Sanctions Evasion in Crypto

When talking about Sanctions Evasion, the practice of bypassing economic or political restrictions through alternative channels. Also known as sanctions busting, it often relies on the speed and anonymity of digital assets to move value across borders where traditional banks would be blocked. This makes it a hot topic for regulators, investors, and anyone watching the crypto space because the stakes involve national security, market stability, and real money losses.

How Cryptocurrency Powers Evasion and Why AML Matters

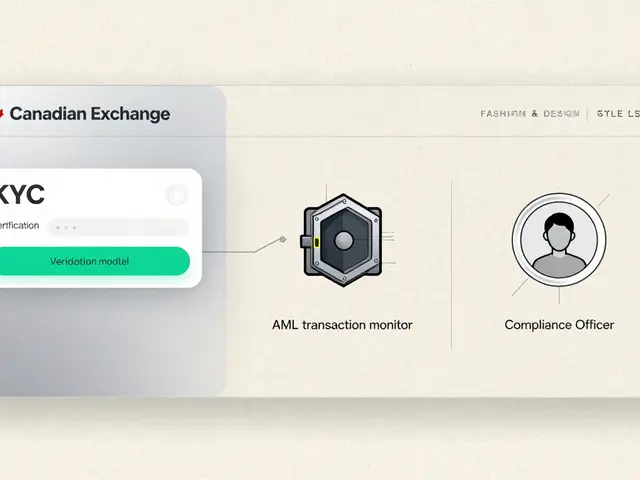

The rise of cryptocurrency, digital money that operates on blockchain networks. Also called digital currency, offers near‑instant transfers without a central authority. That very feature lets users slip past sanctions by sending tokens to wallets in jurisdictions that ignore or lack enforcement tools. Yet the same technology also creates data trails that can be mined by investigators. That’s where anti‑money‑laundering (AML), a set of regulations and processes designed to detect and prevent illicit financial flows steps in. Effective AML programs require crypto exchanges to screen addresses, flag suspicious patterns, and cooperate with sanctions lists. When a platform skimp on AML, it becomes a conduit for evaders, as seen in recent case studies of privacy‑focused coins and low‑liquidity airdrops that slip under the radar.

Crypto exchanges, airdrop campaigns, and DeFi protocols each add a layer of complexity. Exchanges like the ones reviewed on PoolMega—whether they charge low fees, offer exotic tokens, or lack robust KYC—directly influence how easy it is to hide behind a series of trades. Airdrops, such as those for new tokens on emerging blockchains, can unintentionally fund sanctioned actors if eligibility checks miss flagged addresses. Meanwhile, mining operations in regions with lax oversight (think the Norway ban or UAE licensing shifts) provide additional routes to convert fiat‑blocked funds into untraceable crypto. All these pieces connect: Sanctions evasion thrives where AML is weak, exchange compliance falters, and new token launches fly under the regulatory radar. Below you’ll find a curated set of articles that break down each of these angles—coin profiles, exchange reviews, regulatory updates, and practical how‑tos—so you can see the whole picture and spot the red flags before they become a problem.

Russia Legalizes Crypto Mining to Aid Sanctions Evasion - What It Means

Russia legalizes crypto mining, enabling a ruble‑backed stablecoin and new sanctions‑evasion routes, while the US and UK tighten crypto sanctions.

View More