NBOX Token Overview

When working with NBOX token, a utility‑focused digital asset built on the Ethereum blockchain. Also known as NBOX, it aims to bridge decentralized finance and community‑driven incentives. The token follows the ERC-20 standard, which ensures compatibility with most wallets and exchanges. By using a widely adopted protocol, NBOX can tap into existing infrastructure while offering its own set of features.

Tokenomics is the backbone of any crypto project, and NBOX is no exception. Its total supply is capped at 100 million tokens, with 40% allocated for liquidity provisioning, 30% reserved for ecosystem development, 20% for community rewards, and the remaining 10% for the founding team under a vesting schedule. This distribution is designed to balance short‑term market needs with long‑term growth. Governance rights are tied to token holdings, allowing holders to vote on protocol upgrades, fee structures, and partnership decisions. In practice, this means that the more NBOX you own, the louder your voice in shaping the project’s future.

One of the most practical ways NBOX adds value is through DeFi liquidity provision on automated market makers and liquidity pools. By staking NBOX in these pools, users earn a share of transaction fees and can benefit from liquidity mining programs. The relationship between liquidity depth and price stability is direct: deeper pools dampen price swings, making NBOX more attractive to traders. Moreover, the token’s design includes a small fee on each swap that is redistributed to liquidity providers, creating a self‑reinforcing incentive loop.

Community growth often receives a boost from crypto airdrop campaigns that distribute free tokens to eligible participants. NBOX has planned periodic airdrops targeting early adopters, active stakers, and developers who contribute to its ecosystem. These drops serve two purposes: they reward loyalty and they expand the holder base, which in turn improves liquidity and market depth. Eligibility criteria typically include holding a minimum amount of NBOX, completing specific on‑chain actions, or participating in governance votes. By aligning incentives, the airdrop mechanism helps sustain long‑term engagement.

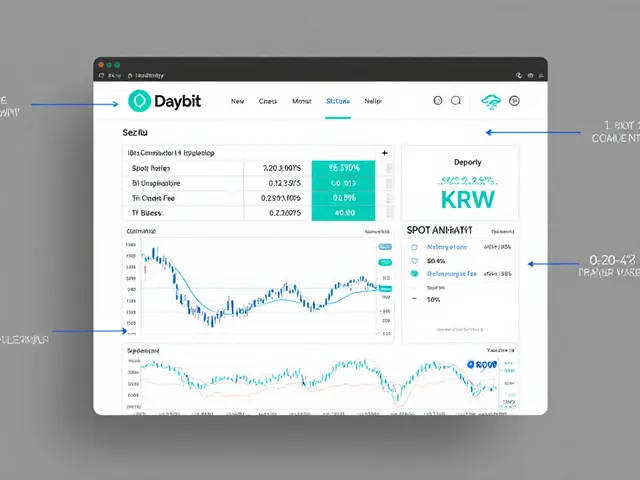

From a market perspective, NBOX exhibits the typical volatility of emerging DeFi tokens but also shows signs of resilience. Trading volume is strongest on platforms that support ERC‑20 assets, and price movements often correlate with broader Ethereum network activity. Risk factors include smart‑contract bugs, regulatory shifts affecting DeFi, and competition from similar utility tokens. Investors should monitor on‑chain metrics such as total value locked (TVL) in NBOX liquidity pools, the rate of token burn (if any), and governance proposal outcomes to gauge health.

Integration with other protocols is another growth lever. NBOX can be wrapped for use on layer‑2 solutions like Arbitrum or Polygon, reducing transaction fees and expanding user reach. Partnerships with NFT marketplaces or gaming platforms add utility by allowing NBOX to be spent on digital goods or in‑game purchases. These cross‑chain and cross‑industry use cases illustrate how a single token can serve multiple ecosystems while maintaining a coherent value proposition.

All of these elements—standardized ERC‑20 architecture, purposeful tokenomics, active liquidity provision, community‑centric airdrops, and strategic integrations—form the foundation of the NBOX token ecosystem. Below you’ll find a curated collection of articles that dive deeper into each of these topics, from detailed token‑omics breakdowns to step‑by‑step guides on staking and earning rewards. Use the insights here to decide how NBOX fits into your portfolio or DeFi strategy.

NBOX NFT Giveaway & Super Hero Game Airdrop Details (2025)

Discover the full details of NBOX's NFT giveaway and Super Hero game launch airdrop, including eligibility, claim steps, rewards, and expert tips.

View More