Bitcoin

When talking about Bitcoin, a peer‑to‑peer digital cash system that lives on a public blockchain, BTC, you’re looking at the first true cryptocurrency. It lets anyone send value without a bank, stores wealth over time, and runs on a network of computers that all agree on the same ledger. Because there’s no central boss, the rules are baked into the code and can’t be changed on a whim. That openness is why Bitcoin shows up in every conversation about digital money, from retail purchases to institutional portfolios.

How Bitcoin Mining Powers the Network

Mining, the process of solving proof‑of‑work puzzles to add new blocks to the Bitcoin blockchain is the engine that keeps Bitcoin honest. Miners compete to find a hash that meets the network’s difficulty target, and the winner gets fresh Bitcoins and the right to write the latest transactions. This work secures the ledger, confirms payments, and creates new supply. Energy use, ASIC efficiency and electricity costs all matter, which is why countries like Norway have stepped in with temporary bans to protect their power grids. Understanding mining helps you see why block times stay steady and why the network can survive attacks.

Every four years or so Bitcoin goes through a Halving, the scheduled event that cuts the block reward in half. The reward drop squeezes new supply, often shaking up miner profits and price dynamics. After the 2024 halving, many miners faced capitulation, forcing them to upgrade hardware or cut electricity usage. Strategies like running more efficient ASICs, joining mining pools, or switching to lower‑cost regions can keep a operation afloat. At the same time, Regulation, government rules that shape how Bitcoin can be used, traded, and taxed is changing fast. The UAE introduced a licensing framework for crypto firms, while other jurisdictions tighten AML rules. These rules affect where you can buy, how you report gains, and even which exchanges stay open. Keeping an eye on both halving cycles and regulatory shifts lets you anticipate market moves and stay compliant.

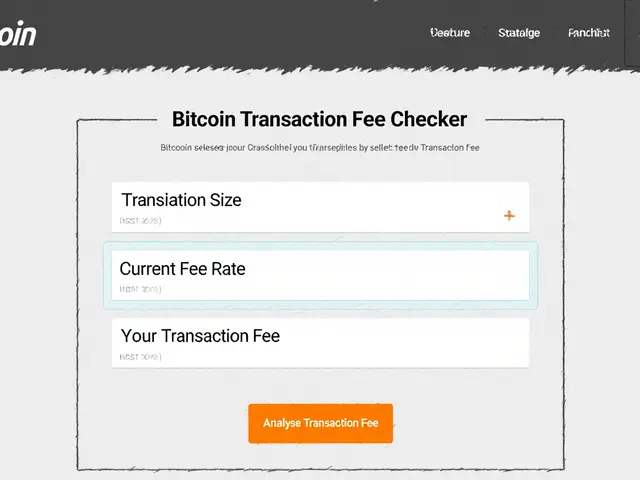

Transaction hiccups are another everyday reality. When a payment gets stuck in the mempool, tools like Replace‑by‑Fee (RBF), Child‑Pays‑for‑Parent (CPFP) or third‑party accelerators can free it. Knowing which method fits your situation saves time and frustration. Exchanges also play a role – some charge low fees, others focus on security or fiat on‑ramps. Below you’ll find a curated mix of articles that break down new coins, airdrop opportunities, exchange reviews, mining updates, and step‑by‑step guides. Whether you’re looking for a quick fix on a stuck Bitcoin transaction or a deep dive into the latest regulatory headline, the posts ahead have you covered.

How Venezuelans Use Crypto to Survive Hyperinflation

Explore how Venezuelans rely on Bitcoin, USDT, Binance and peer‑to‑peer platforms to survive hyperinflation, pay daily bills, and send remittances.

View More