CMP token

When working with CMP token, a utility token built for cross‑chain market data aggregation. Also known as Coin Market Price token, it aims to provide real‑time pricing feeds for traders and apps. CMP token encompasses tokenomics, a fixed 100 million supply, a 2 % transaction burn, and a 5 % liquidity fee that funds development, requires liquidity pools, smart contracts on Ethereum and BSC that lock assets for stable trading, and benefits from a recent airdrop, that distributed 1 % of the total supply to early community members. Major crypto exchanges, list CMP on both spot and futures markets, giving it broad market exposure and the DeFi, ecosystem where CMP powers yield farms and cross‑chain swaps. Regulation influences CMP token by shaping how exchanges can list it and how developers must report token distribution. In short, CMP token sits at the intersection of data services, liquidity engineering, and community incentives.

Why does this matter for you? If you’re hunting for the latest CMP token news, you’ll want to understand three core ideas. First, the token’s supply model and burn mechanism directly affect price scarcity – a classic supply‑demand dynamic that traders watch closely. Second, liquidity pool design decides how easily you can swap CMP without slippage; deeper pools mean smoother trades and lower fees. Third, the airdrop history shows how the project rewards early adopters and builds network effects, which often translates into higher trading volume. Each of these elements links back to the broader DeFi landscape, where yield opportunities and cross‑chain bridges depend on reliable market data – the very service CMP token promises to deliver. By connecting tokenomics, liquidity, and regulatory context, you get a clearer picture of the risks and upside before you commit capital.

Below you’ll find a curated collection of articles that dive deeper into each of these areas. We cover everything from a step‑by‑step guide on claiming the CMP airdrop, to an analysis of how its tokenomics compare with other utility tokens, to reviews of the exchanges that list CMP and the DeFi protocols that integrate its price feeds. Whether you’re a beginner trying to grasp the basics or a seasoned trader looking for the latest yield‑farm strategies, the posts ahead give practical insights you can act on right now. Let’s explore the world of CMP token together and see how it fits into your crypto toolkit.

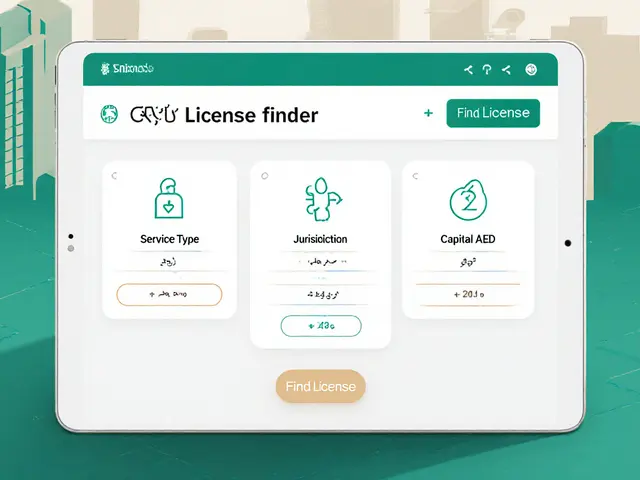

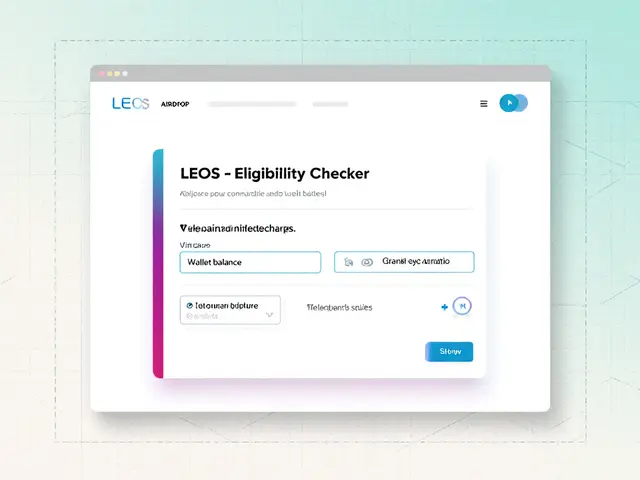

Caduceus CMP Airdrop Details (Old) - How to Claim & What You Need to Know

Explore every detail of the old Caduceus CMP airdrop: eligibility, claim steps, token stats, risks, and how to stay updated on future giveaways.

View More