SushiSwap Fee Calculator

Calculate Your Trading Savings

See how much you could save by using SushiSwap on Binance Smart Chain versus Ethereum.

When you want to trade crypto without handing over your keys to a centralized exchange, SushiSwap on Binance Smart Chain (BSC) is one of the most popular choices. But is it right for you? It’s not just another DeFi platform. It’s a community-owned exchange that pays you to use it - if you know how to use it right.

What Is SushiSwap on BSC?

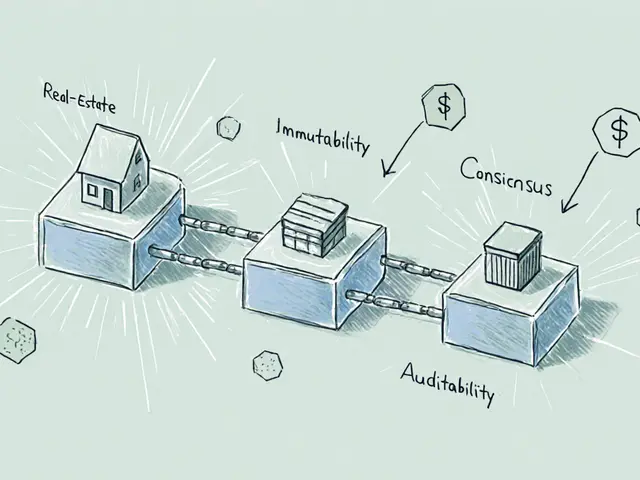

SushiSwap is a decentralized exchange (DEX) that started on Ethereum but quickly expanded to other blockchains. On Binance Smart Chain, it runs faster and cheaper than its Ethereum version. You swap tokens directly from your wallet - no sign-up, no KYC, no middleman. That’s the core idea behind DeFi: you hold your own crypto, and the smart contract handles the trade.

The platform uses an automated market maker (AMM) model. Instead of order books like Binance or Coinbase, SushiSwap relies on liquidity pools. Think of it like a shared jar of tokens. If you put in 1 ETH and 3000 USDT, you’re adding liquidity. In return, you earn a cut of every trade that happens in that pool. And on BSC, those trades cost less than $0.10 in gas fees, even during busy times.

SushiSwap’s BSC version supports hundreds of tokens, including BNB, USDT, BUSD, CAKE, and lesser-known altcoins. You can swap them in seconds. The interface is clean, with a Japanese sushi theme - BentoBox for staking, Kashi for lending - which makes it feel less like a financial terminal and more like an app you can learn by doing.

Why Choose SushiSwap on BSC Over Other DEXs?

Let’s compare it to the big names.

Uniswap is the original AMM. But on Ethereum, gas fees can hit $20 or more per trade. SushiSwap on BSC? You’re looking at $0.10 to $0.50. That’s a 95% cost saving. For frequent traders, that adds up fast.

Then there’s PancakeSwap, the dominant DEX on BSC. It’s popular, but it’s mostly focused on yield farming and token launches. SushiSwap offers more structure. It has:

- Liquidity pools - earn fees from trades

- SushiBar - stake SUSHI tokens to earn more SUSHI

- Kashi - lend or borrow crypto with collateral

- BentoBox - deposit tokens to earn interest and reduce swap fees

That’s more than just swapping. It’s a full DeFi toolkit. And unlike PancakeSwap, SushiSwap gives you a share of trading fees even if you’re not farming. Every time someone swaps on the platform, 0.05% of the fee goes to SUSHI stakers. That’s extra income just for holding and staking the token.

Also, SushiSwap supports seven blockchains. If you want to move from BSC to Arbitrum or Solana later, you can. That kind of flexibility matters when gas prices shift or new chains get popular.

How SUSHI Tokens Work - And Why They Matter

SUSHI is the governance token. You don’t need it to swap, but you need it to earn more.

Here’s how it works:

- You get SUSHI by providing liquidity to pools (like SUSHI/BNB)

- You can stake SUSHI in SushiBar to earn more SUSHI (currently around 1-3% APY)

- You can vote on proposals that change the platform - like fee structures or new chains

There are 250 million SUSHI tokens total. As of 2025, about 180 million are in circulation. No single wallet holds more than 1% of those - that’s good. But here’s the catch: only nine people control the multisig wallet that can change smart contracts. Five of them can approve code updates. That’s not fully decentralized. It’s a trade-off. Speed and security require some central control, but it’s a risk.

Still, SUSHI’s market cap sits around $200 million. It’s not in the top 50, but it’s stable. It’s listed on Coinbase, Kraken, and Binance. So if you want to cash out, you can.

Real-World Use Cases - Who Benefits Most?

Who’s SushiSwap on BSC for?

Beginners: If you’re new to DeFi, the Sushi Academy has clear guides on how to connect your wallet, add liquidity, and stake tokens. The UI is intuitive. You won’t see lines of code - just buttons labeled "Add Liquidity" and "Stake SUSHI." But there’s no demo mode. You’re using real funds from day one. That’s risky if you don’t understand impermanent loss.

Active traders: If you’re swapping tokens daily, the low fees on BSC make SushiSwap a winner. You can save $100+ a month compared to Ethereum-based DEXs.

Yield farmers: The SUSHI/BNB pool offers double rewards - you earn trading fees plus SUSHI tokens. Some pools have APYs over 20%, but those are high-risk. Always check the token’s volatility and audit status.

Privacy-focused users: No one knows your identity. No email. No phone number. Just your wallet address. That’s a big plus if you’re tired of KYC.

But if you’re looking for customer support, you won’t find it. No live chat. No phone number. If something goes wrong, you’re on your own - or you’ll find help in Telegram groups or Reddit threads.

The Downsides - What No One Tells You

SushiSwap isn’t perfect.

Impermanent loss: If you add liquidity to a volatile pair (like SUSHI/BNB), and one token’s price swings hard, you could lose money compared to just holding. This isn’t a bug - it’s how AMMs work. But beginners often don’t realize it until they check their balance.

Token selection: You won’t find every new meme coin here. SushiSwap is selective. If you’re chasing the latest pump, you might need to go to PancakeSwap or a new chain.

Governance centralization: Again, nine people hold the keys. That’s not how DeFi is supposed to work. The community votes, but the core team can pause or change things fast. That’s a red flag for purists.

No mobile app: You have to use a browser wallet like MetaMask or Trust Wallet. No official SushiSwap app. That’s fine for most, but it’s a barrier for users who want one-tap access.

How to Get Started on SushiSwap (BSC)

Here’s a simple step-by-step:

- Get a wallet: Install MetaMask or Trust Wallet. Set it to Binance Smart Chain (BSC) network.

- Buy BNB: Use a centralized exchange like Binance to buy BNB, then send it to your wallet.

- Go to sushi.com and connect your wallet.

- Click "Swap" to trade BNB for any token. Or click "Liquidity" to earn fees.

- To stake SUSHI, go to "SushiBar" and stake your tokens.

Always double-check the token contract address. Scammers create fake SUSHI tokens with similar names. The real one is 0x6b3595068778dd592e39a122f4f5a5cf09c90fe2.

Start small. Try swapping $10 worth of BNB for USDT. See how it feels. Then try adding $50 to a pool. Learn before you go big.

Final Verdict: Is SushiSwap (BSC) Worth It?

Yes - if you want low fees, multi-chain flexibility, and ways to earn beyond just trading. It’s not the easiest DEX for absolute beginners, but it’s one of the most rewarding if you’re willing to learn.

Compared to Uniswap on Ethereum? SushiSwap on BSC wins on cost and speed.

Compared to PancakeSwap? SushiSwap wins on structure and long-term incentives.

It’s not for everyone. If you need customer service, regulatory protection, or a simple app - stick with a centralized exchange. But if you believe in self-custody, community control, and earning while you trade? SushiSwap on BSC is one of the strongest options you’ve got.

The platform’s TVL is around $400 million as of 2025. That’s not massive compared to Uniswap’s $8 billion, but it’s stable. And with active development, multi-chain support, and a clear path to earn, it’s not going anywhere soon.

Frequently Asked Questions

Is SushiSwap on BSC safe to use?

Yes, but with caveats. The smart contracts have been audited by reputable firms like CertiK and PeckShield. No major exploits have occurred on BSC. However, there’s no insurance or customer support. If you send funds to the wrong address or interact with a fake contract, you lose them. Always verify contract addresses and never share your private key.

How do I earn rewards on SushiSwap?

You earn rewards in three ways: 1) By providing liquidity to trading pairs - you get a share of trading fees. 2) By staking SUSHI tokens in SushiBar - you earn more SUSHI. 3) By using BentoBox - you earn interest on deposited tokens and get discounted swap fees. The best returns usually come from high-yield pools, but those carry higher risk.

What’s the difference between SushiSwap on Ethereum and BSC?

The core features are the same, but BSC is faster and cheaper. Ethereum transactions can take minutes and cost $5-$50 in gas. On BSC, trades take seconds and cost under $0.50. If you’re swapping often or farming, BSC saves you money. Ethereum has more liquidity overall, but BSC is better for everyday use.

Can I lose money using SushiSwap?

Yes. You can lose money from impermanent loss when token prices swing wildly. You can also lose money if you stake in a pool with a collapsing token. And if you’re tricked into approving a malicious contract, hackers can drain your wallet. Always read what you’re approving. Never click "Approve" on unknown tokens.

Do I need to pay taxes on SushiSwap earnings?

In most countries, yes. Earning SUSHI tokens from staking or liquidity provision is usually treated as income. Selling those tokens later triggers capital gains. Tax rules vary by country - New Zealand, for example, treats crypto as property. Keep records of every transaction. Use tools like Koinly or CryptoTax to track your activity.

What’s the future of SushiSwap?

SushiSwap is focusing on cross-chain interoperability and user experience. They’re reducing complexity, adding better analytics, and improving governance transparency. Long-term, their success depends on whether they can decentralize control further. If they do, they could grow beyond DeFi enthusiasts and attract mainstream users. If not, they’ll remain a niche tool for experienced traders.