DEX (Decentralized Exchange) Overview

When working with DEX, a peer‑to‑peer crypto trading platform that runs without a central custodian. Also known as decentralized exchange, it lets users swap tokens straight from their wallets, avoiding the need to deposit funds on an intermediary.

One of the building blocks behind every DEX is the liquidity pool, a reserve of two or more tokens that traders draw from to execute swaps. Liquidity providers lock assets into these pools and earn a slice of the transaction fees. Without pools, there would be no market depth, and trades would slip wildly.

Key Components of a DEX

The pricing engine most DEXes rely on is called an Automated Market Maker (AMM), a smart‑contract algorithm that continuously adjusts token prices based on pool balances. AMMs replace order books, making trades instant and accessible to anyone with a compatible wallet. Because the math is on‑chain, anyone can audit how prices are set, which adds a layer of transparency you rarely see on centralized platforms.

All of this magic runs on smart contracts, self‑executing code that enforces the rules of a DEX without human intervention. When you hit "swap" in your interface, the contract checks your balance, updates the liquidity pool, and distributes fees—all in a single transaction. This trustless design reduces the risk of funds being frozen or seized by a third party.

From a user’s perspective, the core action is token swapping, exchanging one cryptocurrency for another directly on the blockchain. Swaps are usually settled in seconds, and the fee structure is often flat or based on a small percentage of the trade volume. Because there’s no middleman, you keep full control of your private keys, which is why many traders prefer DEXs for privacy and security.

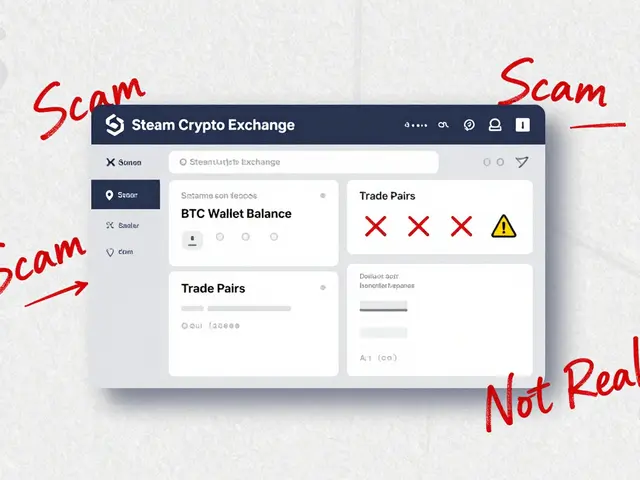

Security, however, isn’t a free lunch. Buggy contracts, poorly designed pools, or malicious front‑running bots can expose users to loss. That’s why reputable DEXs undergo audits, publish their code, and offer bounty programs. Meanwhile, regulators are still figuring out how to treat decentralized platforms, so the legal landscape can shift quickly. Keeping an eye on audit reports and community sentiment is a good habit if you plan to move sizable amounts.

Below you’ll find a hand‑picked collection of articles that break down everything from rollup finality to real‑world DEX reviews. Whether you’re curious about the newest AMM model, need a step‑by‑step guide to claim a token airdrop, or want to compare security features across exchanges, the posts ahead give you practical insights you can act on. Dive in and discover which DEX tools match your trading style.

SushiSwap V3 on Arbitrum: In‑Depth Review of the Decentralized Crypto Exchange

A thorough review of SushiSwap V3 on Arbitrum covering fees, liquidity, rewards, risks, and how it stacks up against Uniswap for crypto traders.

View More