DeFi Fees: Understanding Costs in Decentralized Finance

When working with DeFi fees, the charges users pay for swapping, lending, or providing liquidity on decentralized platforms. Also known as decentralized finance transaction costs, they directly impact net yields and portfolio decisions. One major source of these costs comes from liquidity provider fees, the percentage paid to pool contributors for each trade, while the underlying AMM fee structure, rules set by automated market makers that determine how much of each swap is taken as a fee shapes the overall expense landscape. In short, DeFi fees encompass transaction costs, protocol fees, and any on‑chain gas you spend.

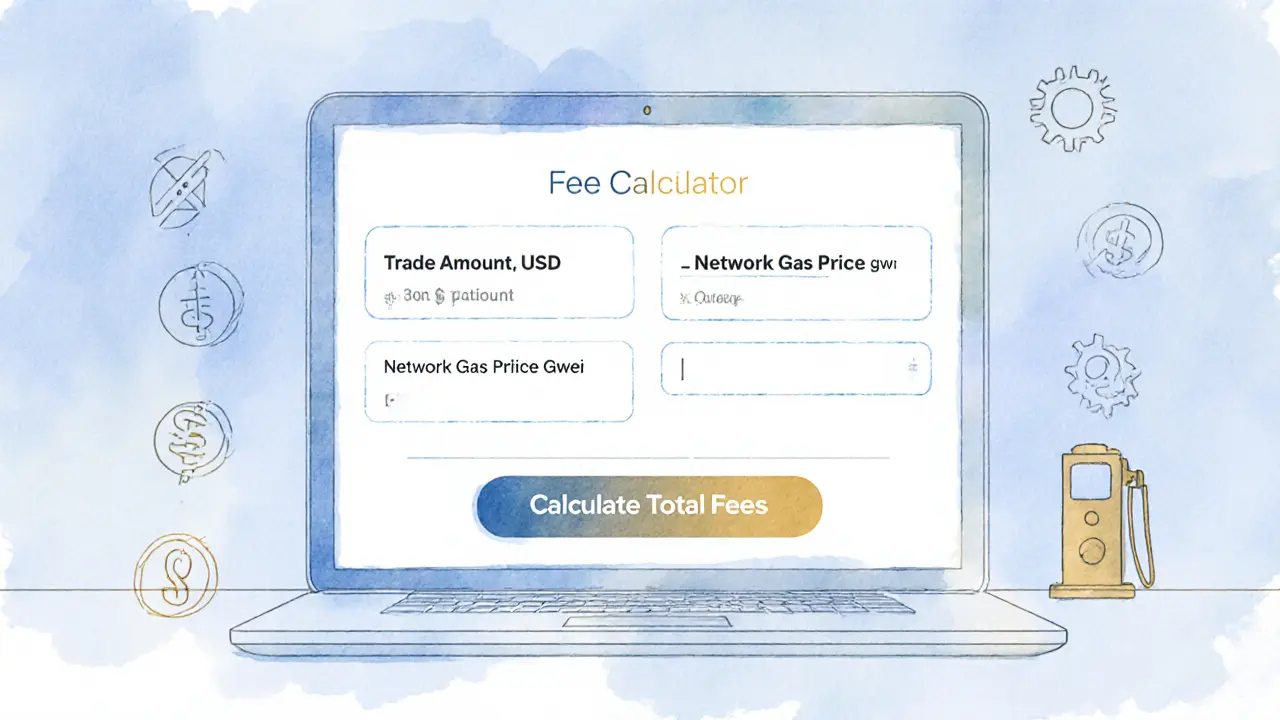

Another piece of the puzzle is gas fees, the amount of Ether or other native tokens required to execute a smart‑contract operation. On Ethereum‑based DEXs, high gas fees can dwarf the quoted AMM fee, making a seemingly cheap swap expensive in practice. Conversely, layer‑2 solutions and alternative blockchains lower gas, allowing the AMM’s fee model to shine. Yield farmers often craft strategies that harvest rewards fast enough to offset both liquidity provider fees and gas costs, turning a cost‑center into a profit‑engine.

Understanding how these entities interact helps you pick the right platform and timing. Liquidity provider fees influence the overall DeFi fee picture, gas fees can amplify or mute that effect, and savvy yield‑farming tactics can neutralize the impact. Below you’ll find a curated collection of articles that break down each fee component, compare popular protocols, and show practical ways to keep more of your earnings.

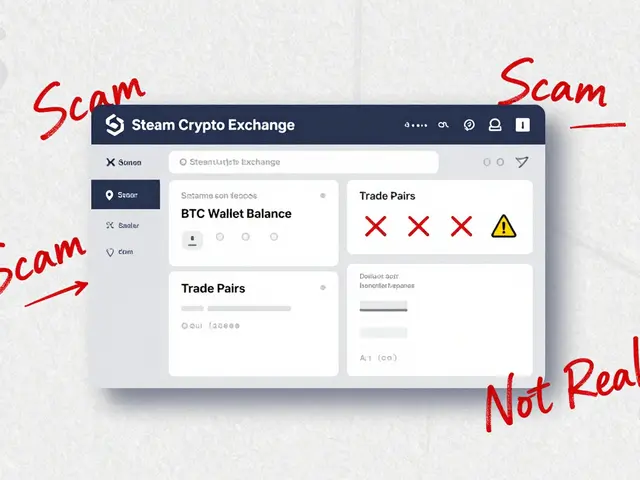

SushiSwap v2 (Base) Review: Fees, Features & Security

A detailed review of SushiSwap v2 on Base, covering fees, features, security, liquidity provision, and future roadmap for DeFi traders.

View More