Transaction Finality Explained: Why It Matters for Crypto Traders

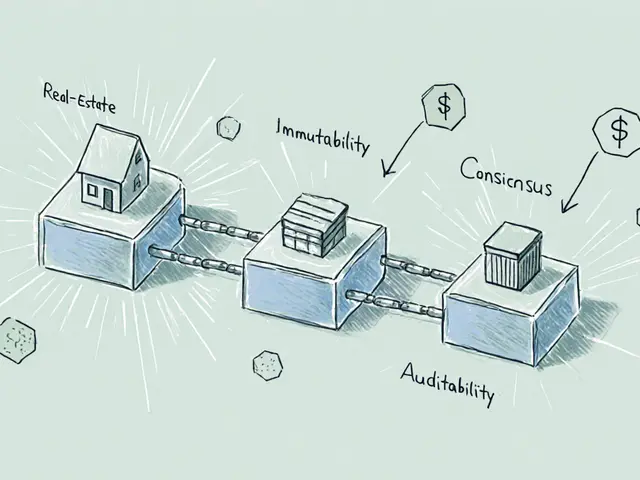

When dealing with transaction finality, the point at which a blockchain transaction becomes irreversible and cannot be altered or rolled back. Also known as finality guarantee, it ensures the network reaches consensus on the ledger state. Block confirmation, the process of adding subsequent blocks that cement a transaction’s status is the most visible sign of finality for users. Different consensus algorithms, such as Proof‑of‑Work, Proof‑of‑Stake or Byzantine Fault Tolerance, dictate how quickly and securely that consensus is reached. On layer‑2 solutions like rollups, layer‑2 scaling, the finality model often inherits the base chain’s guarantees but can add its own confirmation windows, so traders need to understand both layers. Finally, a reorg risk, the chance that recent blocks are orphaned and transactions are reversed becomes a practical concern whenever finality is still pending.

Key Factors Influencing Finality

In practice, the number of block confirmations required for a transaction to feel "final" varies by chain and by use case. Bitcoin miners typically recommend six confirmations for large transfers, while many Ethereum‑based DeFi platforms treat a single block as sufficient because the network’s finality is faster under Proof‑of‑Stake. Layer‑2 rollups such as Arbitrum or Optimism add an extra step: they post batch proofs to the main chain, meaning the finality of a rollup transaction is ultimately tied to the underlying base chain’s confirmation schedule. Consensus algorithms also bring trade‑offs: PoW offers strong security but slower finality, whereas PoS can finalize in seconds but relies on a different set of economic incentives. Reorg risk drops dramatically once the network passes a certain depth of blocks; however, during periods of high volatility or after a hard fork, even well‑established chains can experience short‑lived reorgs that affect pending trades.

Understanding these dynamics helps you decide when to move funds, place orders, or claim airdrops. In the list below you’ll find deep dives on DEX reviews, airdrop guides, exchange security analyses, and market‑order vs limit‑order mechanics – all of which touch on transaction finality in one way or another. Use the insights here to gauge how finality impacts your trading strategy, whether you’re swapping on SushiSwap V3, tracking a Flux Protocol airdrop, or evaluating the safety of a new crypto exchange. The articles that follow will give you practical examples of how finality plays out across different protocols and what you can do to minimize risk.

Understanding Transaction Finality in Ethereum Rollups

Explore how transaction finality works in Ethereum rollups, compare optimistic and ZK rollups, and learn practical steps to handle finality securely.

View More