LIT Token – What It Is and Why It Matters

When working with LIT token, a utility token on Ethereum that fuels the Lit Protocol’s privacy‑first services. Also known as Lit, it lets developers encrypt data, manage access rights, and build decentralized applications without exposing underlying information.

One of the first things you’ll notice is the token’s tokenomics, which outlines a fixed supply of 1 billion LIT, a gradual release schedule, and a small burn mechanism tied to protocol usage. LIT token — its limited supply and utility‑driven demand — creates a clear value proposition for both holders and developers. The token also fits snugly into the broader DeFi, ecosystem where privacy layers are increasingly valuable for lending, borrowing, and yield‑farm strategies. By integrating privacy controls directly into smart contracts, LIT opens doors for decentralized finance products that need confidential data, such as credit scoring or private order books.

How the LIT Token Connects to Exchanges and Airdrops

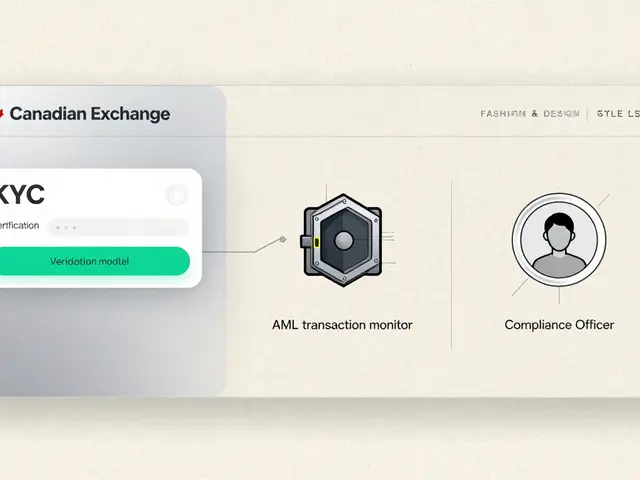

To actually use LIT, you need a crypto exchange, platform that lists the token, provides liquidity, and supports ERC‑20 transfers. Most major exchanges now support LIT, which means traders can buy, sell, or stake the token without hopping between niche platforms. Exchange listings also affect the token’s market depth, a key factor for anyone looking to move sizable amounts without slippage.

Meanwhile, the Lit Protocol occasionally runs airdrop, distribution events that reward early adopters or participants in testnets with free LIT tokens. Airdrops serve two purposes: they broaden the token’s community and they give newcomers a low‑risk way to experience the protocol’s features. Watching the protocol’s roadmap and community channels can help you catch the next airdrop before it’s widely announced.

All these pieces—tokenomics, DeFi integration, exchange accessibility, and occasional airdrops—form a network of relationships that shape the LIT token’s market behavior. Understanding how each element influences the others lets you assess risk, spot opportunities, and decide whether LIT fits your portfolio or development plans. Below you’ll find a hand‑picked selection of articles that break down the token’s technical specs, walk through exchange onboarding, compare DeFi use cases, and explain the latest airdrop mechanics. Dive in to get the practical insights you need before you trade, build, or simply stay informed about the LIT token.

Timeless (TIMELESS) Crypto Coin Explained: Token Details, Price, and Risks

Explore the two Timeless (TIMELESS) crypto tokens, their blockchain bases, market data, and key risks. Learn how they work, where to trade, and a checklist for safe investing.

View More