STICK Token – Definition, Use‑Cases and Market Outlook

When talking about STICK Token, a utility token built for reward distribution within decentralized finance platforms, you’re dealing with a piece of code that aims to blend incentives and governance. Also known as STICK, it powers a set of smart contracts that handle staking, liquidity provision and community voting. The token’s core design follows a fixed supply model, with a 30% allocation reserved for early adopters, 40% for liquidity mining pools, and the remaining 30% split between development and future airdrop campaigns. This structure means the token’s value hinges on how many users lock it in DeFi protocols, how often it’s handed out in airdrop, targeted distribution events meant to boost participation, and the overall health of the surrounding ecosystem. In plain terms, the more you stake or provide liquidity, the more STICK you can earn – a direct link between participation and reward.

Key Features and Related Concepts

The DeFi, a network of decentralized financial services environment is the playground where STICK token lives. Within this space, the token enables staking on governance platforms, letting holders vote on protocol upgrades while earning a share of transaction fees. Moreover, the token is at the heart of liquidity mining, reward programs that compensate users for supplying assets to automated market makers. This creates a feedback loop: more liquidity boosts trading volume, which in turn raises the fee pool that STICK distributes. The tokenomics also embed a burn mechanism where a small percentage of every transaction is removed from circulation, tightening supply over time. Together, these elements satisfy several semantic triples: STICK token encompasses liquidity mining rewards; STICK token requires staking on DeFi platforms; airdrop programs influence STICK token distribution; tokenomics define the supply and emission schedule of STICK token; DeFi ecosystem supports STICK token utility.

For anyone eyeing the current market trends, the STICK token offers a blend of short‑term earning opportunities and long‑term governance influence. Whether you’re chasing yield in a liquidity pool, aiming to collect tokens from upcoming airdrops, or planning to cast votes on future protocol changes, the token presents multiple entry points. Below you’ll find a curated set of articles that break down everything from the token’s technical specs to practical guides on staking, liquidity mining strategies, airdrop participation, and risk assessment. Dive in to see how each piece fits into the broader picture of earning and participating in the fast‑moving world of decentralized finance.

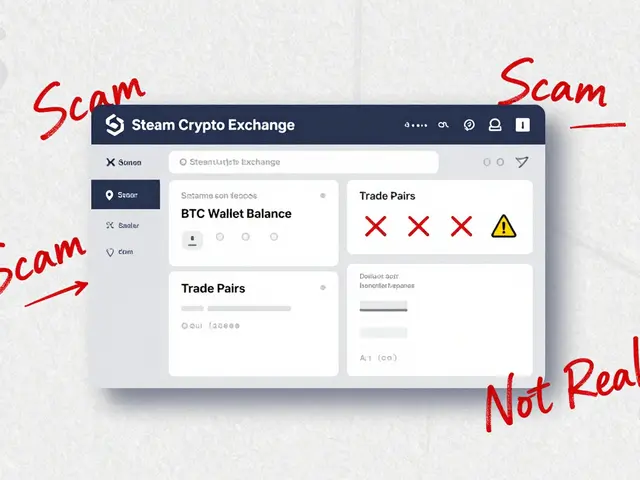

Stick (STICK) Crypto Coin Explained - Versions, Risks & How to Spot the Right One

Discover what Stick (STICK) crypto coin really is, its three blockchain versions, key technical details, market risks, and how to avoid buying the wrong token.

View More