EVA Token: Your Complete Quick‑Start Guide

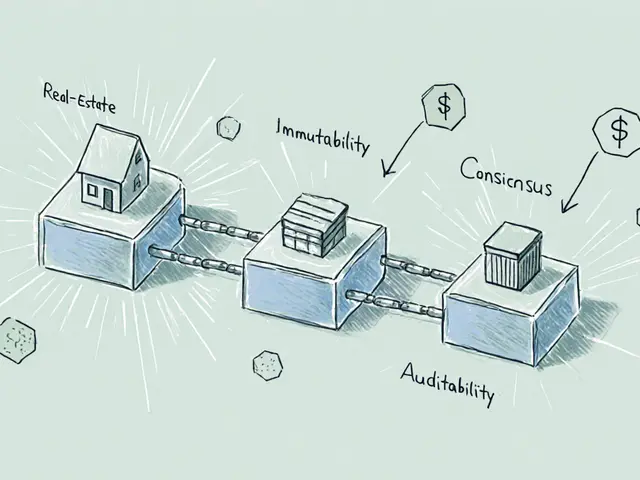

When working with EVA Token, a blockchain‑based digital asset designed to serve both DeFi protocols and real‑world utility cases. Also known as EVA, it offers a mix of governance rights, staking rewards and cross‑chain compatibility.

The token’s Tokenomics, supply caps, inflation schedule and reward distribution model define how value is created and shared. Built as an ERC‑20, standard on the Ethereum network asset, EVA can be stored in any compatible wallet and moved with low friction. In the DeFi world, DeFi platforms, lending, staking and yield farms that run smart contracts treat EVA as collateral, liquidity provider token or governance vote. Major crypto exchanges, centralized marketplaces where users trade tokens for fiat or other crypto list EVA, giving it market depth and price discovery. Occasionally, developers launch airdrops, free token distributions to early adopters or active community members to boost awareness and bootstrap network effects.

How EVA Token Connects Core Crypto Concepts

EVA token sits at the intersection of three main ideas: transparent tokenomics, smart‑contract interoperability, and community‑driven growth. First, its tokenomics encompass a fixed maximum supply of 100 million, a gradual release schedule for developers, and a staking pool that returns up to 12% APR—this rewards holders while keeping inflation in check. Second, because EVA follows the ERC‑20 standard, it can be wrapped for use on layer‑2 solutions like Arbitrum or Polygon, expanding its reach without sacrificing security. Third, airdrop campaigns have proved effective; a recent snapshot rewarded users who held at least 0.1 EVA in the previous month, resulting in a 15% surge in wallet activity. Together, these elements create a feedback loop: solid tokenomics attract exchanges, exchange listings increase liquidity, liquidity fuels DeFi adoption, and DeFi use cases encourage more airdrops and community participation.

From a practical standpoint, anyone looking to get involved should start by checking the latest market data on reputable exchanges, then review the official tokenomics whitepaper for lock‑up periods and reward structures. Next, explore DeFi dashboards to see which platforms currently accept EVA for staking or lending—these often list APY rates and risk metrics. Finally, keep an eye on official channels for upcoming airdrop announcements; past events have required simple on‑chain actions like a single transaction or a social‑media verification, making participation low‑cost but potentially high‑reward. By following this structured approach, you can evaluate EVA’s fit for your portfolio, understand its risk profile, and tap into growth opportunities as the ecosystem evolves.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these areas—tokenomics breakdowns, exchange reviews, DeFi integration guides, and step‑by‑step airdrop tutorials—all curated to give you a thorough view of the EVA token landscape.

EVA Airdrop Details: What Evanesco Network Says & How to Verify

No official EVA airdrop exists yet. Learn what Evanesco Network offers, how to verify legitimate drops, avoid scams, and stay ready for future token rewards.

View More