Western sanctions

When discussing Western sanctions, policy measures imposed by the United States, the European Union and allied nations to restrict trade, finance and technology with targeted countries or entities, they are often seen as a blunt tool for geopolitical goals. In reality, they act like a filter that decides which money can move where and which tech can be used. This filter directly touches the world of digital assets because crypto transactions cross borders in seconds, hiding behind code instead of banks. As a result, Western sanctions have become a daily concern for traders, developers and regulators who need to know who they can safely work with.

Why sanctions matter for crypto enthusiasts

The explosion of cryptocurrency, digital tokens that rely on cryptographic security and operate on decentralized networks turned the financial system upside down. Blockchain, the immutable ledger that records every transaction for cryptocurrencies and many other use‑cases now powers everything from NFTs to supply‑chain tracking. When a sanction‑listed entity tries to move crypto, the blockchain’s transparency makes it possible to flag and freeze those assets, but the pseudonymous nature also creates loopholes. Mining, the process of validating transactions and securing a blockchain by solving complex puzzles is another choke point: governments can ban new mining facilities, as Norway did, to cut off energy‑intensive operations that could fund sanctioned activities. Finally, compliance, the set of procedures firms follow to obey legal and regulatory requirements now includes robust sanction‑screening tools, AML checks and real‑time monitoring. In short, Western sanctions encompass crypto markets, blockchain applications, mining operations and compliance programs, creating a tightly linked ecosystem where each element influences the others.

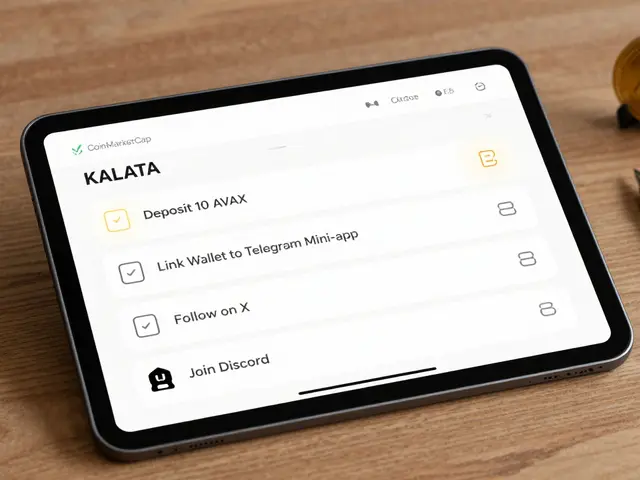

Recent regulatory moves illustrate how sanctions shape the crypto landscape. Norway’s temporary crypto‑mining ban was justified as a way to protect renewable energy, but it also acted as a de‑facto sanction against miners linked to geopolitical risks. The UAE’s 2025 crypto licensing framework introduced strict reporting for token issuers, mirroring Western pressure to keep funds out of sanctioned hands. Even exchange reviews, like those of Korbit, BitFriends and IncrementSwap, now highlight whether platforms screen for sanctioned addresses and comply with OFAC or EU rules. These examples show that every player—from miners to exchanges—must factor sanctions into their business models, or risk losing access to the global market.

Below you’ll find a curated list of articles that dive deeper into each of these angles. We cover everything from detailed coin breakdowns that mention sanction risks, to exchange reviews that assess compliance tools, and country‑specific regulations that reflect Western policy pressure. Whether you’re a trader trying to avoid frozen assets, a developer building compliant smart contracts, or a miner navigating energy bans, the posts below give you practical guidance and up‑to‑date analysis. Explore the collection to see how sanctions intersect with crypto, mining, and broader financial compliance, and arm yourself with the knowledge you need to stay on the right side of the law.

Russia Legalizes Crypto Mining to Aid Sanctions Evasion - What It Means

Russia legalizes crypto mining, enabling a ruble‑backed stablecoin and new sanctions‑evasion routes, while the US and UK tighten crypto sanctions.

View More