Crypto-Asset Reporting Framework Explained

When navigating the world of digital finance, Crypto-Asset Reporting Framework, a set of guidelines that tells companies how to measure, disclose, and audit crypto holdings. Also known as CARF, it bridges the gap between traditional accounting and the fast‑moving blockchain space. The framework draws heavily from International Financial Reporting Standards, global accounting rules that help ensure consistency across markets, while also satisfying the demands of the U.S. Securities and Exchange Commission, the regulator that oversees public disclosures for American firms. As investors ask for more Environmental, Social, and Governance (ESG) data that shows how crypto projects impact sustainability and social outcomes, the framework expands to capture those metrics too. In short, CARF encompasses classification, valuation, and risk‑adjusted reporting, requires transparent disclosure of tokenomics, and is influenced by both accounting boards and securities regulators. Below you’ll see how all these pieces fit together and why they matter for anyone handling digital assets.

Key Elements and How They Interact

The first attribute of the Crypto-Asset Reporting Framework is classification: every token must be tagged as a utility, security, commodity, or stablecoin. This determines which valuation model applies—fair value, cost basis, or market approach. Next comes measurement. Under IFRS guidance, crypto assets are often recorded at fair value with changes recognized in profit and loss, but some jurisdictions allow a cost model for long‑term holdings. Disclosure is the third pillar; companies must reveal transaction volume, custody arrangements, and any associated smart‑contract risks. Auditors then verify that the reported numbers match blockchain data, using tools that pull on‑chain analytics and off‑chain custodial records. Finally, the framework ties into tax compliance: the same fair‑value swings that affect earnings also trigger capital‑gain events for the IRS or local tax authorities. By linking classification, measurement, disclosure, and audit, the framework creates a single, repeatable workflow that satisfies both investors and regulators.

Practically, firms start by mapping each crypto position to a reporting category, then choose a valuation method that aligns with either IFRS or local GAAP. They set up a data pipeline—often a combination of node‑level APIs and custodial reports—to feed real‑time pricing into their accounting system. The next step is drafting a disclosure note that covers holding purpose, risk factors, and ESG impact where relevant. After the financial statements are ready, an independent auditor cross‑checks the on‑chain data against the reported figures, flagging any mismatches. Throughout the year, the tax team tracks realized and unrealized gains to prepare the required 1099‑DA or local equivalents. This end‑to‑end process not only keeps the company compliant but also builds credibility with investors who demand clear, comparable crypto metrics. The articles below dive into each of these stages—whether you’re looking for a quick overview of CARF, a deep dive into crypto tax treatment, or a review of the latest exchange compliance tools, you’ll find practical guidance ready to use.

Ready to see the specifics? Below is a curated list of in‑depth pieces that break down tokenomics, exchange reviews, mining regulations, airdrop mechanics, and even how different countries are shaping their crypto‑asset reporting rules. Each post ties back to the core ideas of the Crypto-Asset Reporting Framework, giving you both the theory and the hands‑on steps you need to stay ahead of the curve.

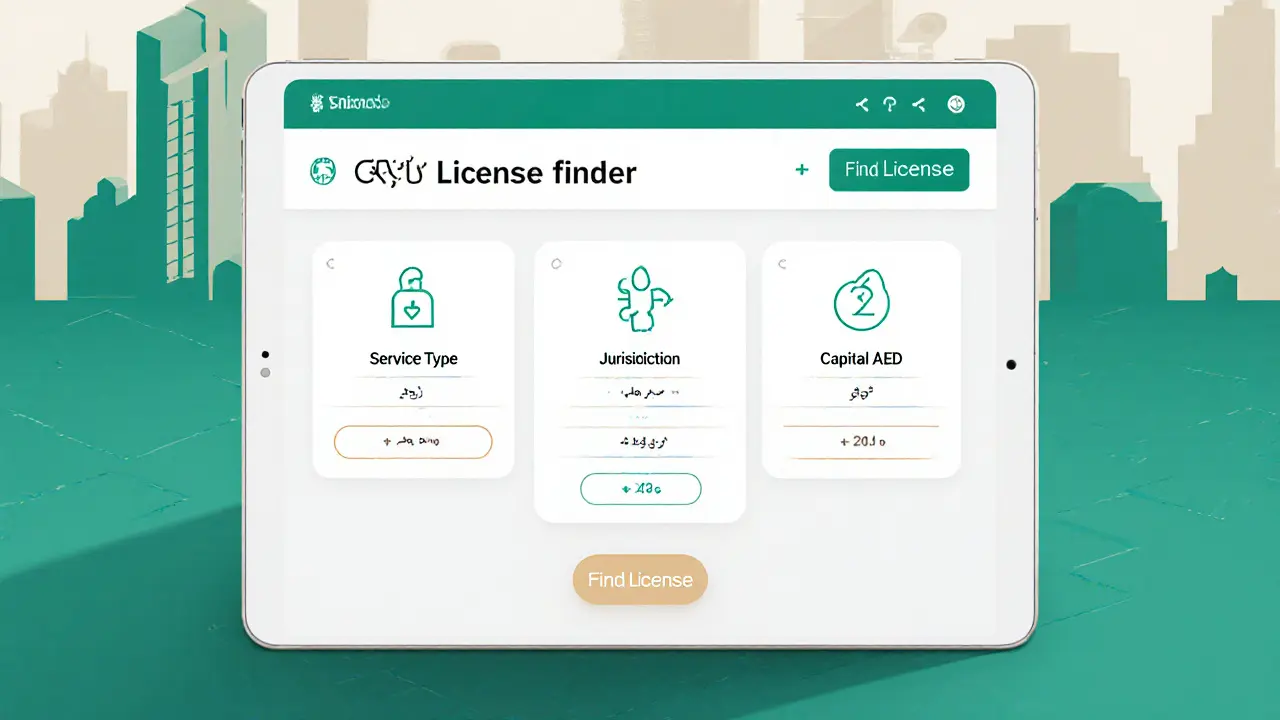

UAE Crypto Regulations 2025: Bitcoin, Altcoins & Licensing Guide

Explore the UAE's 2025 crypto regulations, licensing steps, VAT exemptions, and the new Crypto-Asset Reporting Framework for Bitcoin and altcoins.

View More