Crypto Investment Risk: A Practical Overview

When dealing with crypto investment risk, the possibility of losing money due to price swings, regulatory changes, security breaches, or flawed token designs. Also called digital asset risk, it shapes every decision a trader makes, whether you’re buying a meme coin or a blue‑chip Bitcoin. Understanding this risk isn’t a theory exercise; it’s the first step to protecting your capital.

Key Risk Categories

One of the biggest drivers is market volatility, the rapid price swings that can erase gains in minutes. Crypto investment risk encompasses this volatility, which is amplified by low liquidity in many new tokens. Another critical factor is tokenomics risk, flawed supply models, unclear utility, or unrealistic reward promises that can crash a token’s value. When a project like Flourishing AI or Midnight Evergreen releases a token with opaque economics, investors often face sudden dump cycles.

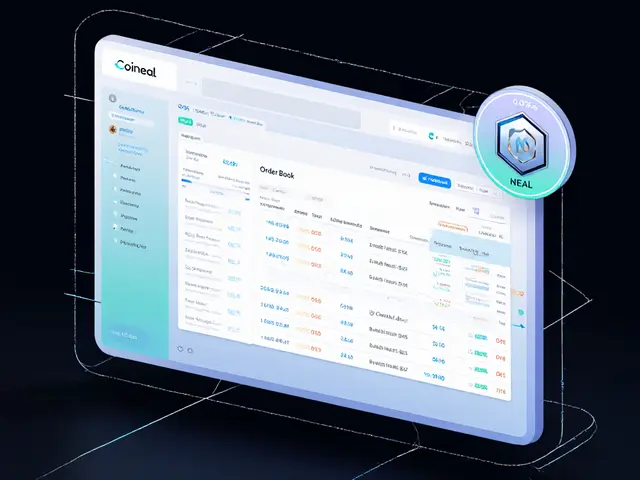

Security of the platform you trade on matters just as much. Exchange security issues—ranging from poor cold‑wallet practices to outright scams—can wipe out portfolios overnight. Reviews of exchanges such as Korbit, BitFriends, and IncrementSwap show how fee structures, KYC procedures, and audit histories affect user safety. Meanwhile, regulatory risk, the threat of new laws, licensing requirements, or bans that change the legal landscape, can force a token off the market or freeze assets, as seen with Norway’s temporary mining ban or the UAE’s 2025 licensing rules.

Beyond the big picture, operational risks hide in the details. Mining profitability, for example, hinges on electricity costs and hardware efficiency; a sudden halving or power price hike can turn a profitable operation into a loss-maker. Liquidity risk shows up when you can’t find a buyer at a fair price, especially on smaller DEXs where slippage can double your intended trade cost. Tax treatment adds another layer—U.S. spot‑trading rules differ from forex, and failing to report gains can lead to penalties.

Airdrops look tempting, but they often carry hidden dangers. Projects like CHY, SupremeX, or PandaSwap may promise free tokens while exposing participants to phishing attacks or junk‑token scams. Knowing how to verify a drop, check contract addresses, and avoid fake claim sites is part of managing overall crypto investment risk.

All these factors intertwine: market volatility fuels tokenomics risk, regulatory changes can trigger security overhauls, and liquidity crunches magnify tax complexities. By grasping each piece, you’ll be better equipped to pick projects that match your risk tolerance and set up safeguards before you commit capital. Below you’ll find a curated list of articles that break down these risks in depth, give you step‑by‑step safety checklists, and show real‑world examples of what can go right—or wrong—when you dive into crypto investing.

Timeless (TIMELESS) Crypto Coin Explained: Token Details, Price, and Risks

Explore the two Timeless (TIMELESS) crypto tokens, their blockchain bases, market data, and key risks. Learn how they work, where to trade, and a checklist for safe investing.

View More