Jswap.Finance: Your Go‑to DeFi Swap and Liquidity Hub

When working with Jswap.Finance, a decentralized finance platform that lets users swap tokens, add liquidity, and earn rewards. Also known as Jswap, it bridges the gap between crypto traders and DeFi services, making token swaps as easy as clicking a button.

Why Jswap.Finance matters for traders

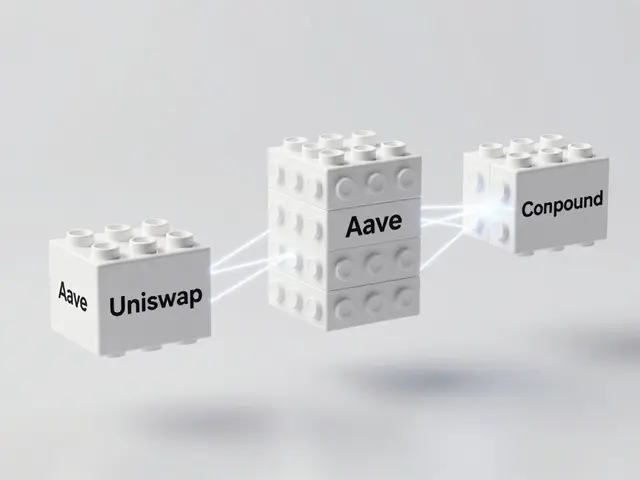

The power of Liquidity Pools, shared reserves of tokens that enable instant swaps without order books is at the core of Jswap.Finance. Liquidity Pools provide the depth needed for large trades, and they also fuel Yield Farming, the practice of locking tokens in pools to earn extra tokens. In other words, Jswap.Finance enables token swaps (entity‑action‑entity) while liquidity pools power yield farming (entity‑enables‑action), and yield farming drives participation in crypto airdrops, free token distributions that often require users to hold or stake assets. This chain of relationships makes the platform a one‑stop shop for anyone looking to trade, earn, and stay ahead of airdrop opportunities.

Beyond swaps, Jswap.Finance integrates with major crypto exchanges, offers competitive fee structures, and complies with evolving regulations in regions like the UAE and Norway. Whether you’re scanning the latest exchange reviews, checking airdrop eligibility, or figuring out how market orders differ from limit orders, the posts below give you the practical details you need. Dive in to see how Jswap.Finance fits into the broader DeFi ecosystem and how you can leverage its tools for smarter trading decisions.

JF Token Airdrop by Jswap.Finance: Full Breakdown and What You Need to Know

A detailed look at Jswap.Finance's JF token airdrop, covering how it worked, tokenomics, current market status, risks, and how to verify future airdrops.

View More