Base blockchain DEX – Decentralized Trading on Base

When working with Base blockchain DEX, a decentralized exchange that runs on the Base layer‑2 chain, enabling trust‑less token swaps and liquidity provisioning. Also known as Base DEX, it leverages the low‑fee, high‑throughput environment of Base to give users a fast, cheap alternative to Ethereum’s mainnet DEXes. The core idea is simple: instead of a central order book, traders interact directly with smart contracts that match swaps on‑chain.

One of the most important pieces of the puzzle is the decentralized exchange, a platform where users retain custody of their assets while swapping tokens without an intermediary. On Base, DEXes rely heavily on liquidity pools, collections of token pairs supplied by users that power automated trades. These pools feed price data into the automated market maker, an algorithm that determines swap rates based on pool ratios. The AMM model eliminates order matching latency and lets anyone become a market maker by depositing assets.

How the pieces fit together

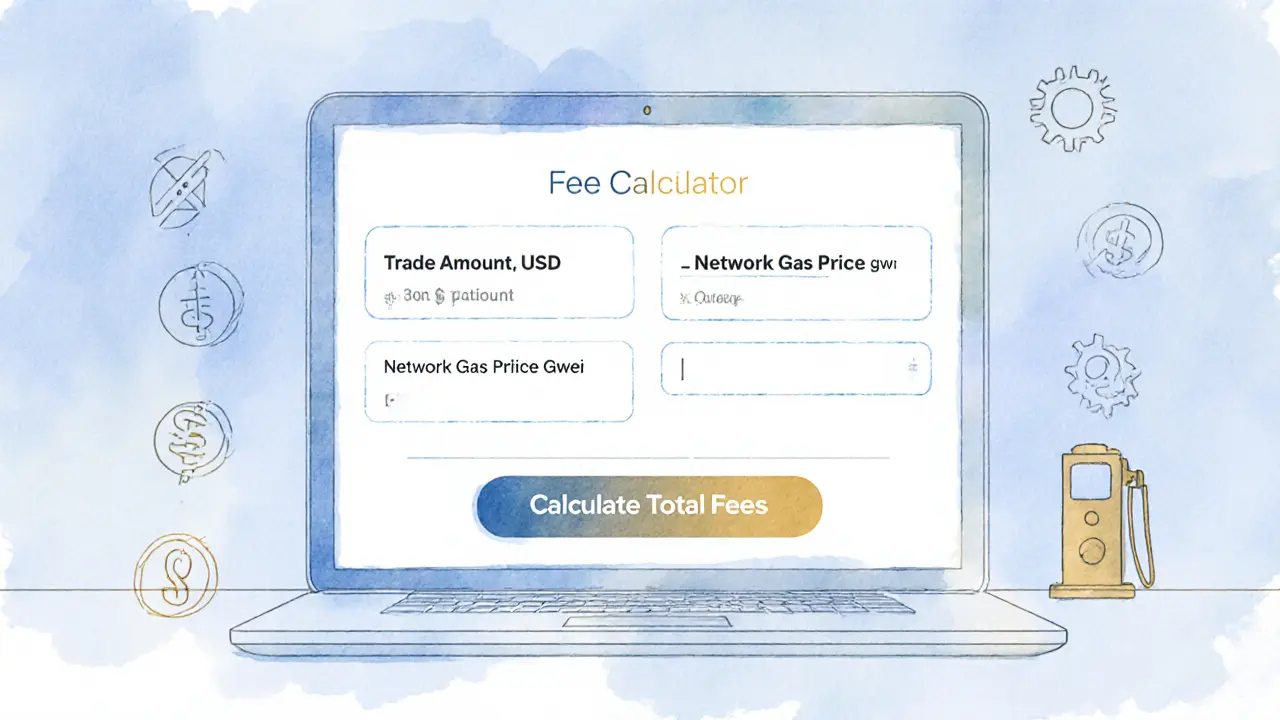

Base blockchain DEX requires smart contracts to enforce rules, calculate prices, and settle trades automatically. Smart contracts also handle fee distribution back to liquidity providers, creating an incentive loop that keeps pools deep and spreads slippage across many participants. Because the contracts sit on a layer‑2, transaction costs stay low, making it viable for smaller swaps that would be costly on Ethereum. Cross‑chain bridges further extend the reach, allowing assets from other networks to flow into Base’s pools, which in turn broadens the token selection for traders. This ecosystem of DEX, liquidity pools, AMM, and smart contracts drives price discovery while maintaining decentralization.

Below you’ll find a curated set of articles that break down everything from token‑specific guides to exchange reviews and regulatory updates. Whether you’re curious about how a new DeFi token like Quicksilver (QCK) integrates with Base’s AMM, or you need a step‑by‑step on staking on a Base‑based DEX, the collection covers practical use cases, security tips, and market insights to help you navigate this fast‑moving space.

SushiSwap v2 (Base) Review: Fees, Features & Security

A detailed review of SushiSwap v2 on Base, covering fees, features, security, liquidity provision, and future roadmap for DeFi traders.

View More