Nigeria Crypto Exchange License Checker

Check if your preferred crypto exchange is licensed by Nigeria's SEC for Naira transactions. Only licensed exchanges can process Naira deposits, withdrawals, and provide legal protection.

Nigeria doesn’t have a blanket ban on crypto exchanges anymore. That’s the first thing you need to understand. If you’re looking for a list of banned platforms like it’s 2021, you’ll be disappointed. The rules changed. In March 2025, President Bola Ahmed Tinubu signed the Investments and Securities Act (ISA 2025), which didn’t outlaw exchanges-it gave them a license to operate. Now, it’s not about which exchanges are banned. It’s about which ones are licensed.

There Are No Official Bans-Only Unlicensed Exchanges

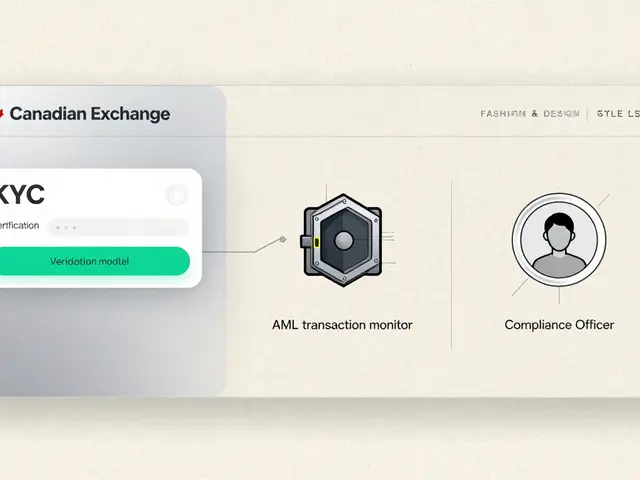

The Securities and Exchange Commission (SEC) of Nigeria is now the gatekeeper. Any crypto exchange that wants to serve Nigerian users must apply for a license. No license? You’re not allowed to offer Naira deposits, withdrawals, or local customer support. That’s the law. But it doesn’t mean you can’t access the platform at all.

Take Binance. In February 2024, the Nigerian government blocked access to its website through local ISPs. Naira trading on its peer-to-peer platform was suspended. But here’s the catch: Nigerian users still hold Binance accounts. They still send and receive Bitcoin, Ethereum, and other cryptos. They just can’t deposit or withdraw Naira directly. To get around the block, many use VPNs. The government doesn’t arrest them for that. They just don’t protect them if something goes wrong.

So Binance isn’t banned-it’s restricted. And that’s the pattern. The SEC doesn’t name and shame exchanges. Instead, it says: “If you’re not licensed, you’re not operating legally in Nigeria.” That’s a legal distinction, not a technical one.

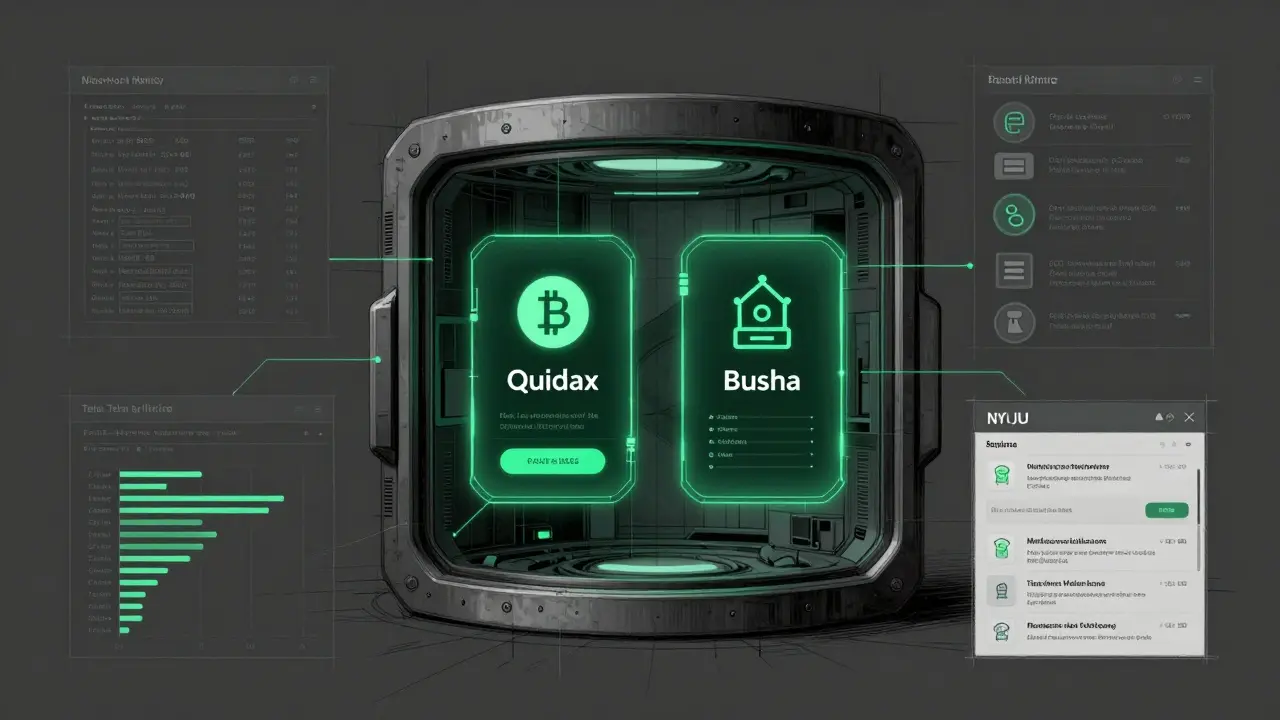

Only Two Exchanges Are Officially Licensed (So Far)

As of late 2025, only two crypto exchanges have received full SEC approval to operate in Nigeria: Quidax and Busha. These are Nigerian-founded platforms that spent over a year preparing for compliance. They’ve built full KYC systems, integrated AML monitoring, and set up local customer service teams. They report transaction data to the SEC and the Nigerian Financial Intelligence Unit (NFIU) every month.

These two aren’t just allowed-they’re examples. The SEC uses them as templates for other applicants. If you’re a Nigerian user who wants to trade crypto legally, these are your only two options right now. Everything else? Technically, you’re using an unlicensed service. That doesn’t mean it’s illegal to use-it just means you’re on your own if there’s a scam, hack, or frozen withdrawal.

Why Binance and Others Are Still Accessible

Why hasn’t Nigeria shut down Binance completely? Because it can’t. Nigeria’s crypto market is massive. Between July 2024 and June 2025, over $92 billion in cryptocurrency flowed into the country. That’s more than any other African nation-double South Africa’s volume. People use crypto to send remittances, protect savings from inflation, and buy goods from overseas. Banning it entirely would cause economic chaos.

The government’s strategy is smarter: control it, don’t kill it. By forcing exchanges to get licensed, they gain visibility into who’s trading what, where, and when. They can track suspicious activity, freeze fraud accounts, and even collect taxes. The Nigeria Tax Administration Act (NTAA) 2025, coming into effect in 2026, will require exchanges to report user income from crypto. Defaulters face fines of ₦10 million ($6,693) in the first month, plus ₦1 million ($669) every month after.

So Binance stays online because the government can’t shut it down without pushing millions of users into even riskier, completely unregulated corners. Instead, they’re trying to pull it into the light.

What Happens If You Use an Unlicensed Exchange?

If you use KuCoin, Kraken, Bybit, or any other international platform that hasn’t applied for a Nigerian license, you’re not breaking the law by holding crypto. But you are breaking the rules if you try to deposit Naira directly or use their local customer support. You won’t get help from Nigerian authorities if your funds disappear. No police report will be filed. No SEC investigation will open. You’re outside the legal safety net.

Some users report that unlicensed exchanges still accept Naira deposits through third-party payment processors or P2P traders. That’s a gray area. The SEC doesn’t regulate those intermediaries. If someone scams you on a P2P trade, you’re on your own. Licensed exchanges like Quidax and Busha have dispute resolution teams. They can reverse fraudulent trades. Unlicensed ones? No such thing.

The Real Risk Isn’t Getting Banned-It’s Getting Scammed

The biggest danger in Nigeria’s crypto scene isn’t government bans. It’s fraud. Before 2025, unregulated platforms promised 20% weekly returns. Thousands lost life savings to Ponzi schemes disguised as “crypto investment clubs.” The ISA 2025 cracked down on those. Now, any platform offering guaranteed returns is automatically illegal-and the SEC can shut them down fast.

But scams still happen. Fake apps, phishing sites, and impersonators are everywhere. Licensed exchanges have verified websites, official customer service numbers, and SEC registration IDs. Unlicensed ones? You can’t verify them. One user on Reddit said he lost $8,000 to a “Binance Nigeria” app that looked real-until he realized it wasn’t the real Binance. He couldn’t get his money back. No one could help him.

What’s Next? More Licenses Coming

The SEC is reviewing over 20 more exchange applications as of late 2025. International platforms like Luno and BitPesa are reportedly preparing their filings. The process is slow-taking 6 to 12 months-because the SEC demands detailed audits of security systems, data storage, and staff training. Smaller exchanges are struggling to meet the costs. That’s why only two made it so far.

Expect more licensed names in 2026. The goal isn’t to limit crypto. It’s to bring it into the financial system. Nigeria wants to be the fintech hub of Africa. That means regulating, not banning. And if you want to trade safely, you’ll want to be on a licensed platform.

Bottom Line: It’s Not About Bans-It’s About Licensing

There are no official lists of banned crypto exchanges in Nigeria. Instead, there’s one simple rule: Only Quidax and Busha are licensed to offer Naira services. Everything else operates in a legal gray zone. You can still use Binance, Kraken, or KuCoin-but you lose legal protection. You can’t deposit Naira legally. You can’t get help if something goes wrong. And you’re at higher risk of fraud.

If you’re serious about crypto in Nigeria, use Quidax or Busha. They’re slow, they’re bureaucratic, and they’re not as flashy as Binance. But they’re safe. And in a market where $92 billion moved in a year, safety matters more than speed.

Yzak victor

6 December, 2025 . 14:08 PM

So basically, Nigeria didn’t ban crypto-they just made it way less convenient if you’re not using the two licensed apps. Smart move, honestly. People were already using crypto to survive inflation and send remittances. Killing it would’ve been like cutting off a limb because it’s bruised.

Josh Rivera

8 December, 2025 . 02:13 AM

Oh wow, Quidax and Busha are the only ones licensed? Wow. I’m shocked. Not. 😏 Meanwhile, Binance is still the only exchange my cousin in Lagos uses-because Quidax takes 3 days to verify your ID and their UI looks like it was designed in 2012. This isn’t regulation, it’s bureaucratic theater.

Neal Schechter

9 December, 2025 . 03:21 AM

For anyone outside Nigeria: this is actually a textbook example of how to regulate a decentralized market without crushing it. Most governments either ban crypto outright or ignore it completely. Nigeria’s doing the hard thing-building oversight from the ground up. It’s messy, slow, and imperfect, but it’s working. The fact that $92B flowed in last year proves demand isn’t going away. The question is whether the system can scale before fraud catches up.

Madison Agado

10 December, 2025 . 15:01 PM

It’s funny how we call it ‘banning’ when what’s really happening is the government is finally asking, ‘Who are you? Where’s your ID? And why should I care if you lose money?’ Crypto was never about freedom from rules-it was about freedom from accountability. Now Nigeria’s saying: no more anonymity without responsibility. And honestly? That’s not tyranny. That’s maturity.

Tisha Berg

12 December, 2025 . 05:05 AM

Just a heads-up for anyone new to this: if you’re using a non-licensed exchange, don’t assume you’re safe just because you can still log in. No protection means no refunds, no legal recourse, no nothing. I’ve seen people lose everything because they trusted a fake app that looked just like Binance. Stick with Quidax or Busha-even if they’re slow. Your money’s worth the wait.

Billye Nipper

12 December, 2025 . 10:38 AM

YES!! This is the most balanced take I’ve seen on this!! 🙌 I’ve been telling my cousins in Lagos for months: it’s not about banning-it’s about safety. And licensed exchanges = real customer support. Unlicensed = hope you have a backup wallet. I’m so proud of Nigeria for not panicking and just… regulating. 💪

Roseline Stephen

13 December, 2025 . 10:32 AM

Interesting. I wonder how many of the unlicensed exchanges are actually owned by Nigerian founders trying to go global, or if it’s mostly foreign platforms ignoring local compliance. The line between ‘banned’ and ‘non-compliant’ feels blurry when you’re trying to build a business.

Isha Kaur

13 December, 2025 . 12:16 PM

Actually, I think this whole licensing model is going to become the standard across Africa. Look at Kenya and Ghana-they’re watching Nigeria closely. The problem isn’t just crypto-it’s how to integrate digital finance into a banking system that still relies on paper trails and physical branches. Nigeria’s trying to leapfrog that by forcing exchanges to become part of the financial infrastructure. It’s not perfect, but it’s the first real attempt at a structured crypto economy in the region. And honestly, the fact that they’re even trying is more than most countries have done.

Glenn Jones

14 December, 2025 . 06:07 AM

QUIDAX? BUSHA? LOL. Those are just glorified P2P middlemen with KYC forms. The SEC is just playing pretend. Meanwhile, Binance’s API is still the backbone of 80% of Nigerian crypto activity. This is like banning Uber but letting everyone use Lyft’s black car service while ignoring that half the drivers are still using unlicensed cars. The government’s not regulating-they’re doing PR. And the people? They’re just using VPNs and laughin’ at the whole charade.

Tara Marshall

14 December, 2025 . 14:53 PM

Only two licensed. That’s it. Everything else is a gamble.

Nelson Issangya

14 December, 2025 . 22:10 PM

Don’t let these bureaucrats scare you. If you’re using crypto to survive inflation, you’re not breaking the law-you’re fighting it. Quidax and Busha are fine for small trades, but if you’re moving real money, you’re going to need liquidity. And guess what? Only Binance and KuCoin have that. Don’t let the SEC’s paperwork fool you. The real power is still in the decentralized networks. Stay smart. Stay safe. And don’t let red tape steal your freedom.

Richard T

15 December, 2025 . 08:46 AM

Wait, so if I use Kraken and deposit via a P2P trader, am I technically violating the law? Or is it just the exchange that’s in trouble? Because I’ve been using a local guy on Telegram to buy BTC with Naira for months. Is he the one breaking the rules?

Mariam Almatrook

16 December, 2025 . 03:43 AM

One must question the philosophical underpinnings of this so-called ‘regulatory framework.’ By permitting only two indigenous platforms, the Nigerian state is effectively endorsing corporatist capture under the guise of financial inclusion. The implicit assumption-that legitimacy is conferred by bureaucratic sanction-is a dangerous precedent for decentralized systems. One cannot ‘license’ decentralization. One can only suppress it. And in doing so, one empowers the very monopolies one claims to oppose.

rita linda

16 December, 2025 . 19:00 PM

Let me get this straight-Nigeria is letting a couple of homegrown startups control the entire crypto market? Meanwhile, global giants like Binance are being sidelined? This is economic nationalism at its worst. We’re not in 1975. You don’t protect your economy by building tiny, inefficient local monopolies. You protect it by competing globally. This is a step backward, not forward.

Lore Vanvliet

17 December, 2025 . 21:07 PM

OMG I just lost $12K to a fake Busha app last week 😭😭😭 I thought it was legit because it had the SEC logo! I’m so mad. Why doesn’t the government just make a verified app store for crypto? Like, Apple has App Store-why can’t they have a ‘Crypto Verified’ section? This is ridiculous!!

Frank Cronin

18 December, 2025 . 22:01 PM

Let’s be real. Quidax and Busha? They’re glorified front-ends for Binance’s backend. The SEC didn’t ‘license’ them-they just rubber-stamped them as proxies for the real players. This whole system is a smokescreen. The only thing regulated here is the illusion of control. Meanwhile, the real market operates on Telegram, WhatsApp, and offshore wallets. The government thinks it’s playing chess. It’s actually playing checkers with a blindfold.

Nicole Parker

20 December, 2025 . 07:48 AM

I think what’s really beautiful here is that Nigeria didn’t try to destroy something it didn’t understand. Instead, it tried to understand it-and then shape it. That’s rare. Most governments see crypto as a threat. Nigeria saw it as a symptom. The real problem isn’t crypto-it’s inflation, broken banking, and remittance costs. Crypto’s just the tool people grabbed to fix it. So instead of outlawing the tool, they’re trying to make it safer. That’s not control. That’s care.

Kenneth Ljungström

22 December, 2025 . 03:24 AM

Just wanted to say big respect to Nigeria for not going full authoritarian on crypto. 🙌 I’ve seen so many countries panic and ban everything. But here? They said ‘okay, this is happening-how do we make it less dangerous?’ And that’s leadership. Also, if you’re using Quidax, their customer service actually replies within 24 hours. That’s more than I can say for most US exchanges 😅

Brooke Schmalbach

23 December, 2025 . 20:00 PM

Only two licensed? That’s a cartel. And you’re calling it regulation? The SEC is just protecting local incumbents from global competition. This isn’t about safety-it’s about control. And let’s not pretend the ‘gray zone’ isn’t where the real innovation is happening. The licensed platforms are slow, bloated, and boring. The unlicensed ones? They’re agile, responsive, and actually listening to users. If you’re choosing Quidax over Binance because it’s ‘safer,’ you’re not being smart-you’re being complacent.