Stablecoins: The Backbone of Low‑Volatility Crypto

When talking about stablecoins, digital assets engineered to hold a steady price by linking to a fiat currency, commodity, or algorithmic basket. Also known as price‑stable cryptocurrencies, they serve as a bridge between traditional money and the blockchain world. Stablecoins let traders hop in and out of volatile markets without cashing to fiat, which saves time and fees. One of the most widely used examples is USDT (Tether), a fiat‑backed token that claims each coin is backed by a US dollar reserve.

Key Types and How They Keep Their Peg

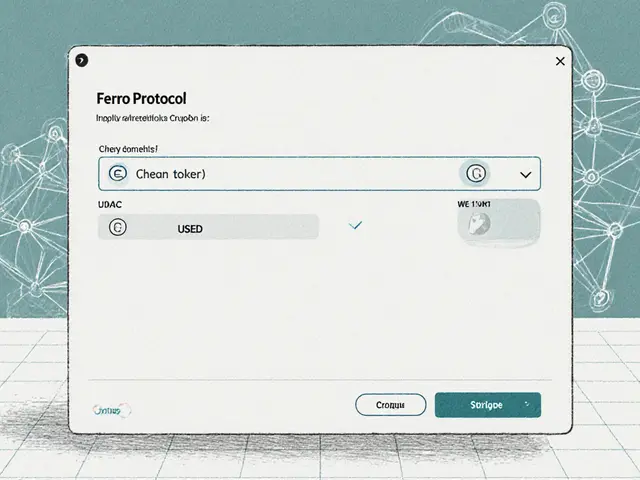

Not all stablecoins work the same way. USDC (USD Coin), another fiat‑backed coin, differentiates itself with regular audits and full‑reserve transparency, making it popular for institutional users. Algorithmic stablecoins rely on smart‑contract rules and market incentives to maintain a price target, without holding actual dollars; they adjust supply dynamically to match demand. Meanwhile, crypto‑collateralized options lock up assets like Ether to back each token, adding a layer of over‑collateralization for safety. These categories affect tokenomics, risk profiles, and regulatory scrutiny, so knowing which peg mechanism you’re dealing with is crucial before you invest or use them in a protocol.

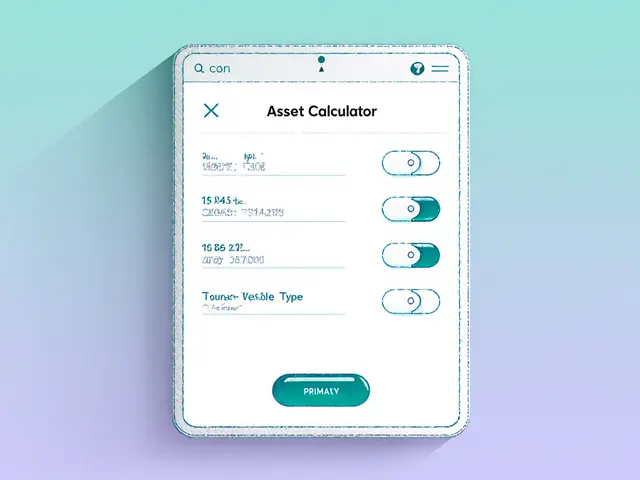

The rise of DeFi has turned stablecoins into the fuel for lending, borrowing, and yield farming. Platforms such as decentralized lending markets treat stablecoins as the base asset for low‑risk loans, because their predictable value reduces liquidation chances. This relationship means that stablecoins enable high‑frequency trading, cross‑border payments, and hedging against crypto volatility, while being influenced by regulatory moves that target their reserve practices. As you explore the articles below, you’ll see real‑world examples of how USDT, USDC, and algorithmic designs impact market liquidity, what risks traders face, and which new projects are pushing the stablecoin space forward.

How Argentine Peso Instability Fuels Rapid Cryptocurrency Adoption

Explore how Argentina's hyperinflation and strict capital controls are driving massive cryptocurrency and stablecoin adoption, reshaping everyday finance and future prospects.

View More