Exchange Transparency: Why It Matters in Crypto Trading

When evaluating exchange transparency, the practice of openly sharing fee structures, security audits, and liquidity metrics by crypto platforms. Also known as exchange openness, it lets traders judge whether a service respects their money and data.

Key players in this space include crypto exchange, a platform where users buy, sell, or trade digital assets, exchange security, the set of audits, encryption methods, and insurance policies that protect user funds, and fee disclosure, the clear presentation of maker, taker, withdrawal, and hidden costs. exchange transparency links these elements together, forming a trust triangle that users rely on every day.

Key Elements of Exchange Transparency

First, fee disclosure is not just a numbers table; it’s a promise that traders won’t be hit by surprise charges. An exchange that publishes exact percentages for spot trades, futures, and margin positions lets you calculate net profit before you click ‘buy’. Second, exchange security requires regular third‑party audits, cold‑storage ratios, and bug‑bounty programs. When an exchange publishes audit reports, you can verify that its code matches the claimed security standards. Third, liquidity data – the depth of order books and average spread – tells you how quickly you can enter or exit a position without slippage. Transparent platforms share real‑time depth charts and historical volume, so you know whether a market can handle your trade size.

Regulatory compliance is the fourth pillar. Laws in the US, EU, or Southeast Asia demand that exchanges report suspicious activity, hold sufficient capital, and protect consumer data. When regulators require public filings, they indirectly push exchanges toward higher regulatory compliance, the adherence to financial rules and reporting standards set by government bodies. This creates a feedback loop: tighter rules force better transparency, and better transparency helps exchanges meet those rules. In practice, a platform that displays its licensing status, AML procedures, and jurisdiction details earns a credibility boost that attracts more institutional traders.

All these pieces – fee clarity, security audits, liquidity visibility, and regulatory compliance – form a network of trust. Exchange transparency encompasses fee disclosure, requires security audits, and is influenced by regulation. When you see a platform that openly shares these metrics, you can focus on your trading strategy instead of worrying about hidden risks. Below you’ll find a curated list of articles that deep‑dive into specific exchanges, fee structures, security assessments, and the latest regulatory moves. Use them to compare platforms, spot red flags, and choose services that match your risk tolerance and trading goals.

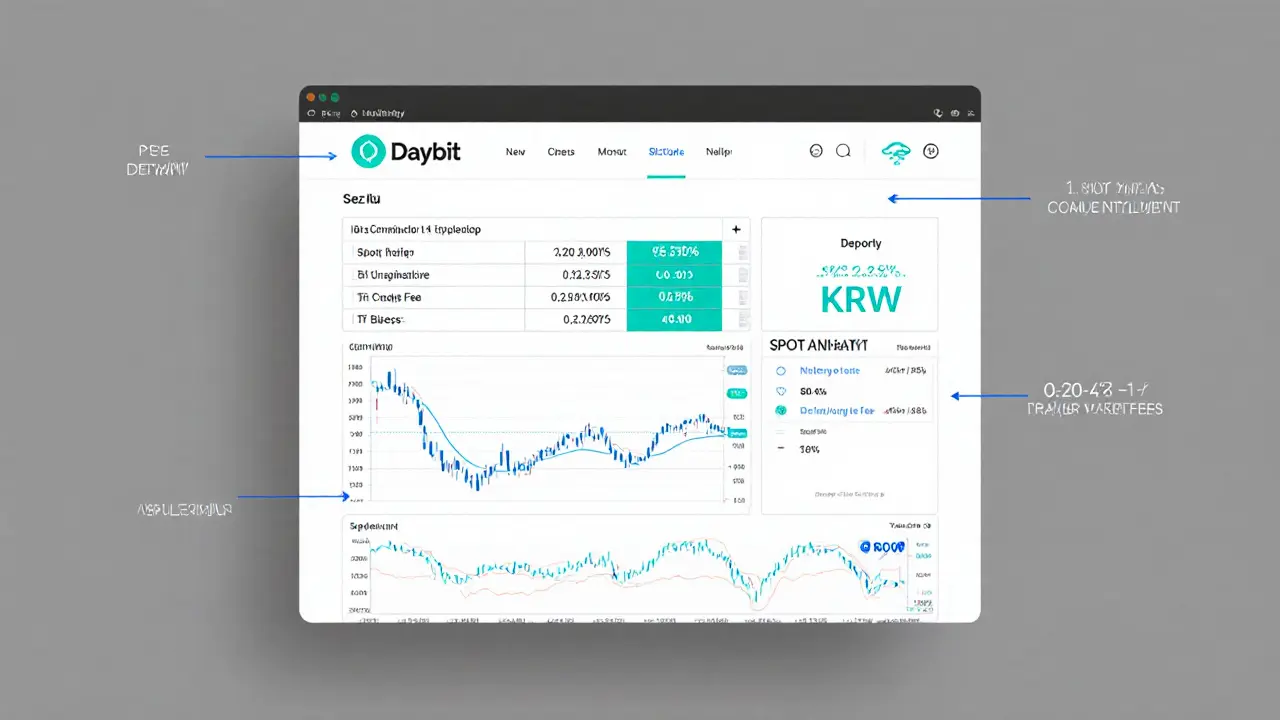

Daybit Exchange Review - Fees, Features, and Safety in 2025

A thorough 2025 review of Daybit Exchange covering fees, features, safety, and how it stacks up against Binance, Bybit, KuCoin, and Bitpanda.

View More