Multi-Chain NFTs – The Future of Digital Collectibles

When dealing with multi-chain NFTs, non‑fungible tokens designed to function on more than one blockchain. Also known as cross‑chain NFTs, they let creators and collectors shift assets between ecosystems without minting a fresh token each time. This ability hinges on blockchain bridges, protocols that lock an NFT on one chain and issue a wrapped version on another. By wrapping, the original token stays safe while the wrapped copy can be used in games, DeFi, or marketplaces on the target chain. The result is a more fluid NFT economy where scarcity and provenance stay intact, no matter where the token travels.

Why Creators and Collectors Care About Cross‑Chain Interoperability

Imagine you bought a rare character skin on Ethereum, but the game you love runs on Arbitrum or Binance Smart Chain. With NFT gaming, games that embed NFTs as in‑game assets, a multi-chain token means you don’t have to abandon your collectable or pay extra minting fees. Instead, a bridge moves the token, and the game reads the wrapped version instantly. This lowers entry barriers, boosts liquidity, and expands the audience for both developers and players. Recent airdrops like the Dragon Kart NFT Weapon Box and the LNR (Lunar) giveaway showed how gaming projects are already leveraging cross‑chain drops to reach users on Ethereum, BSC, and newer L2 solutions.

From a collector’s perspective, multi-chain NFTs increase resale options. If a marketplace on Solana offers better fees or faster trades, you can bridge your token there without losing its original provenance. Moreover, platforms such as SushiSwap V3 on Arbitrum are adding NFT liquidity pools that accept wrapped NFTs, letting you earn yield while waiting for the next market move. This creates a feedback loop: more bridges drive more utility, and more utility fuels demand for bridges.

In practice, three core steps make a multi-chain transfer work: (1) lock the original NFT on its home chain, (2) mint a wrapped representation on the destination chain, and (3) verify the wrap via an oracle or smart‑contract proof. Projects like the Flux Protocol airdrop already use similar mechanisms to distribute tokens across multiple chains, proving the model works at scale. As bridges become more audited and gas‑efficient, risk drops and confidence rises, encouraging even larger NFT drops and DeFi integrations.

All of this means the NFT space is no longer siloed. multi-chain NFTs open doors for cross‑platform collaborations, new revenue streams for artists, and smoother experiences for fans. Below you’ll find reviews, guides, and real‑world examples that dive deeper into each piece of this puzzle—from rollup finality on Ethereum to specific airdrop claim processes. Use the insights here to decide which bridge fits your collection, how to safeguard wrapped assets, and which multi-chain projects are worth watching as the market evolves.

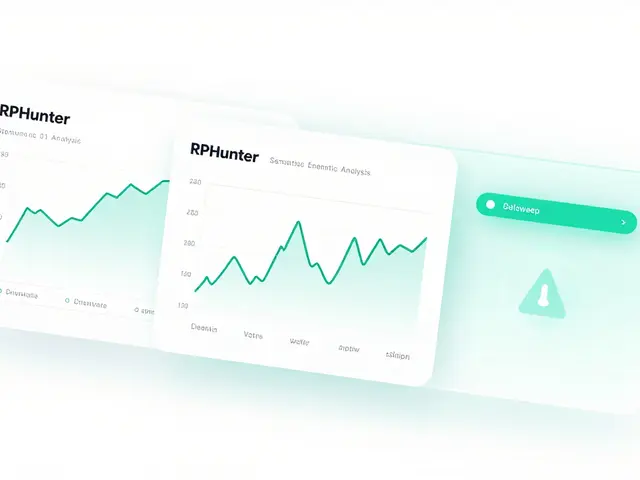

The Future of NFT Marketplace Technology: Trends Shaping 2025‑2026

Explore how AI, DeFi, multi‑chain support, and real‑world tokenization are reshaping NFT marketplaces in 2025‑2026, with practical insights for creators, investors, and developers.

View More