Altcoin Compliance UAE – What You Need to Know

When dealing with Altcoin compliance UAE, the set of rules that govern how alternative crypto tokens can be issued, traded, and held in the United Arab Emirates. Also known as UAE altcoin regulation, it sits under the broader UAE crypto regulations, the legal framework covering all digital assets in the country and the requirements for a VASP license, a permit issued to virtual‑asset service providers that must meet strict anti‑money‑laundering and know‑your‑customer standards. Understanding these pieces helps anyone from a startup token team to a seasoned investor stay on the right side of the law.

Key compliance components you need to know

The first semantic triple is clear: Altcoin compliance UAE encompasses VASP licensing. The UAE’s Securities and Commodities Authority (SCA) and the Central Bank jointly require every platform that issues or trades altcoins to register as a VASP. That registration triggers a second triple – UAE crypto regulations require AML/KYC procedures. In practice, an exchange must collect ID documents, run sanctions checks, and keep transaction records for at least five years. Failure to meet these checks can lead to hefty fines or a full revocation of the licence.

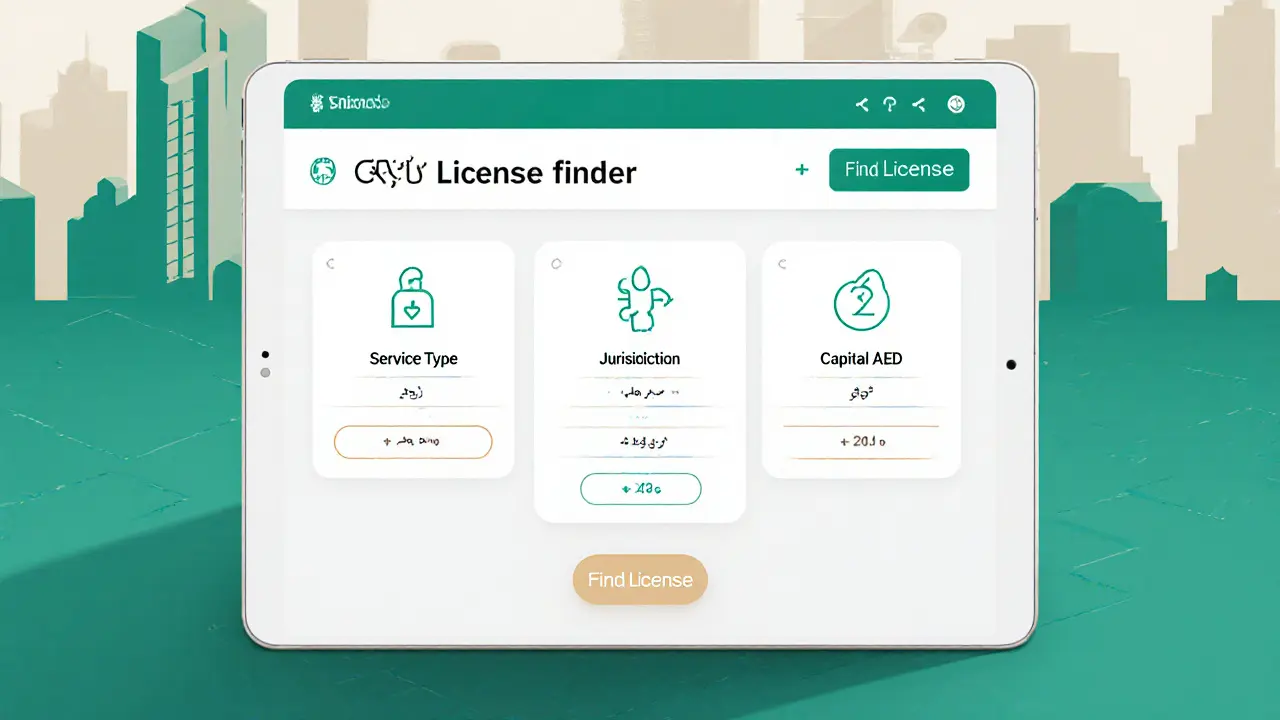

Third, compliance tools act as the bridge between token projects and regulators. A third triple reads: Compliance software enables Altcoin compliance UAE by automating AML screening, generating audit‑ready reports, and updating policies whenever the SCA issues a new guidance note. Popular solutions integrate directly with blockchain explorers, so you can flag suspicious wallet activity in real time without manual oversight.

So what does this mean for you? If you’re launching an altcoin, start by filing a VASP application, then build a KYC flow that captures passports, Emirates IDs and proof of address. Next, plug a compliant AML engine into your smart‑contract infrastructure – most providers offer API keys you can test on the testnet before going live. Finally, keep an eye on the SCA’s quarterly bulletins; they often tweak reporting thresholds or introduce new token‑classification rules that could affect your token’s tax treatment.

Below you’ll find a curated list of articles that walk through each step in detail – from understanding the licensing checklist to choosing the right AML provider and staying compliant as regulations evolve. Dive in to get practical tips, real‑world examples, and the latest updates that keep your altcoin strategy solid in the UAE market.

UAE Crypto Regulations 2025: Bitcoin, Altcoins & Licensing Guide

Explore the UAE's 2025 crypto regulations, licensing steps, VAT exemptions, and the new Crypto-Asset Reporting Framework for Bitcoin and altcoins.

View More