Crypto Mining Laws: What’s Legal, Illegal, and Where It Matters in 2025

When you mine crypto, you’re not just running software—you’re participating in a system shaped by crypto mining laws, government rules that control who can mine, how much energy they can use, and where the profits go. Also known as cryptocurrency mining regulations, these rules are turning mining from a libertarian hobby into a tightly controlled industry. In some places, it’s a right. In others, it’s a crime. And in a few, it’s a state-run business.

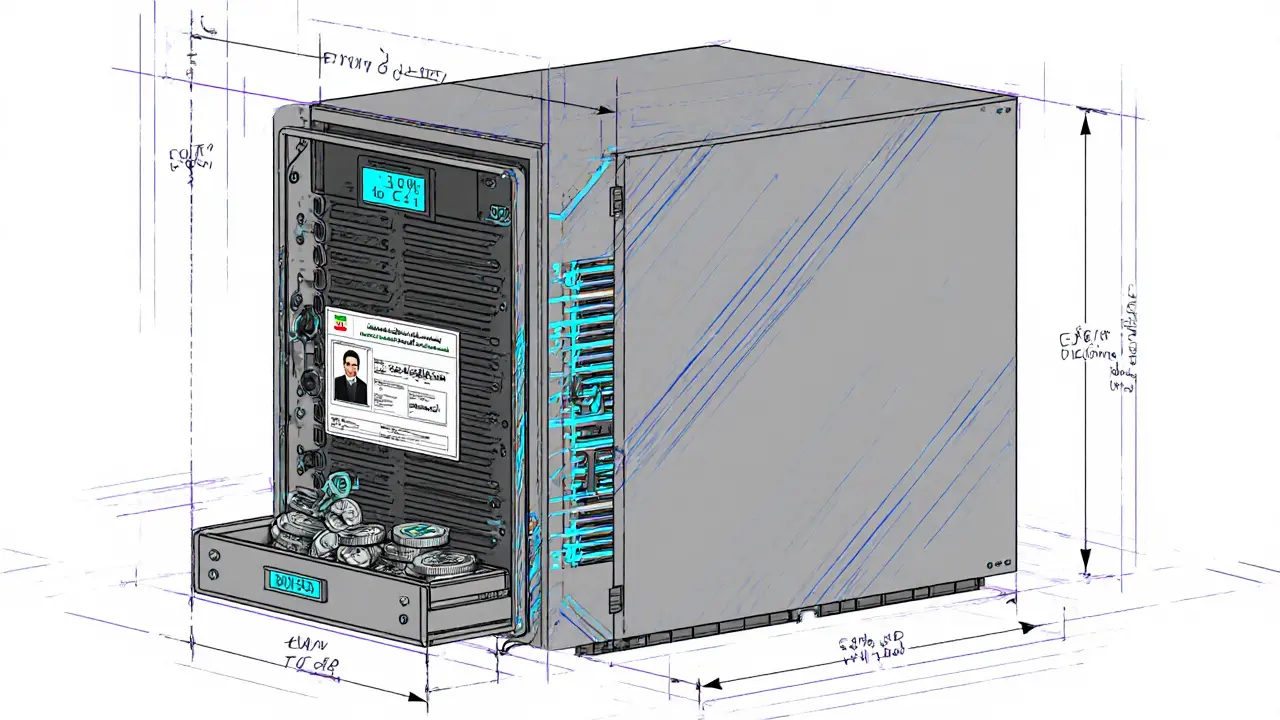

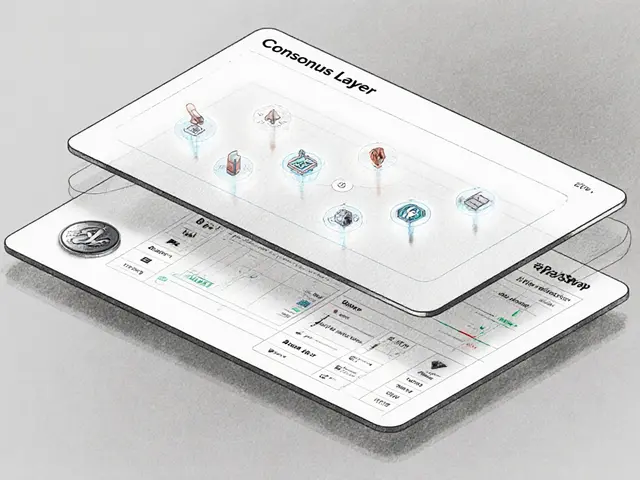

Take Iran crypto mining, a major global mining hub where the government now forces miners to sell 30% of their output directly to the Central Bank. Also known as mandatory crypto sales, this policy isn’t about stopping mining—it’s about controlling it. The state gets crypto to bypass sanctions, while miners get electricity subsidies. Meanwhile, in Switzerland crypto regulations, the town of Zug offers clear, business-friendly rules under its DLT Act, making it the safest place in the world to legally mine and hold crypto. Also known as Crypto Valley, this region doesn’t ban mining—it invites it with low taxes and banking access. Then there’s the U.S., where FBAR crypto, a reporting rule for foreign accounts over $10,000, catches miners who use overseas exchanges or cloud mining services without declaring them. Also known as FinCEN Form 114, it’s not a tax—it’s a disclosure. Miss it, and you could face $10,000 fines per year. These aren’t just technicalities. They’re life-changing rules.

Some countries ban mining outright. Others tax it like a business. A few, like Iran, treat it like a public utility. The truth? There’s no global standard. What’s legal in Zug is illegal in China. What’s taxed in Germany is incentivized in Texas. And if you’re mining on a foreign server or using a no-KYC exchange like ZoomEx, you might be unknowingly breaking rules in your own country. This collection dives into the real cases—where governments are seizing mining rigs, where miners are getting fined for not filing FBAR, and where the only way to stay legal is to sell half your output to the state. You’ll find deep dives on Iran’s 2025 mandate, Switzerland’s innovation-friendly framework, and the hidden reporting traps that could cost you more than your electricity bill. No fluff. Just what you need to know before you plug in your next rig.

Iranian Central Bank Mandates Crypto Sales from Miners Under New 2025 Regulations

Iran's Central Bank now requires crypto miners to sell 30% of their output to the state under new 2025 regulations. This move controls energy use, funds imports, and suppresses private crypto markets.

View More