re buying it to send money or pay bills. The law keeps it simple.

Custody Rules - Who Holds Your Keys?

If a company holds your private keys or custody assets, they must be regulated. That means only banks, credit unions, or federally approved custodians can manage those keys. No more relying on a startup’s app to store your digital dollars.

But here’s the catch: if you use your own hardware wallet - like a Ledger or Trezor - the law doesn’t touch you. The law only regulates the companies, not the users. You’re free to self-custody. You just can’t be forced to give your keys to an unregulated third party.

The Stablecoin Certification Review Committee

At the center of all this is a new federal body: the Stablecoin Certification Review Committee (SCRC). It’s chaired by the Treasury Secretary and includes the Fed Chair and FDIC Chair. Their job? To decide whether state-level stablecoin rules are good enough.

Why does that matter? Because the GENIUS Act doesn’t override state laws. It lets states keep their own rules - as long as they’re "substantially similar" to the federal standard. The SCRC has the power to approve or reject those state frameworks. If a state’s rules are too weak, the committee can block stablecoin issuers from operating there.

This is a double-edged sword. On one hand, it prevents states from creating a race to the bottom. On the other, it creates uncertainty. Some states may still try to loosen rules to attract crypto firms. The SCRC’s decisions will be watched closely - and challenged in court.

Implementation Timeline - 18 Months to Get Ready

The law doesn’t take effect immediately. It kicks in on January 18, 2027 - or 120 days after final rules are published, whichever comes first. That gives companies a year and a half to adapt.

Why so long? Because building systems to track reserves, audit daily, verify identities, and report to federal regulators isn’t easy. Banks are already working on it. Smaller players are scrambling. Some may not make it. That’s the point.

This isn’t about forcing everyone out. It’s about filtering out the risky players and letting the solid ones grow.

Why This Matters - Beyond Crypto

The GENIUS Act isn’t just about digital money. It’s about the U.S. dollar.

Other countries are moving fast. China has its digital yuan. The EU has the Digital Euro proposal. Hong Kong passed its own stablecoin law in May 2025. The U.S. was falling behind. This law says: we’re not going to let someone else set the rules for the world’s reserve currency.

By making stablecoins safe, transparent, and regulated, the U.S. is saying: if you want to use a digital dollar, you do it here - under our rules.

That’s not just financial policy. It’s national strategy.

What’s Still Unclear?

Even with this law, questions remain.

- Will states like Wyoming or Texas create loopholes?

- Can foreign stablecoins still be used in the U.S. if they’re not approved?

- What happens if a bank fails and its stablecoin reserves are tied up?

- How will the SCRC handle political pressure?

These aren’t theoretical. They’re real. And they’ll shape how the law works in practice.

One thing is certain: the era of unregulated stablecoins is over. The GENIUS Act doesn’t ban innovation. It demands responsibility. And that’s exactly what the market needed.