Crypto Token Safety Checker

Token Safety Assessment Tool

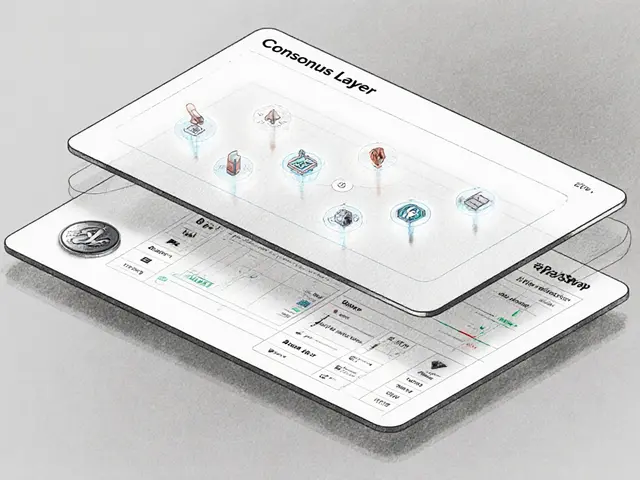

Check any cryptocurrency token for rug pull risk using the latest detection methodologies. Enter a token address to get an instant safety score.

Safety Assessment Results

Low Risk

Key Metrics

Based on the latest detection methodologies from RPHunter, Token Sniffer, and Token Metrics.

Tools like this can detect 95% of rug pulls by analyzing both smart contract code AND transaction behavior.

Remember: A score above 80 is generally safe, while anything below 50 indicates high risk.

Between January and November 2024, over $9.3 billion was stolen from crypto investors in the U.S. alone - and rug pulls accounted for the majority of those losses. These aren’t just random scams. They’re organized, automated, and getting smarter. Developers launch tokens with flashy websites, celebrity endorsements, and promises of 100x returns. Then, one day, the liquidity vanishes. The team disappears. The token drops to zero. And you’re left holding nothing. The good news? The tools to stop this are already here - and they’re getting better every month.

How Rug Pulls Work Today

A rug pull isn’t just one thing. It’s a set of tactics. The most common is the liquidity sweep. Scammers create a token paired with SOL or ETH, lock in a small amount of liquidity, and wait. When real investors start buying, the price rises. Then, in a single transaction, the dev wallet pulls out 90% of the liquidity. No warning. No notice. The token crashes instantly because there’s no one left to buy it. This exact pattern was observed on Solana’s Raydium V4 platform, where over 80% of new memecoins followed this script. Then there are soft rug pulls. These are quieter. The team keeps posting updates. They say they’re "building." They even release minor features. But behind the scenes, they’re slowly selling their tokens, draining the treasury, and cutting support. It takes weeks or months, but the result is the same: your investment becomes worthless. Hard rug pulls are fast. Soft ones are crueler. Both rely on one thing: you trusting what you can’t see.The Rise of RPHunter: Code + Behavior Detection

Traditional scanners look for known bad code patterns - like functions that let the owner withdraw all funds. But scammers changed their code to avoid those flags. Now, they hide malicious logic inside complex, legitimate-looking contracts. That’s where RPHunter comes in. Launched in early 2025, it’s the first system that doesn’t just check code - it watches how people interact with it. RPHunter builds two graphs: one of the smart contract’s logic (the semantic risk code graph), and another of token transactions (the token flow behavior graph). It then uses machine learning to find connections between them. For example: a contract might look clean, but if 90% of trades happen in the first hour, and the dev wallet immediately sends half the liquidity to a new address, RPHunter flags it - even if the code has no obvious backdoors. Its results are staggering: 95.3% precision, 93.8% recall. In real-world use, it caught 4,801 rug pull tokens with only 9% false positives. That’s not just detection - that’s prevention at scale.Token Sniffer and GoPlus: Automated Safety Scores

You don’t need to be a coder to protect yourself. Platforms like Token Sniffer give every token a safety score from 0 to 100. It checks: Is liquidity locked? Are there more than 500 holders? Is the contract renounced? Is there a known dev wallet with a history of scams? It even scans for honeypots - contracts that look tradable but trap your funds. A score above 80? Probably safe. Below 50? Run. Token Sniffer works across Ethereum, BSC, Solana, and Polygon. And it updates in real time. If someone pulls liquidity 10 minutes after launch, your dashboard shows it immediately. GoPlus Security does something similar but focuses on dApps and wallet interactions. It spots if a token’s contract allows unauthorized transfers, if the dev wallet can mint new tokens, or if there’s a hidden pause function. These aren’t just features - they’re red flags.

Token Metrics: The Investor Grade

Security isn’t enough. A token can be technically safe but still be a scam. That’s why Token Metrics created the Investor Grade. It doesn’t just look at code. It asks: Who’s behind this? Are they anonymous? Do they have a track record? Is the team verified on Twitter or LinkedIn? Is there real community engagement - or just bots? Is the token’s supply concentrated in 5 wallets? It also tracks liquidity stability. If a token’s liquidity drops by 30% in a week, even if the contract is clean, the Investor Grade drops. This system caught dozens of soft rug pulls before they became full-blown disasters. It’s not about avoiding risk - it’s about understanding it.Behavioral Analytics: Tracking Scammer Wallets

The next layer is behavioral detection. Companies like Elliptic track wallets across chains. They don’t just look at one transaction. They look at patterns: Does this wallet always send funds to exchanges right after a token launches? Does it interact with 20+ new tokens in a week? Does it use mixers or bridges to obscure its trail? These wallets leave fingerprints. Even if a scammer creates a new address, their behavior stays the same. Elliptic’s system flags these wallets automatically. Exchanges and DeFi platforms use these flags to block deposits or freeze accounts before the scam even starts. This shifts protection from reactive to predictive.

What You Can Do Right Now

Technology helps - but it doesn’t replace you. Here’s what you need to do:- Never invest based on a Telegram group hype or a YouTube influencer’s "100x gem." If it sounds too good to be true, it is.

- Always check the token’s liquidity. If it’s not locked for at least 6 months, walk away.

- Use Token Sniffer or GoPlus before buying. A 10-second check can save you $10,000.

- Look at the holder distribution. If the top 10 wallets hold more than 40% of the supply, it’s a red flag.

- Follow the dev team. Do they respond to questions? Do they have real profiles? Or are they using stock photos and fake names?

- Invest only what you can afford to lose. Crypto is risky. Rug pulls are designed to exploit FOMO. Don’t let emotion drive your decisions.

The Bigger Picture: Regulation and Community

Governments are starting to act. The California Department of Financial Protection and Innovation now runs a public Crypto Scam Tracker. It lists known rug pull projects, fake teams, and malicious contracts. You can search by token name or wallet address. It’s not perfect - scammers operate globally - but it’s a start. Community reporting is growing too. Platforms like DeFiLlama and Dune Analytics let users flag suspicious tokens. When 50+ users report the same project, algorithms prioritize it for deeper analysis. Reputation systems are being tested: users who consistently flag real scams get higher trust scores. Their reports carry more weight. The future isn’t one tool. It’s a network. RPHunter catches the code. Token Sniffer scores the safety. Token Metrics evaluates the team. Elliptic tracks the wallets. Regulators publish known scams. You, the investor, stay skeptical. Together, they form a shield.What’s Next

The next leap will be adaptive AI. Today’s tools rely on past data. Tomorrow’s will learn in real time. Imagine a system that watches 10,000 new tokens daily, learns what normal looks like, and instantly spots the 10 that behave like fraudsters - even if they’ve never been seen before. That’s coming. And it will make rug pulls harder to pull off. But the biggest barrier isn’t technology. It’s belief. Too many people still think, "This time it’s different." It’s not. The pattern never changes. The tools are here. The knowledge is free. The only thing left is your discipline.What exactly is a rug pull in crypto?

A rug pull is when the developers of a cryptocurrency project suddenly remove all the liquidity from a token’s trading pool, making it impossible to sell. They then disappear with the funds raised from investors. The token’s value crashes to zero, leaving holders with worthless assets. Rug pulls can be sudden (hard rug pulls) or gradual (soft rug pulls), where the team slowly sells off their holdings while pretending the project is still active.

How can I tell if a crypto token might be a rug pull?

Check for these red flags: no liquidity lock, anonymous or unverified team, token supply concentrated in a few wallets, lack of audits, and sudden spikes in trading volume with no real news. Use tools like Token Sniffer to get a safety score - anything below 50 is high risk. Also, look at the holder distribution. If the top 10 wallets hold more than 40% of tokens, it’s a warning sign.

Are there tools that can automatically detect rug pulls?

Yes. RPHunter, launched in 2025, combines smart contract analysis with transaction behavior tracking and has achieved over 94% accuracy in detecting rug pulls. Token Sniffer gives tokens a safety score from 0-100 based on code, liquidity, and holder patterns. GoPlus Security scans for malicious functions in contracts. These tools analyze thousands of tokens daily and flag suspicious ones before you invest.

Can blockchain analytics help prevent rug pulls?

Absolutely. Platforms like Elliptic use behavioral AI to identify scammer wallets across multiple blockchains. These wallets often show patterns: sending funds to exchanges immediately after a token launch, interacting with dozens of new projects in a short time, or using privacy tools to hide transactions. By flagging these wallets early, exchanges and DeFi platforms can block them before they cause damage.

Should I trust crypto projects promoted by influencers?

Never rely solely on influencer promotions. Many are paid to hype tokens that are already set up for rug pulls. Always do your own research. Check the token’s contract on Token Sniffer, verify the team’s identity, and look at the liquidity lock status. If the project has no public code, no audit, and no real community, it doesn’t matter who endorsed it - it’s likely a scam.

Is it possible to recover funds after a rug pull?

Almost never. Once liquidity is removed and funds are transferred to mixer services or centralized exchanges, tracing and recovering them is nearly impossible. Blockchain is transparent, but it’s not reversible. Prevention is the only real protection. Use detection tools, avoid unverified projects, and never invest more than you can afford to lose.

What’s the difference between a hard and soft rug pull?

A hard rug pull happens fast - liquidity is pulled in one transaction, the team vanishes, and the token crashes within minutes. A soft rug pull is slower: the team stays active, releases updates, and pretends the project is growing, while quietly selling their own tokens over weeks or months. The token’s price drops gradually, and investors often don’t realize they’ve been scammed until it’s too late.

How do I know if a token’s liquidity is truly locked?

Use platforms like Token Sniffer or Dextools. They show if the liquidity is locked via a smart contract (like Unicrypt or Team Finance) and for how long. A locked liquidity contract means the devs can’t withdraw funds until the lock period ends. If the liquidity isn’t locked at all, or if the lock period is less than 6 months, treat it as high risk.

Are rug pulls illegal?

Yes, in most jurisdictions, rug pulls are considered fraud. The FBI and other agencies classify them as financial crimes. However, because crypto is global and decentralized, enforcement is difficult. Many scammers operate from countries with weak regulations. That’s why personal vigilance and detection tools are more reliable than waiting for legal action.

Can new investors avoid rug pulls completely?

You can’t eliminate all risk - but you can reduce it drastically. Stick to tokens with verified teams, locked liquidity, third-party audits, and strong community engagement. Use detection tools like RPHunter and Token Sniffer. Avoid hype-driven memecoins with no utility. And never invest more than you can afford to lose. With discipline and the right tools, you can navigate crypto safely.

Kathy Wood

15 December, 2025 . 10:36 AM

This is why you never trust a meme coin with a Discord mod as a dev team. One click and your life savings? Gone. 💔

Stanley Machuki

15 December, 2025 . 14:08 PM

Use Token Sniffer before you even open your wallet. Ten seconds saves you ten grand. Simple.

Kathryn Flanagan

15 December, 2025 . 18:23 PM

I remember when I lost my whole crypto budget to a fake Solana token. I thought the influencer was legit. I didn't check the liquidity lock. I didn't look at the holder distribution. I just saw 100x and my heart went boom. I was so embarrassed. But now I use RPHunter and Token Sniffer every single time. I even show my nieces how to check the contract before they click buy. It's not about being rich. It's about not getting ripped off. And honestly? The tools are free. The knowledge is out there. You just gotta be willing to pause. Stop scrolling. Look. Ask. Wait. It's not sexy. But it's how you stay safe.

Rakesh Bhamu

15 December, 2025 . 22:42 PM

The rise of behavioral analytics is genuinely promising. Tools like Elliptic are not just reactive; they are predictive. By identifying wallet patterns across chains, we move from chasing ghosts to preventing the crime before it happens. This is the future of DeFi safety.

Kurt Chambers

17 December, 2025 . 04:54 AM

USA got it right. We dont need some gov to tell us how to trade. We got tools. We got smarts. We dont need hand holding. Just stop the noobs from blowing their cash on shitscoins. Thats all.

Kelly Burn

17 December, 2025 . 07:28 AM

RPHunter is 🔥🔥🔥 I used it on a token yesterday and it flagged it before I even clicked ‘buy’. My wallet is still intact. Thank you, AI gods. 🙏✨

John Sebastian

18 December, 2025 . 08:44 AM

People don't realize that most rug pulls are just corporate greed with a blockchain label. The system rewards speed over substance. That's not crypto. That's casino capitalism.

Jessica Eacker

18 December, 2025 . 11:34 AM

You don't need to be a genius to stay safe. Just be patient. Check the tools. Walk away from the hype. You'll thank yourself later.

Andy Walton

19 December, 2025 . 01:33 AM

I love how tech is finally catching up. But honestly? Most people still think ‘100x’ is a guarantee. They don’t even know what liquidity means. 😭 I lost my rent money to one of these. I’m still mad. But now I use RPHunter. And I yell at my cousins when they ask me about ‘the next doge’. They hate me. Worth it.

Candace Murangi

19 December, 2025 . 03:49 AM

I’m from Kenya and we’ve seen this same pattern with mobile money scams. The tactics are the same. Fake promises. Urgency. No transparency. It’s wild how human nature doesn’t change, even when the tech does. Tools like this? They’re not just for crypto. They’re for every new financial frontier.

Albert Chau

20 December, 2025 . 17:03 PM

If you’re still buying tokens without an audit, you’re not an investor. You’re a donation machine.

Madison Surface

21 December, 2025 . 13:28 PM

I used to think rug pulls were just bad luck. Then I started reading the transaction flows. It’s not luck. It’s engineering. These people plan this stuff like military ops. That’s why tools like RPHunter matter. They’re not just scanners. They’re detectives.

Tiffany M

23 December, 2025 . 03:05 AM

I just used Token Sniffer on a token my friend swore was ‘the next shitcoin moon’... and it gave it a 12/100. I laughed so hard I spilled my coffee. Then I blocked him. No more crypto advice from people who think ‘LFG’ is a research method. 🤦♀️

Eunice Chook

24 December, 2025 . 13:11 PM

Let’s be real: 90% of these tools are just marketing. The real rug pulls are the ones with audits, locked liquidity, and verified teams. The smart ones always have a backdoor. Always.

Lois Glavin

25 December, 2025 . 05:19 AM

I’ve been in crypto since 2017. I’ve lost money. I’ve gained money. But the one thing I’ve learned? The best tool isn’t software. It’s your gut. If something feels off, it is. Don’t overthink it. Just walk away.

Abhishek Bansal

26 December, 2025 . 03:49 AM

You guys are all missing the point. These tools are just a distraction. The real problem? People think crypto is a get-rich-quick scheme. It’s not. It’s a gamble with extra steps. Stop pretending tech fixes human stupidity.

amar zeid

27 December, 2025 . 16:14 PM

While the technological advancements are commendable, I must emphasize that regulatory frameworks must evolve in tandem. Without legal accountability, even the most sophisticated detection systems remain reactive. A decentralized ecosystem requires decentralized governance-not just code.

Hari Sarasan

28 December, 2025 . 22:41 PM

The notion that RPHunter's 95.3% precision implies infallibility is dangerously misleading. Algorithmic detection is inherently backward-looking. Scammers adapt faster than any ML model can retrain. This is a false sense of security masked as innovation. The real vulnerability remains human psychology.