EU Crypto Passport: What It Is and Why It Matters for Crypto Users

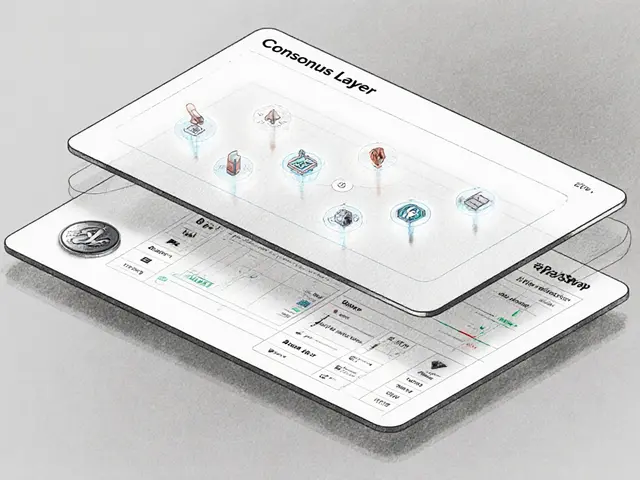

When you hear EU crypto passport, a digital identity credential issued under the EU’s Markets in Crypto-Assets (MiCA) regulation to verify users across member states. It’s not a physical card—it’s a secure, government-backed digital profile that links your identity to crypto transactions. Think of it like a digital driver’s license, but for crypto. If you trade, stake, or use DeFi in Europe, this will soon affect how you interact with exchanges, wallets, and even airdrops.

This EU crypto passport, a digital identity credential issued under the EU’s Markets in Crypto-Assets (MiCA) regulation to verify users across member states. It’s not a physical card—it’s a secure, government-backed digital profile that links your identity to crypto transactions ties directly to MiCA regulation, the EU’s comprehensive legal framework for crypto assets that enforces transparency, consumer protection, and cross-border compliance. It’s the reason why exchanges like Binance and Kraken now need to verify users in ways they didn’t before. It also connects to crypto identity, the system of verified digital profiles used to track ownership, prevent fraud, and meet AML rules in blockchain networks. Without it, you might hit walls when trying to deposit EUR, withdraw to a local bank, or even join a new DeFi protocol in Germany or France. And it’s not just about rules—it’s about access. The passport lets you move freely between EU countries without re-verifying your identity every time you switch platforms.

What you’ll find in the posts below is a real look at how crypto regulation is changing across Europe and beyond. You’ll see how MiCA is forcing exchanges to adapt, how AML rules are tightening under the Travel Rule, and why some platforms are pulling out of certain markets while others double down. You’ll also get clear breakdowns of what happens if you ignore these rules—like FBAR filings for U.S. residents or mandatory reporting in Switzerland. This isn’t theory. It’s what’s happening right now, and if you’re active in crypto, you need to know how it affects your wallet, your trades, and your freedom to move money across borders.

Cross-Border Crypto Services in the EU Under MiCA: What You Need to Know in 2025

MiCA regulation now governs cross-border crypto services across the EU, requiring all providers to get licensed and follow strict rules on transparency, asset protection, and AML. Here’s what businesses and users need to know in 2025.

View More