Fractional Real Estate Investment Explained

When working with fractional real estate investment, a model that lets multiple investors share ownership of a single property. Also known as property shares, it blends traditional real estate with modern finance to lower entry barriers and boost liquidity.

One key enabler is property tokenization, the process of converting real‑world property rights into digital tokens on a blockchain. Tokenization creates a transparent ledger, making it easy to track who owns what slice. Another driver is real estate crowdfunding, online platforms that pool small contributions from many backers to fund a property purchase. Both tokenization and crowdfunding require robust smart contracts to enforce ownership rights, and they enable investors to buy or sell shares quickly, just like stocks.

The landscape also includes REITs, publicly traded vehicles that hold diversified real‑estate portfolios. While REITs offer liquidity and professional management, fractional investment platforms go a step further by allowing direct ownership of specific assets rather than a pooled basket. This distinction means investors can target a beachfront condo or a downtown office space, rather than a generic real‑estate index. The synergy between REITs, tokenization, and crowdfunding creates a hybrid market where traditional and digital solutions complement each other.

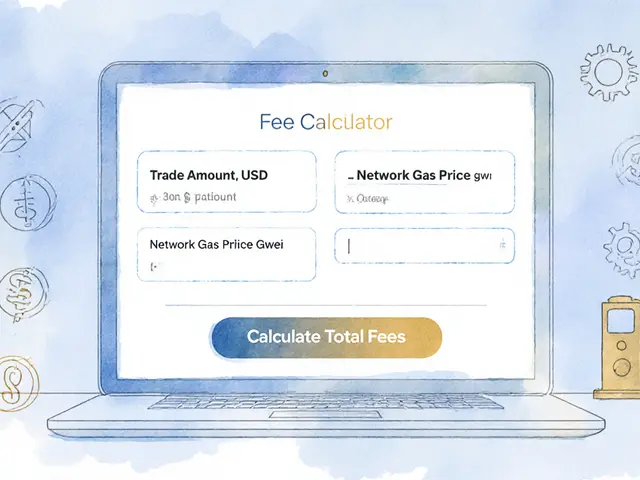

Liquidity is a major advantage of the fractional model. Because each share is represented by a token or a ledger entry, owners can trade on secondary markets, access DeFi lending protocols, or use peer‑to‑peer exchanges. This connects property ownership to the broader blockchain, a decentralized network that secures transactions and automates contracts. Through blockchain, investors enjoy near‑instant settlement, reduced paperwork, and lower custody fees. At the same time, platforms must implement KYC/AML checks and insurance wrappers to protect against fraud and market volatility.

Regulatory and tax considerations differ by jurisdiction, but most regions treat fractional ownership similarly to securities. That means issuers often need to register the offering or qualify for an exemption, and investors must report income and capital gains. Understanding these rules helps participants avoid penalties and choose the right vehicle for their risk tolerance. Whether you’re eyeing a single‑family home in Austin or a commercial tower in Singapore, the core principles remain: share‑based ownership, blockchain‑enabled transparency, and market‑driven liquidity.

Below you’ll find a curated selection of articles that dive deeper into tokenized properties, crowdfunding platforms, REIT alternatives, and the tech that powers fractional real estate investment. Explore practical guides, market analyses, and step‑by‑step tutorials to help you decide which approach fits your portfolio best.

Top Real Estate NFT Platforms & Projects to Watch in 2025

Explore top real estate NFT platforms, learn how tokenization works, compare features, and get a step‑by‑step guide to start investing in fractional property assets.

View More