Daybit vs Binance: Which Crypto Exchange Fits Your Trading Style?

When weighing Daybit vs Binance, a side‑by‑side comparison of two crypto exchanges that helps traders choose the platform that matches their needs. Also known as Daybit and Binance comparison, it breaks down the most critical factors you’ll consider before opening an account.

Both platforms claim to offer everything from spot trading to futures, but their approaches differ. Binance, the world’s largest crypto exchange by volume, provides a massive asset list, high‑frequency API access, and an extensive DeFi hub while Daybit, a newer, Asia‑focused exchange, emphasizes low‑latency order matching and simplified fee tiers for retail users. Understanding these angles helps you decide whether you need depth or simplicity.

Security is non‑negotiable. Exchange Security, the suite of measures like cold‑wallet storage, two‑factor authentication, and regulatory audits that protect user funds varies noticeably between the two. Binance runs a multi‑layer custodial system and undergoes periodic penetration tests, whereas Daybit touts a proprietary hardware‑security‑module (HSM) that isolates private keys at the data‑center level. Daybit vs Binance highlights how these protocols directly impact trust and risk appetite.

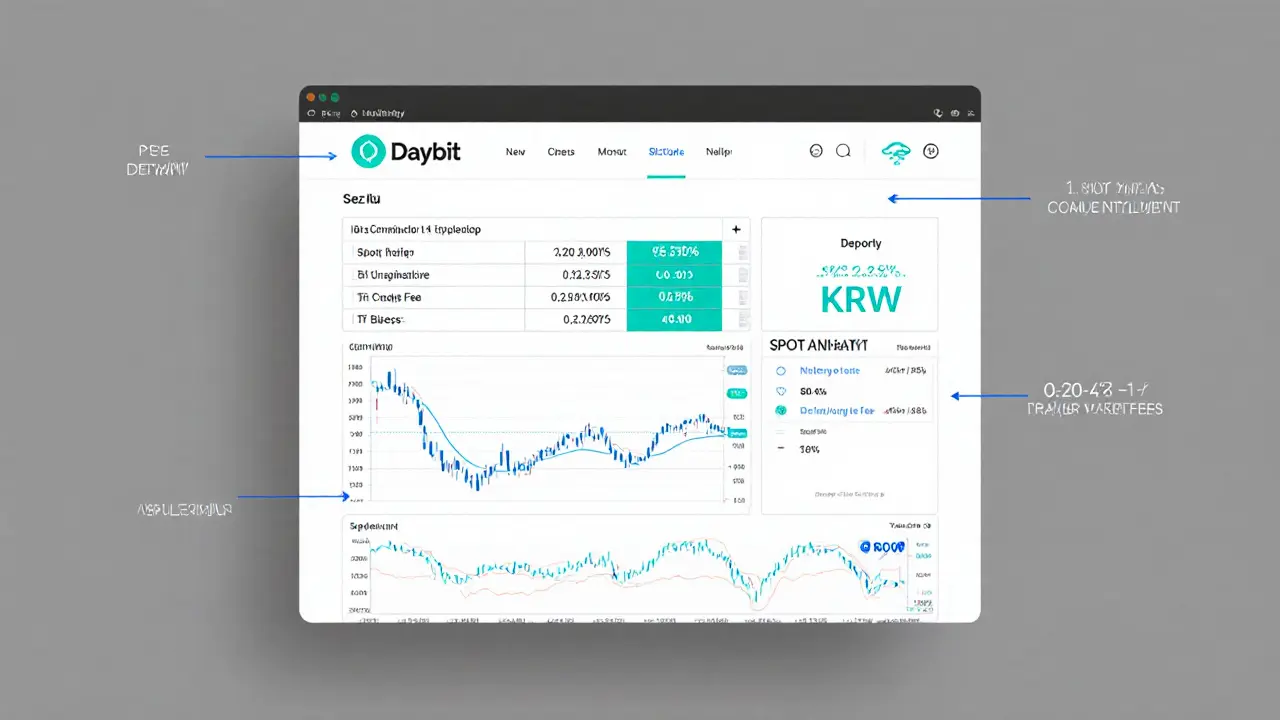

Fees can make or break profitability, especially for frequent traders. Exchange Fees, the transaction cost structure, including maker‑taker spreads, withdrawal charges, and volume‑based discounts on Binance are tiered and can dip below 0.02 % for high‑volume players, but they also add a range of hidden network fees. Daybit’s model is flatter, with a transparent 0.10 % flat rate on most pairs and lower withdrawal fees for supported chains. This fee contrast influences how much you keep after each trade.

Liquidity and order execution speed are the next battlegrounds. Binance’s massive order book often guarantees sub‑second fills, which is essential for scalpers and arbitrageurs. Daybit, though smaller, compensates with an ultra‑low latency matching engine that claims sub‑millisecond latency for its core markets. The choice here ties back to your preferred order types—market orders for instant fills or limit orders for price control—as highlighted in our “Market Orders vs Limit Orders” guide.

Regulatory environment matters more than ever. Binance has been navigating a patchwork of licenses worldwide, securing a VASP license in several jurisdictions while facing scrutiny in others. Daybit is currently licensed in Singapore and holds a Tier‑1 digital asset service provider (DASP) certificate in Japan, aligning it with stricter AML/KYC standards. This regulatory backdrop can affect everything from deposit limits to the availability of fiat on‑ramps.

User experience rounds out the decision matrix. Binance offers a feature‑rich web UI, mobile apps with advanced charting, and a growing ecosystem of launchpad projects. Daybit focuses on a clean, minimalist interface that reduces clutter for beginners, plus a native wallet that integrates directly with its staking solutions. If you value built‑in DeFi tools like yield farms or liquidity mining, Binance’s ecosystem might feel more complete.

By the end of this guide you’ll have a clear picture of how security, fees, liquidity, regulation, and UI stack up in the Daybit vs Binance debate. Below, we dive into each angle with detailed articles, real‑world data, and actionable takeaways to help you pick the exchange that aligns with your trading goals.

Daybit Exchange Review - Fees, Features, and Safety in 2025

A thorough 2025 review of Daybit Exchange covering fees, features, safety, and how it stacks up against Binance, Bybit, KuCoin, and Bitpanda.

View More