Liquidity Mining: Earn Rewards by Supplying Crypto Liquidity

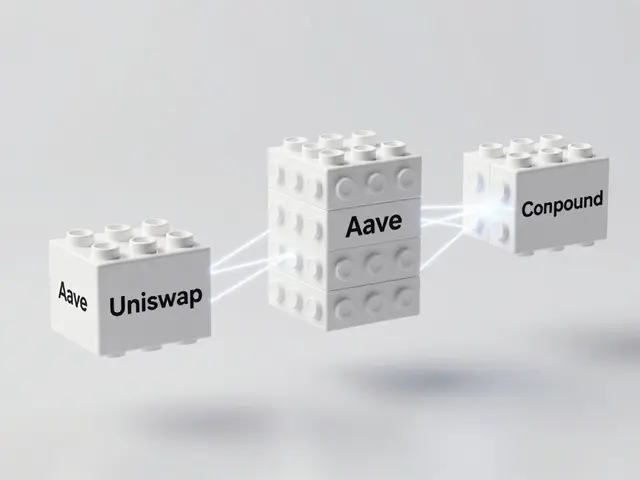

When working with Liquidity Mining, the practice of locking digital assets into a pool to receive extra tokens. Also called LP staking, it sits at the heart of DeFi, decentralized finance platforms that run on smart contracts and connects directly to Yield Farming, a set of tactics that chase the highest returns by moving assets across multiple pools. In simple terms, you provide liquidity, the protocol uses it for traders, and you collect a share of the fees plus any bonus tokens.

The building block of liquidity mining is the Liquidity Pool, a smart contract that holds two or more tokens in a fixed ratio for automated trading. These pools need constant capital, so protocols reward contributors. The reward token can be the native coin of the platform or a governance token that grants voting rights. Because the pool’s value changes with market moves, contributors also face impermanent loss—a temporary dip in value compared to simply holding the assets. Understanding that trade‑off is key before you jump in.

Key Steps to Get Started with Liquidity Mining

First, pick a reputable DeFi platform—Uniswap, SushiSwap, Curve, or newer Layer‑2 solutions each have different fee structures and token incentives. Next, choose a pair that matches your risk tolerance; stable‑coin pairs like USDC/USDT usually have lower impermanent loss, while volatile pairs like ETH/DAI can offer higher yields. After supplying the assets, you’ll receive LP tokens that represent your share of the pool. Stake those LP tokens in the protocol’s farming contract to start earning rewards. Most platforms let you claim and restake rewards automatically, turning the process into a compounding engine.

While the core loop is simple, there are several tools that make liquidity mining smoother. Wallets like MetaMask or Trust Wallet let you interact with contracts directly, and analytics dashboards such as Zapper or Debank track your position, APY, and earned tokens in real time. Some users employ bots to rebalance their positions when the pool’s ratio drifts too far, reducing impermanent loss. If you’re comfortable with code, you can even write custom scripts using Web3 libraries to automate claims and reinvestments.

Liquidity mining isn’t just about earning extra coins—it also fuels the broader DeFi ecosystem. More liquidity means lower slippage for traders, tighter spreads, and a healthier market overall. In turn, higher trading volume generates more fees, which can be redistributed to miners, creating a virtuous cycle. This relationship is why many new projects launch aggressive liquidity mining campaigns to bootstrap network activity and attract early users.

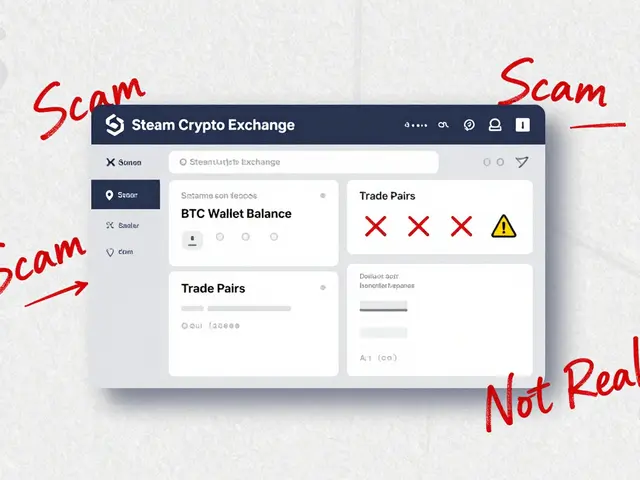

However, the space is competitive and can be risky. Reward rates often start high and decay over time as more participants join. Some projects may release governance tokens that quickly lose value, or they could be outright scams. Always verify the smart contract code, check audits, and read community feedback before locking funds. Diversifying across multiple pools and platforms can spread risk, and keeping a portion of your portfolio in stable assets protects you from sudden market swings.

Beyond pure liquidity mining, you’ll notice many of the articles on this page touch on related concepts. For example, the guide on Quicksilver (QCK) dives into liquid staking—another way to earn yields while still holding the underlying token. The BounceBit (BB) piece explains Bitcoin‑based yields that blend staking with DeFi. Exchange reviews for Korbit, BitFriends, and IncrementSwap show where you can swap tokens and add liquidity safely. Airdrop breakdowns for CHY, SupremeX, and PandaSwap illustrate how projects reward early liquidity providers with free tokens.

All these pieces fit together under the umbrella of Liquidity Mining. Whether you’re a beginner looking for a steady side income or a seasoned trader chasing the next high‑APY pool, the resources below give you practical steps, risk warnings, and platform comparisons. Scan the list, pick a strategy that matches your comfort level, and start putting your crypto to work.

Benefits of Liquidity Mining Programs in DeFi

Liquidity mining lets crypto holders earn rewards by providing funds to decentralized exchanges. It boosts trading efficiency, creates passive income, and gives small investors equal access to DeFi growth - all while reducing reliance on traditional market makers.

View MoreHow Liquidity Mining Rewards Work in DeFi

Liquidity mining lets you earn crypto by locking up tokens in DeFi trading pools. Learn how rewards work, the risks like impermanent loss, and where to start safely in 2025.

View MoreSushiSwap v2 (Base) Review: Fees, Features & Security

A detailed review of SushiSwap v2 on Base, covering fees, features, security, liquidity provision, and future roadmap for DeFi traders.

View More