Cryptocurrency Exchange Comparison

When working with cryptocurrency exchange comparison, the systematic evaluation of crypto trading platforms on security, fees, asset variety, and user experience. Also known as exchange analysis, it guides traders toward a venue that matches their risk tolerance and profit goals. Below you’ll see why a solid comparison matters before you lock up any funds.

One of the first things to check is exchange security, how an exchange protects user assets through encryption, cold storage, and two‑factor authentication. A breach can wipe out weeks of gains, so looking for audits, insurance coverage, and a transparent security track record is essential. Strong security often correlates with higher trust scores, which in turn attract more liquidity and better order fills.

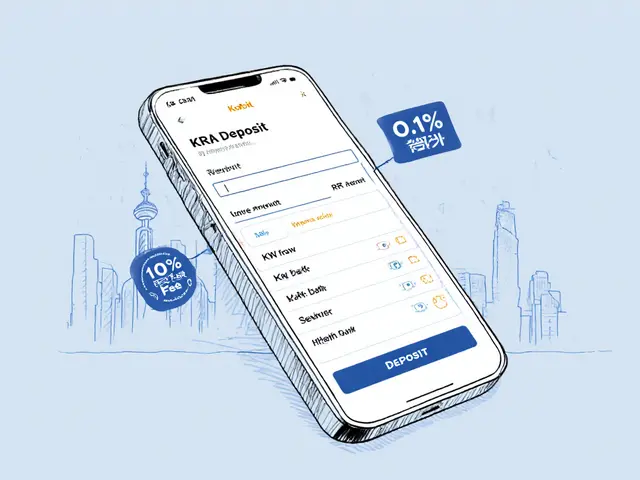

Next up is trading fees, the cost structure that a platform charges per trade, withdrawal, or deposit. Some exchanges use a maker‑taker model, others offer flat rates. Watching fee tiers helps you avoid hidden costs that can erode small‑scale profits. Remember, lower fees don’t always mean better service; they must be weighed against security and liquidity.

Liquidity is the lifeblood of any market. exchange liquidity, the depth of buy and sell orders available on a platform, determines how quickly you can enter or exit a position without slippage. High‑volume exchanges usually provide tighter spreads, which benefits day traders and large investors alike. Checking daily volume charts and order‑book depth gives a realistic picture of real‑world execution.

Don’t forget the rise of decentralized exchanges (DEX), peer‑to‑peer platforms that run on smart contracts instead of a central authority. DEXes offer greater privacy and often lower custody risk, but they can suffer from higher gas fees and limited order types. Comparing DEXs with centralized venues lets you balance control versus convenience.

Putting these pieces together, a thorough cryptocurrency exchange comparison looks like this: security first, fees second, liquidity third, and DEX features as a fourth dimension. Each factor influences the others—strong security can attract more users, boosting liquidity; lower fees can draw higher volume, improving order‑book depth. Understanding these interplays helps you spot platforms that truly deliver value.

In practice, start by listing the exchanges you’re eye‑balling, then score each on the four criteria. Use publicly available audit reports, fee calculators, and on‑chain analytics to fill in the numbers. When the scores line up, you’ll have a clear hierarchy of platforms ready for action.

Now that you know what to look for, the articles below break down specific exchanges, show real‑world fee calculations, and compare DEX performance on popular blockchains. Dive in to see practical examples, safety checklists, and tips for matching the right exchange to your trading style.

BFX Exchange Review 2025: Bitfinex Token Legacy & BlockchainFX Outlook

A clear, up‑to‑date review of Bitfinex's historic BFX token and the newer BlockchainFX project, covering security, features, and whether either qualifies as a trustworthy crypto exchange.

View More