Crypto Business Compliance: What Every crypto Firm Must Know

When navigating crypto business compliance, the set of laws, licensing requirements, and tax obligations that govern crypto activities, you quickly realize it’s not just paperwork. It’s the backbone that lets exchanges, wallets, and DeFi platforms operate without running into regulators. Think of compliance as the rulebook that lets you launch a token, open a trading desk, or run a mining operation while staying on the right side of the law.

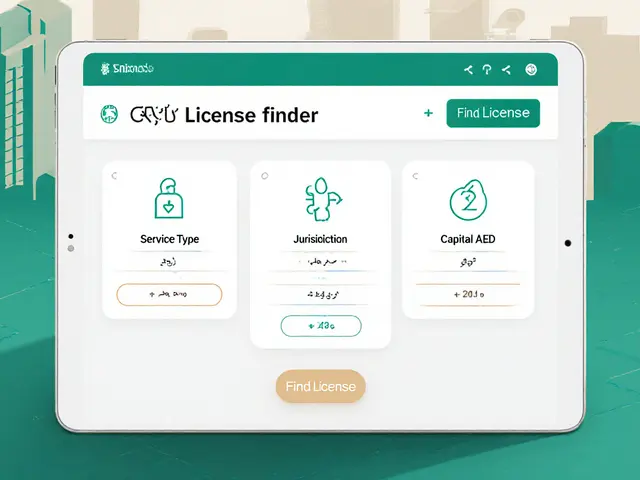

One major piece of the puzzle is UAE crypto regulations, the 2025 framework that defines licensing steps, VAT exemptions, and reporting standards for digital assets in the United Arab Emirates. The UAE’s approach shows how a clear licensing path can attract global firms. Its Entity‑Attribute‑Value snapshot reads: Entity – UAE; Attribute – licensing process; Value – VARA approval, 0% VAT for compliant activities. This model influences other jurisdictions, making it a reference point for compliance officers worldwide.

Another hotspot is Norway crypto mining ban, the temporary prohibition on new mining data centres aimed at protecting renewable energy resources. Norway’s move proves that environmental policy can directly shape compliance requirements for miners. The semantic triple here is: "Norway crypto mining ban influences energy‑use compliance for Bitcoin miners". Understanding this link helps businesses plan where to site operations and how to meet local sustainability standards.

Licensing bodies also play a key role. Bappebti crypto licensing, Indonesia’s former crypto oversight agency that set asset‑licensing criteria before the shift to OJK in 2025 illustrates how regulatory transitions affect compliance roadmaps. Firms that secured Bappebti licenses had to meet capital‑adequacy, AML, and KYC thresholds—attributes that remain relevant under the new OJK framework. This continuity shows that robust compliance foundations survive regulatory changes.

Beyond regional rules, tax treatment is a universal compliance pillar. The U.S. treats spot crypto trades as capital gains, requiring Form 8949 and potentially Form 1099‑DA. The entity‑attribute‑value for tax compliance reads: Entity – United States; Attribute – tax form; Value – 8949 for gains, 1099‑DA for reporting. Knowing which forms apply saves firms from costly audits and keeps traders confident.

Why This Matters for Your Crypto Business

Putting these pieces together, you see that crypto business compliance isn’t a single law but a network of regulations, licensing steps, tax codes, and environmental rules. It demands a clear compliance program that maps each entity to its attributes—whether you’re filing for a VARA license in the UAE, adjusting energy use due to Norway’s ban, or filing the right tax forms in the U.S. The next section lists articles that break down each of these topics, from exchange reviews to deep dives on specific jurisdictional rules. Dive in to get practical steps, real‑world examples, and the latest updates you need to keep your crypto venture compliant and thriving.

Transition Periods for EU Crypto Businesses Under MiCA: Deadlines, Rules, and Cross-Border Risks

MiCA's transition periods for EU crypto businesses vary by country, with deadlines ranging from mid-2025 to mid-2026. Companies must apply for licenses before their national deadline or lose the right to operate. Cross-border operations are bound by the shortest transition window.

View MoreHow to Get a VASP License in Nigeria: Step‑by‑Step Guide for Crypto Companies

A practical, step‑by‑step guide on getting a VASP licence in Nigeria for crypto businesses, covering requirements, the ARIP fast‑track, compliance duties and common pitfalls.

View More