XDOG Market Cap: Real‑Time Numbers, Token Insights & Trading Impact

When analyzing XDOG market cap, the total dollar value of all XDOG tokens in circulation. Also known as XDOG MC, it serves as a quick health check for the project. But the figure alone doesn’t tell the whole story. It’s tied to the XDOG token, a meme‑style coin built on the Ethereum network, whose price and circulating supply drive the cap. Understanding the circulating supply, the number of tokens currently available to trade is the key to interpreting any market‑cap movement.

In practice, XDOG market cap equals price multiplied by circulating supply – a simple semantic triple that underpins most crypto valuations. Accurate price data, however, requires reliable exchange feeds. When major exchanges list XDOG, price spreads tighten, and the market cap becomes a more stable metric. Conversely, low liquidity on a single DEX can cause price spikes that inflate the cap temporarily. This is why developers focus on building deep liquidity pools: more locked assets reduce slippage, keep the cap reflective of genuine demand, and attract institutional interest.

Why Market Cap Matters for XDOG Traders

Beyond the raw number, market cap influences perception. A cap under $50 million often flags a high‑risk, high‑reward scenario, while breaking the $100 million line can unlock broader media coverage and turn casual holders into serious investors. Tokenomics play a role too – the burn schedule, treasury allocation, and staking rewards all feed back into supply dynamics, nudging the cap up or down. For example, a weekly burn that removes 1 % of total supply will shrink circulating supply, which, if price holds, pushes the cap higher.

Regulatory outlook adds another layer. If a jurisdiction signals support for meme coins, exchanges may list XDOG faster, boosting price discovery and, by extension, the market cap. On the flip side, sudden crackdown news can trigger mass sell‑offs, shrinking both price and cap in minutes. Monitoring news channels, social sentiment, and on‑chain metrics gives traders a heads‑up before the cap shifts dramatically.

All these pieces – price feeds, supply changes, liquidity depth, tokenomics, and regulatory signals – intertwine to shape the XDOG market cap story. Below you’ll find our latest deep‑dives, price analyses, and practical guides that unpack each of these angles, giving you the context you need to make informed decisions.

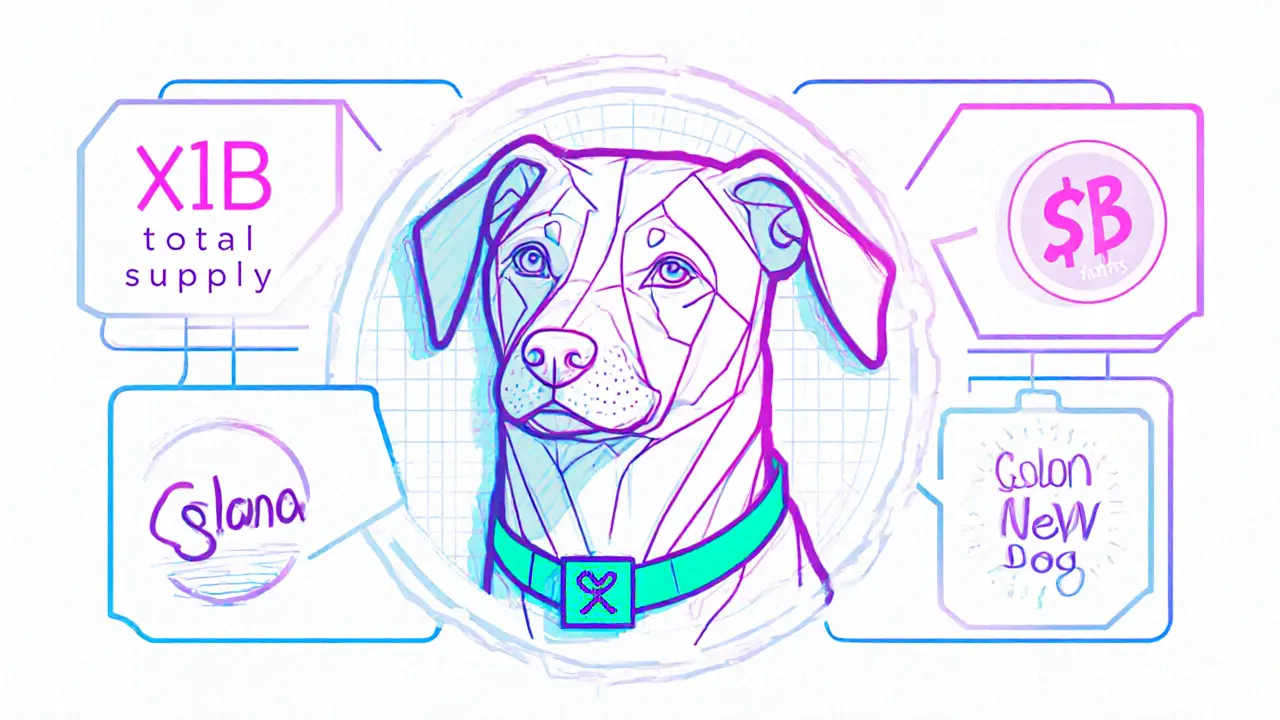

What Is XDOG? A Full Guide to the XDOG Crypto Coin

A concise guide that explains what XDOG is, its Solana foundation, market data, trading options, storage methods, risk factors, and how to buy the token.

View More