Hyperinflation: Causes, Effects, and Crypto Responses

When dealing with hyperinflation, an extreme surge in consumer prices that rapidly erodes purchasing power. Also known as runaway inflation, it typically follows a cascade of fiscal deficits, monetary missteps, and loss of confidence in the national fiat currency, government‑issued money not backed by a physical commodity. The result is a vicious loop where prices climb faster than wages, savings disappear, and everyday transactions become chaotic.

Hyperinflation is a subset of inflation, the general rise in price levels over time. While normal inflation hovers around 2‑3% in stable economies, hyperinflation blasts past 50% per month, sometimes reaching thousands of percent annually. This explosive growth often stems from unchecked money printing, war‑time spending, or severe supply shocks. As the local monetary policy, the actions of a central bank or government to control money supply and interest rates fails to curb the surge, confidence in the currency collapses and people rush to protect their wealth.

Enter hyperinflation as both a problem and a catalyst for digital finance. When traditional money loses its value, citizens start looking for alternatives that can preserve purchasing power. One of the fastest‑growing answers is cryptocurrency, decentralized digital assets that operate on blockchain technology. Bitcoin, for example, is often described as “digital gold” because its limited supply makes it resistant to the inflationary pressure that plagues fiat money. In countries like Argentina, soaring peso inflation has driven a surge in crypto wallet downloads, peer‑to‑peer trading, and even everyday purchases using crypto‑enabled payment apps.

Why Stablecoins Matter in a Hyperinflationary World

While cryptocurrencies offer a hedge, their price volatility can be unsettling for everyday users. That’s where stablecoins, digital tokens pegged to a stable asset such as the US dollar or gold step in. Stablecoins combine the speed and borderless nature of crypto with the price stability of traditional reserves. During hyperinflation, people can convert their dwindling fiat into stablecoins, pause the loss of value, and later reconvert when the local currency stabilizes or when they need to purchase goods priced in foreign currency.

These three entities—hyperinflation, cryptocurrency, and stablecoins—form a clear chain of cause and effect: hyperinflation erodes trust in fiat money, prompting a shift toward digital assets. Digital assets, in turn, introduce the need for price‑stable alternatives, leading to stablecoin adoption. This loop showcases how economic distress can accelerate fintech innovation.

Beyond personal finance, businesses also feel the pressure. Suppliers demand payment in more reliable currencies, and payroll systems adapt to crypto or stablecoin payouts to keep employees from losing income to daily price spikes. Governments sometimes react by imposing capital controls, which unintentionally boost the appeal of decentralized money that bypasses borders.

Our collection of articles below dives deeper into each facet of this picture. You’ll find real‑world case studies from Argentina’s peso crisis, analyses of how Bitcoin and other coins perform during monetary turmoil, and practical guides on choosing the right stablecoin for everyday transactions. Whether you’re a seasoned trader, a curious saver, or someone living through an economic shock, the pieces ahead will give you actionable insight into navigating hyperinflation with modern financial tools.

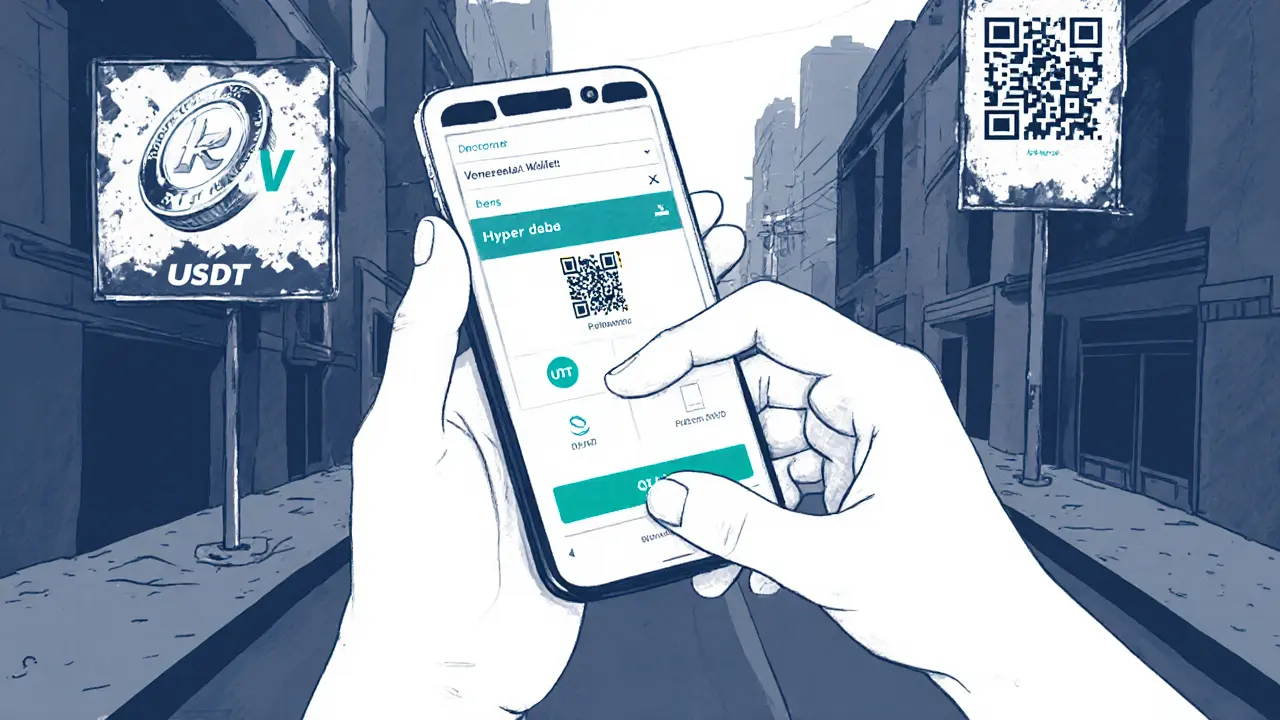

How Venezuelans Use Crypto to Survive Hyperinflation

Explore how Venezuelans rely on Bitcoin, USDT, Binance and peer‑to‑peer platforms to survive hyperinflation, pay daily bills, and send remittances.

View More