Crypto Investment: Guides, Reviews & Strategies

When working with Crypto Investment, the practice of allocating capital to cryptocurrencies and related digital assets. Also known as digital asset investing, it blends market speculation with blockchain technology, regulatory awareness, and active portfolio management.

Understanding the backbone of any crypto investment starts with Blockchain Technology, a decentralized ledger that records transactions across a network of computers. Its key attributes include immutability, transparency, and support for smart contracts, which power everything from tokenized assets to DeFi protocols. Because blockchain underpins every token you might buy, grasping its mechanics directly influences risk assessment and growth potential.

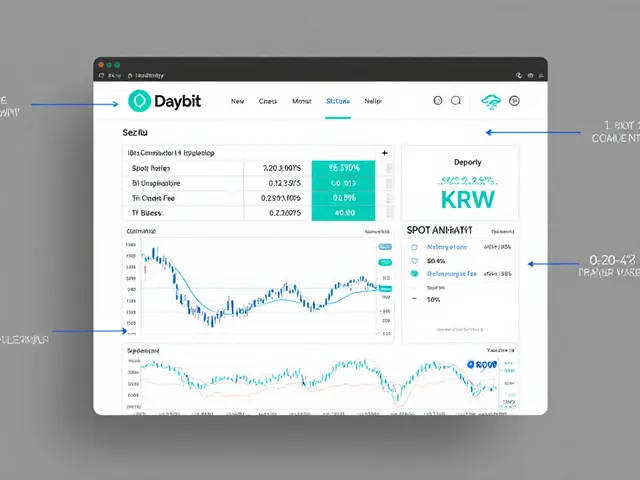

Next up is the platform where you actually buy and sell tokens: the Crypto Exchange, an online service that matches buyers with sellers, handles order books, and often offers custody solutions. Exchange quality is judged by fee structures, security features like two‑factor authentication, and the range of supported assets. Choosing a reputable exchange reduces exposure to hacks and gives you smoother execution, which is crucial when you need to react quickly to market swings.

One of the fastest ways to boost a portfolio without upfront capital is to participate in Airdrops, free token distributions that projects use to build community and liquidity. Successful airdrop hunting requires keeping an eye on project announcements, meeting eligibility tasks, and verifying contract addresses to avoid scams. When timed right, airdrops can add meaningful value and diversify holdings, making them a handy tool in a broader investment strategy.

Beyond buying and selling, many investors generate income through Mining, the process of validating blockchain transactions in exchange for newly minted coins. Mining profitability hinges on hardware efficiency, electricity costs, and the current reward schedule, especially after events like Bitcoin’s halving. Meanwhile, Regulatory Compliance, the set of laws and licensing requirements governing digital asset activities shapes how and where you can operate, influencing tax treatment and access to institutional services.

Why Crypto Investment Matters Today

Crypto investment isn’t just a fad; it’s a growing asset class that intersects finance, technology, and policy. The sector’s rapid evolution means new tokens, exchange features, and regulatory updates appear almost daily. By staying informed about blockchain fundamentals, exchange security, airdrop opportunities, mining economics, and compliance rules, you can navigate the volatility with confidence.

Below you’ll find a curated collection of in‑depth articles that break down individual coins, exchange reviews, tax guides, and market analysis. Whether you’re scouting the next airdrop, evaluating a privacy token, or figuring out how Norway’s mining ban affects profitability, the posts ahead give you actionable insights to sharpen your crypto investment game.

Flourishing AI Crypto Coin Explained: What It Is and How It Works

A clear, 2025‑up‑to‑date look at Flourishing AI crypto coin, covering its purpose, tokenomics, market performance, risks and whether it’s worth investing.

View More