UTHX: Your One‑Stop Guide to the Token

When talking about UTHX, a new crypto asset that launched on a proof‑of‑stake blockchain, designed for fast, low‑fee transactions and community governance. Also known as U‑Token, it aims to bridge DeFi utilities with everyday payments. If you’re looking for the latest on UTHX, you’re in the right spot.

Understanding the tokenomics, the economic model that controls supply, inflation, and distribution of a crypto token is key. UTHX caps its total supply at 500 million, releases 5 % annually to staking rewards, and burns a fraction of transaction fees to curb inflation. This blend of scarcity and incentives helps keep the price stable while rewarding long‑term holders. In practice, tokenomics determines how quickly new coins enter the market and how much voting power each holder earns.

Why UTHX Matters Today

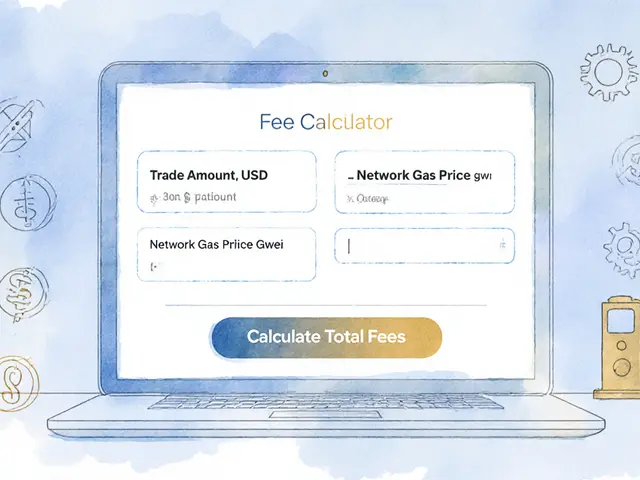

One of the biggest draws for UTHX is its presence on major crypto exchanges, platforms where users can trade digital assets, provide liquidity, and access advanced trading tools. Listings on reputable exchanges boost liquidity, reduce slippage, and give the token broader exposure. At the same time, the community runs periodic airdrops, free token distributions aimed at rewarding early adopters and expanding the user base. These airdrops often require simple tasks like joining Telegram groups or staking a small amount of UTHX, turning promotion into participation.

Regulatory outlook also plays a role. Countries such as the UAE and Norway have recently updated crypto rules that affect how tokens like UTHX can be offered and traded. While the UAE’s licensing framework encourages innovation, Norway’s mining ban highlights the importance of sustainable energy use for proof‑of‑stake networks. Keeping an eye on these developments helps investors stay compliant and anticipate market shifts.

From a technical standpoint, UTHX relies on a modular smart‑contract architecture that supports DeFi features like liquidity mining, staking pools, and cross‑chain bridges. This makes it easier for developers to build on top of UTHX without rewriting core code. The ecosystem also includes a lightweight wallet that integrates with popular hardware devices, ensuring that users can store their tokens securely.

For traders, the token’s price action is closely tied to on‑chain activity metrics such as active addresses, staking ratios, and transaction volume. When staking participation spikes, you often see a short‑term price bump due to reduced circulating supply. Conversely, a sudden surge in withdrawals can pressure the market. Understanding these signals can improve entry and exit timing.

Below you’ll find a curated collection of articles that dive deeper into each of these areas—coin profiles, exchange reviews, airdrop guides, regulatory analyses, and practical how‑tos. Whether you’re a beginner wanting a clear definition or an experienced trader seeking the latest market insights, the posts ahead cover the full spectrum of UTHX-related knowledge.

Utherverse (UTHX) Crypto Coin Explained - Definition, Tokenomics & Outlook

Learn what Utherverse (UTHX) crypto coin is, its tokenomics, how to get and use it, market performance, and future outlook in the metaverse space.

View More