VARA License – Your Gateway to Crypto Operations in the UAE

When navigating the VARA license, the official permission issued by the UAE's Virtual Assets Regulatory Authority for crypto businesses. Also known as UAE crypto licensing, it sets the compliance baseline for operating token projects, exchanges, and service providers in the region. The broader UAE crypto regulations, a set of rules introduced in 2023 to oversee digital assets require a VARA license before any public offering. In addition, the Crypto-Asset Reporting Framework, a mandatory disclosure system for crypto transactions works hand‑in‑hand with the licensing regime, ensuring tax authorities see every trade.

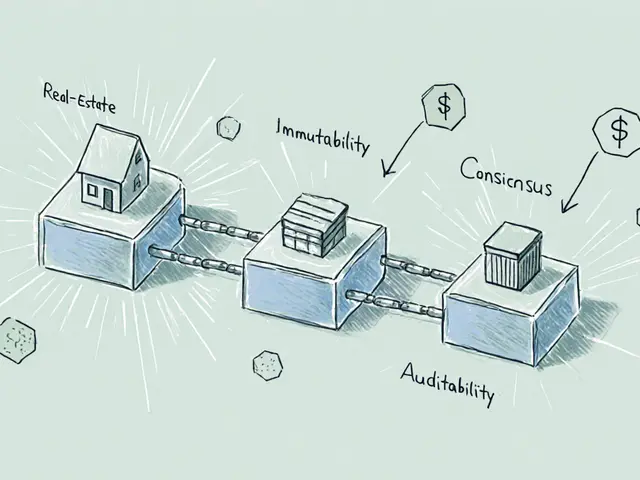

Key Elements of the VARA License

Getting a VARA license starts with a clear business plan that outlines the token type, target market, and security measures. Applicants must submit corporate documents, proof of capital, and a detailed AML/KYC policy. The Authority reviews the dossier, runs background checks, and usually replies within 30‑45 days. Once approved, the license is valid for two years and must be renewed with an updated compliance report. The process is designed to weed out fraud, protect investors, and give regulators a transparent view of the crypto landscape.

Licensing is only half the story. After the VARA seal, firms must obey the Crypto-Asset Reporting Framework. Every trade, staking reward, or token swap must be logged and submitted quarterly to the UAE’s tax office. The framework uses a standardized JSON schema, making it easy for software providers to automate uploads. Failure to report on time triggers fines and can lead to license suspension. For traders, this means keeping accurate wallets and transaction histories—no more hiding behind anonymous addresses.

How does this affect Bitcoin and altcoins? The VARA license treats Bitcoin as a “digital commodity” while classifying most altcoins as “utility tokens.” This distinction changes the tax rate and reporting fields. Exchanges that list BTC need a separate commodity‑trading permission, whereas platforms offering DeFi tokens must prove the token’s utility and disclose smart‑contract audits. The result is a more segmented market: Bitcoin‑focused services often enjoy lower fees, while altcoin projects invest heavily in compliance to stay listed.

Below you’ll find a curated set of articles that walk you through each step of the UAE crypto journey. From a deep dive into the licensing checklist to real‑world reviews of exchanges that have passed VARA scrutiny, we’ve gathered practical guides, risk warnings, and the latest airdrop news that ties into the regulatory environment. Dive in to see how the VARA license shapes the market, what you need to do to stay compliant, and which opportunities are worth your attention.

VARA Crypto Licensing Requirements in Dubai: A Complete 2025 Guide for VASPs

Learn the latest VARA crypto licensing rules for Dubai in 2025. Understand capital requirements, AML rules, and how to get approved for virtual asset services.

View More