Imagine trying to send $5 to a friend using Bitcoin during peak hours in 2017. You wait 40 minutes. The fee? Over $50. That wasn’t a glitch - it was the system hitting its limit. Blockchains like Bitcoin and Ethereum were never built to handle the volume of modern financial activity. Today, with millions of users trading, swapping, and staking daily, the pressure is even greater. So how do these networks keep running without turning into a traffic jam? The answer lies in scalability solutions - the hidden engines behind fast, cheap, and reliable crypto transactions.

Why Scalability Matters More Than You Think

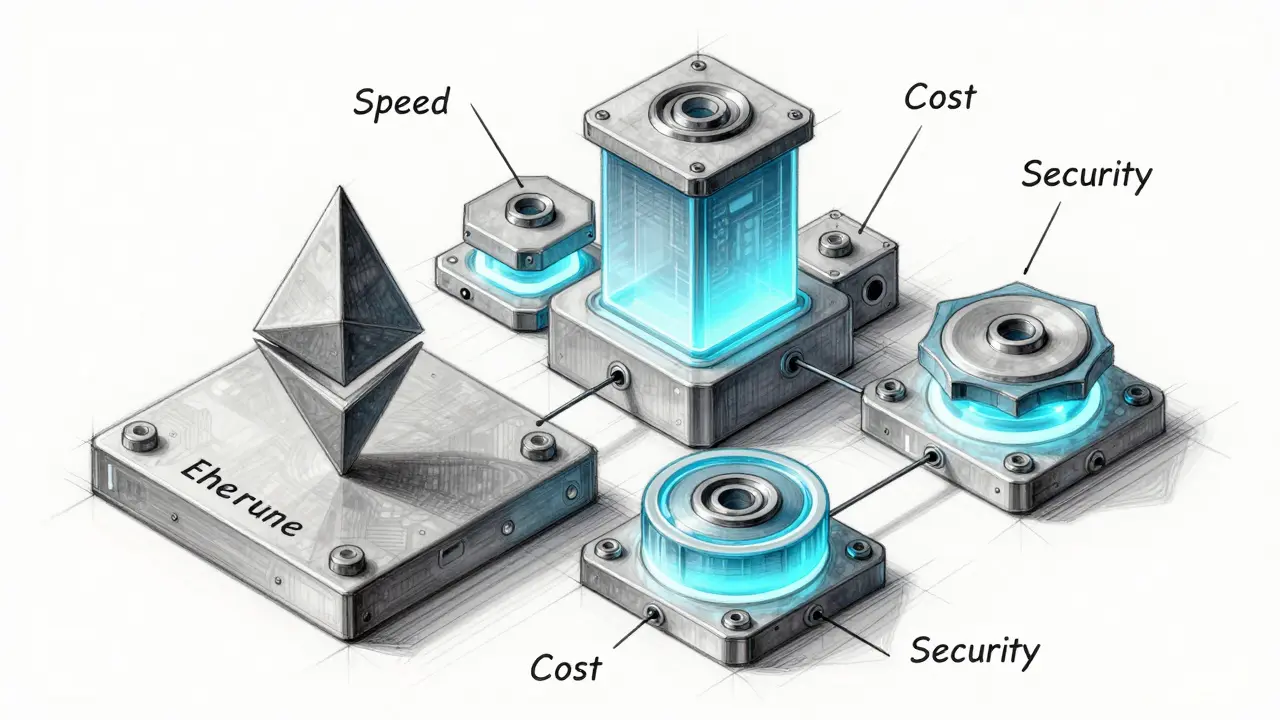

Bitcoin’s original design capped blocks at 1MB. That meant about 7 transactions per second. Visa? 65,000. The gap isn’t just technical - it’s existential. If crypto can’t move money faster than banks, why use it? This problem became urgent in 2017, when Bitcoin fees spiked and Ethereum’s gas prices made simple token swaps unaffordable for most users. Since then, developers have been racing to solve what’s called the Blockchain Trilemma: you can’t have security, decentralization, and scalability all at once. You have to pick two. Most projects now aim for security and scalability, accepting a slight trade-off in decentralization - or building systems that avoid the trade-off entirely.Layer 1: Changing the Foundation

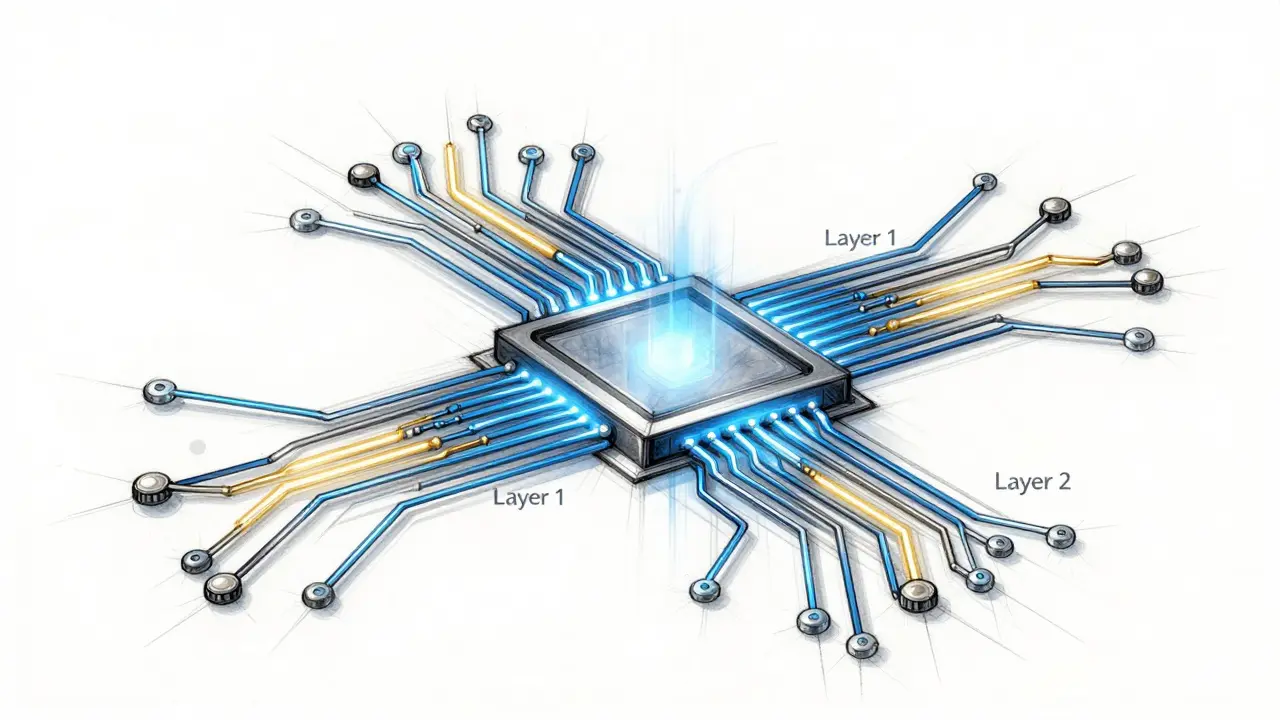

Layer 1 solutions mean changing the core blockchain protocol itself. These are big, risky, and slow - but they fix the root problem. Ethereum’s shift from Proof-of-Work to Proof-of-Stake in September 2022 was the biggest Layer 1 upgrade ever. It cut energy use by 99.95% and slashed block times from 13 seconds to 12. That alone didn’t solve throughput, but it laid the groundwork for what came next. Another major Layer 1 move is sharding. Ethereum 2.0 split the network into 64 parallel chains called shards. Each shard processes its own transactions, so the whole network can handle 64 times more. By 2026, Ethereum plans to expand to 1,024 shards. Cardano uses a similar idea with its Ouroboros PoS protocol, hitting 250 transactions per second (TPS) with 20-second finality. Avalanche? It uses a different consensus model called Snowman and hits 4,500 TPS with sub-second finality. These aren’t theoretical - they’re live, handling real user traffic every second. Bitcoin took a different path. Instead of increasing block size (like Bitcoin Cash did with 32MB blocks), it introduced SegWit in 2017. SegWit separated digital signatures from transaction data, freeing up space. Think of it like removing the heavy packaging from a shipment - suddenly, you can fit 20% more goods in the same truck. Today, over 90% of Bitcoin transactions use SegWit, making fees lower and confirmations faster.Layer 2: Building on Top

Layer 2 solutions don’t change the base chain. They build parallel systems that settle back to the main blockchain later. This is like building a side street that feeds into the highway. It’s faster to deploy, cheaper to use, and doesn’t require a network-wide vote. The most famous Layer 2 is the Lightning Network for Bitcoin. It lets users open payment channels between each other. You send money back and forth thousands of times without touching the blockchain. Only the final balance gets recorded. By 2023, Lightning was processing over $10.5 million daily. But it has limits: routing fails on large payments, and you need to keep funds locked up. Reddit users report that transactions over $1,000 often get stuck. For Ethereum, the real game-changer is Rollups. There are two types: Optimistic and Zero-Knowledge (ZK). Optimistic Rollups (like Optimism and Arbitrum) assume transactions are valid unless someone proves otherwise. They can process 2,000-4,000 TPS - 100x faster than Ethereum’s base layer. But they have a 7-day window where fraud claims can be filed. That’s fine for most users, but not for traders who need instant finality. ZK-Rollups (like zkSync and StarkNet) use advanced math to prove transactions are valid without revealing the data. They’re faster, cheaper, and finalize in seconds. zkSync hit 2,500 TPS in early 2024. And because they don’t need a waiting period, they’re safer for high-value transfers. Polygon, originally a sidechain, now runs multiple ZK-Rollups and processes 7,000 TPS at $0.001 per transaction. It’s become the go-to for NFTs and gaming apps - 87% of the top 50 NFT marketplaces use it.

Hybrid Models: The New Standard

No single solution works for everything. That’s why the smartest platforms now combine Layer 1 and Layer 2. Ethereum’s future isn’t just one chain. It’s a multi-layer stack: the main chain handles security and settlement, while Rollups handle execution. Vitalik Buterin called this the “endgame” - and it’s already happening. The Dencun upgrade in March 2024 introduced proto-danksharding, which will cut Rollup fees by up to 100x. That means even cheaper, faster transactions. Polkadot takes another approach. It lets independent blockchains (called parachains) connect to a central relay chain. Each parachain can be optimized for a specific use case - one for DeFi, one for gaming, one for private enterprise. You need to bond 800,000 DOT to rent a slot, which sounds expensive - but it’s designed for serious projects, not casual apps. Avalanche’s “Connect” tool lets Ethereum dApps move over in hours, not months. It doesn’t require rewriting code. Just recompile. That’s why DeFi projects like Trader Joe and Pangolin moved there - they needed speed without losing compatibility.Real-World Impact: What Users Actually Experience

It’s easy to talk about TPS numbers. But what does it feel like? A DeFi trader in Wellington told me: “I used to wait 10 minutes for a swap on Ethereum. Now on zkSync, it’s instant. Gas fees? $0.02. It’s like going from dial-up to fiber.” On the flip side, a user on Reddit reported: “I tried Polygon for my NFT mint. Saved $15 in fees - but the whole network froze for 4 hours. I lost my spot.” Exchanges like Binance and Coinbase use sharded databases internally to handle 100,000+ daily users. Binance’s system processes orders in 1.2 milliseconds - even during the 2021 bull run. But when scaling fails, the fallout is brutal. Crypto.com’s 2022 outage left 1.5 million users stranded for 5 hours. That’s not a bug - it’s a scalability crisis.What’s Next? The Road to 2026

By 2026, the market for blockchain scalability solutions will be worth over $34 billion. But adoption isn’t just about tech - it’s about trust. Regulators in the EU are now requiring exchanges to clearly disclose how their scaling systems work. MiCA, which took effect in June 2024, demands transparency on finality times and security guarantees. That’s why ZK-Rollups are gaining favor - their cryptographic proofs are verifiable. Optimistic Rollups? Still under scrutiny. The Bitcoin community is quietly building its own Layer 2: Taproot Assets (formerly Taro). It lets users issue tokens, NFTs, and stablecoins directly on Bitcoin - using the same security as Bitcoin itself. No Ethereum needed. Meanwhile, Polygon’s $1 billion Infinity DAO is funding a network of interconnected ZK-Rollups. Think of it as a highway system where each road leads to a different city. You can switch lanes without leaving the network.

Choosing the Right Solution

Not all scalability solutions are created equal. Here’s what to consider:- Speed vs. Security: If you’re trading crypto, you need sub-second finality. ZK-Rollups or Avalanche win here.

- Cost: For small payments, Lightning Network or Polygon are unbeatable. For large transfers, stick to Ethereum mainnet or ZK-Rollups.

- Complexity: Setting up a Lightning node takes technical skill. Most users should use a wallet that handles it for them.

- Longevity: Ethereum’s roadmap is the most mature. Layer 2s built on it have the strongest developer support.

Frequently Asked Questions

What’s the difference between Layer 1 and Layer 2 scalability solutions?

Layer 1 solutions change the core blockchain protocol - like Ethereum’s move to Proof-of-Stake or Bitcoin’s SegWit upgrade. These are permanent, network-wide changes that improve the base system. Layer 2 solutions build on top of existing chains without changing them. Examples include the Lightning Network and Rollups. Layer 2s are faster to deploy and cheaper to use, but they rely on the main chain for security. Layer 1 fixes the engine; Layer 2 adds turbochargers.

Why do some people say Layer 2 solutions aren’t as secure?

It’s not that they’re insecure - it’s about trust assumptions. Layer 2s like Optimistic Rollups rely on a 7-day challenge period where anyone can dispute a transaction. If no one checks, a fraudulent transaction could slip through. ZK-Rollups avoid this with math-based proofs. But even ZK-Rollups depend on the main chain being honest. If Ethereum goes down, so do most Layer 2s. True decentralization still lives on Layer 1.

Is Bitcoin scalable without changing its block size?

Yes - but only for certain uses. Bitcoin’s base layer will never match Visa’s speed. But with SegWit and the Lightning Network, it handles micropayments and small transfers extremely well. A $5 coffee? Lightning makes it instant and free. A $5,000 wire transfer? That’s still better done on Ethereum or another chain. Bitcoin’s strength is security, not throughput. Scaling it for large volumes isn’t the goal - keeping it simple and decentralized is.

Which scalability solution is best for NFTs and gaming?

Polygon dominates here. Over 87% of top NFT marketplaces use Polygon’s ZK-Rollups because they’re cheap, fast, and compatible with Ethereum tools. Games need low fees and instant confirmations - paying $15 to mint an NFT kills adoption. Polygon delivers sub-second finality at $0.001 per transaction. Other options like Solana and Avalanche also work, but Polygon has the largest ecosystem and developer support.

Will Ethereum’s Dencun upgrade make Layer 2s obsolete?

No - it makes them better. Dencun introduces proto-danksharding, which gives Rollups more space to store transaction data. This slashes fees by up to 100x. Instead of competing with Ethereum, Layer 2s now work *with* it more efficiently. Think of it like upgrading the highway so the on-ramps (Rollups) can handle even more traffic. Ethereum becomes the settlement layer, and Rollups become the workhorses. They’re not replacing each other - they’re teaming up.

Nicole Stewart

17 February, 2026 . 17:23 PM

Layer 2s are just band-aids. Real scalability means changing the base protocol. Everything else is just delaying the inevitable collapse when the main chain gets overloaded again.

Alan Enfield

17 February, 2026 . 21:38 PM

I get the tech but honestly? I just want my swap to go through fast and cheap. If zkSync does that, I don’t care if it’s Layer 1 or Layer 2. Just stop making me wait.