Trading Execution: How to Make Your Trades Work Efficiently

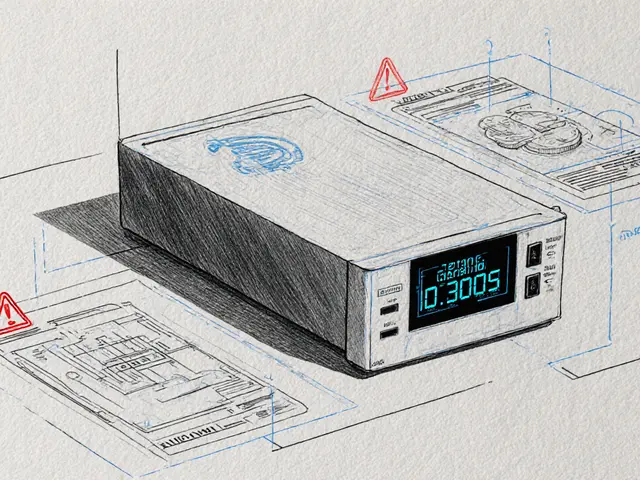

When working with trading execution, the process of turning a trade idea into a finished transaction on an exchange or blockchain. Also known as order fulfillment, it links your strategy to the market in real time. Trading execution trading execution encompasses order routing, slippage control, and fee optimization, all of which decide whether a good idea stays profitable. Think of it as the bridge between a signal and the actual coin moving in your wallet – if the bridge wobbles, you lose value.

Key Elements That Shape Execution

The first building block is the market order, an order to buy or sell instantly at the best available price. Its attribute of immediacy means you get filled fast, but you sacrifice price certainty, especially on thin markets. In contrast, a limit order, an order that only executes at a pre‑set price or better gives you price control while risking non‑execution if the market never reaches your limit. These order types influence execution speed, a core attribute of any trading workflow. Another critical factor is liquidity, the depth of buy and sell orders that determines how easily a trade can be entered or exited. High liquidity reduces slippage – the price drift that happens when large orders eat through the order book – so liquidity directly affects the final trade price. Finally, the exchange platform, the marketplace where assets are matched, can be centralized or decentralized, each with its own fee model, security profile, and settlement speed. Centralized venues often offer lower latency and clearer fee structures, while decentralized protocols give you custody of your keys but may introduce higher gas costs and variable settlement times. Together, these entities form a web: liquidity influences slippage, order type determines execution speed, and the exchange platform sets the fee environment.

The articles below dive deep into each of these pieces. You’ll find a side‑by‑side review of Korbit, BitFriends, IncrementSwap, and other exchanges that breaks down fee schedules, security measures, and order‑type support. Our guide on clearing stuck Bitcoin transactions explains how replace‑by‑fee (RBF) and child‑pays‑for‑parent (CPFP) affect execution outcomes. We also cover tax treatment for spot trades, VASP licensing in Nigeria, and Norway’s mining ban – all topics that shape the practical environment where execution happens. By understanding the interplay of market orders, limit orders, liquidity, and exchange choice, you’ll be ready to pick the right setup for any strategy. Below you’ll see the full list of posts that flesh out these concepts with real‑world examples and step‑by‑step instructions.

Market Orders vs Limit Orders: How They Work in Order Books

Learn the key differences between market orders and limit orders, how they work inside an order book, and when to choose each for optimal trade execution.

View More