Cryptocurrency Banking Restrictions

When dealing with Cryptocurrency Banking Restrictions, rules that limit or shape how banks can interact with crypto assets, including deposits, withdrawals, and lending services. Also known as crypto banking bans, these limits aim to protect financial stability while addressing risk concerns. cryptocurrency banking restrictions are part of a broader crypto regulations, government‑issued policies that govern token trading, taxation, and market conduct. They intersect with bank compliance, the set of internal controls banks must follow to meet legal and supervisory standards, and with anti‑money‑laundering (AML), frameworks that require monitoring and reporting of suspicious transactions. In practice, a banking restriction often forces a bank to obtain a crypto exchange licensing, official permission to offer crypto‑related services, which comes with strict reporting and capital requirements. This creates a chain: crypto regulations shape bank compliance, which in turn drives AML practices, culminating in the need for exchange licensing. Understanding this chain helps anyone navigating the crypto‑financial landscape avoid costly missteps.

Why These Restrictions Matter

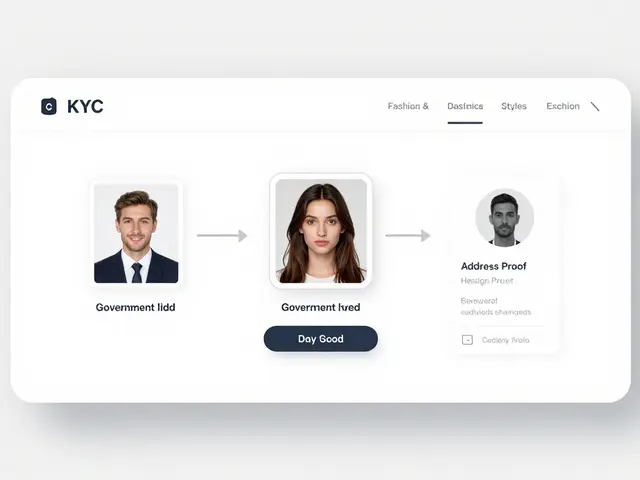

One key reason banks face strict rules is the risk of rapid market swings that can threaten liquidity. When a regulator imposes a ban on crypto deposits, banks must quickly adjust their risk models, often tightening KYC procedures to stay compliant. This shift directly influences AML requirements, because tighter monitoring helps prevent illicit fund flows that could arise from unchecked crypto transactions. At the same time, crypto exchange licensing becomes a lever for banks to continue offering services legally; the license demands regular audits, capital buffers, and transparent reporting. Another semantic link is that bank compliance often requires dedicated crypto‑risk teams, which in turn push the industry toward clearer crypto regulations. These interdependencies mean that a change in one area—say, a new AML rule—ripple‑effects through licensing, compliance, and overall market access.

Below you’ll find a curated collection of articles that break down country‑specific banking bans, explain how banks are adapting their compliance frameworks, and detail what you need to know about getting a crypto exchange license. Whether you’re a trader, a fintech founder, or just curious about the shifting rules, the posts ahead give actionable insights to keep you ahead of the curve.

Middle Eastern Crypto Banking Bans: Full 2025 Regulatory Overview

A 2025 guide to Middle Eastern crypto banking bans, covering GCC policies, country‑specific rules, CBDC pilots, and future liberalisation prospects.

View More