SEC CASP: Understanding the SEC’s Crypto Asset Service Provider Framework

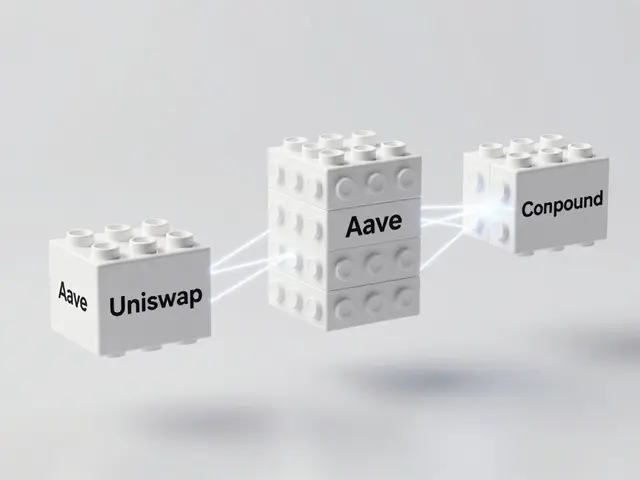

When navigating SEC CASP, the U.S. Securities and Exchange Commission’s Crypto Asset Service Provider classification that governs firms offering crypto‑related services. Also known as SEC Crypto Asset Service Provider, it sets the baseline for compliance, reporting, and consumer protection. crypto regulation, the body of rules that oversee digital asset activities in the United States encompasses this framework, while VASP licensing, the virtual asset service provider licence required for firms that store, transfer or trade crypto requires adherence to SEC CASP standards. In practice, digital asset compliance, the set of internal controls and reporting duties crypto firms must follow influences how the SEC enforces its rules, and cryptocurrency exchanges, platforms that match buyers and sellers of digital tokens must meet the SEC CASP criteria to operate legally. The relationship can be phrased as: SEC CASP encompasses crypto regulation, requires VASP licensing, and influences digital asset compliance; in turn, crypto exchanges must meet its standards, while blockchain technology enables the SEC to monitor activity effectively.

Why SEC CASP matters for the crypto ecosystem

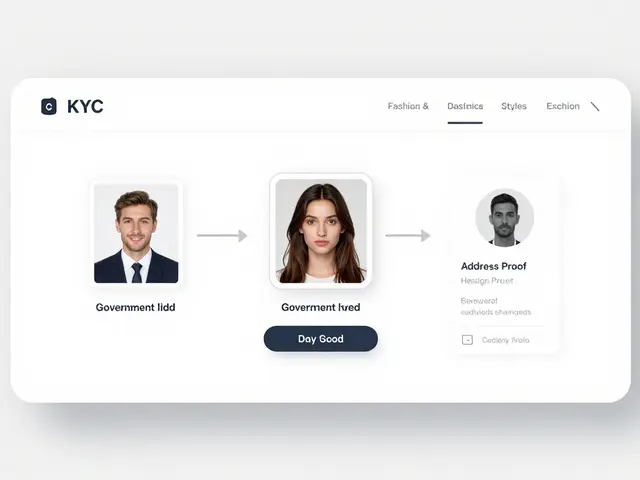

From a trader’s perspective, SEC CASP shapes the safety net around every token you buy. If a platform holds a valid VASP licence, you can expect clearer reporting on trades, stronger security protocols, and better recourse if something goes wrong. That’s why the recent Nigeria VASP license guide, a step‑by‑step look at getting a virtual asset service provider licence in Nigeria mirrors many of the SEC’s expectations: thorough KYC, AML checks, and continuous audit trails. Similarly, Indonesia’s shift from Bappebti to OJK oversight highlights how different jurisdictions adopt parallel models to the SEC’s approach, reinforcing global convergence on compliance. For miners, the Norway crypto mining ban demonstrates how regulatory pressure can shift operational costs, prompting miners to seek jurisdictions that recognize SEC CASP‑aligned licences. Investors eyeing airdrops—like the SupremeX (SXC) or PandaSwap (PND) events—should also check whether the issuing project’s exchange partner holds a VASP licence, because non‑compliant platforms risk token freezes or loss of user funds. In short, every piece of crypto news you read—whether it’s a new exchange review, an airdrop announcement, or a mining policy update—gets filtered through the lens of SEC CASP compliance.

Below you’ll find a curated set of articles that dive deep into the practical side of these rules. From detailed exchange reviews (Korbit, BitFriends, IncrementSwap) that score platforms on their VASP status, to country‑specific regulation breakdowns (UAE, Nigeria, Indonesia), and guides on handling stuck Bitcoin transactions or tax treatment of spot trades, the collection gives you a 360‑degree view of how SEC CASP shapes the market today. Use these insights to spot compliant services, avoid potential scams, and make informed decisions as the regulatory landscape keeps evolving.

Crypto Licensing Requirements in the Philippines: SEC Guidelines for CASPs

A detailed guide on the Philippines SEC's 2025 crypto licensing rules, covering capital, office, AML, marketing, fees, enforcement, and step‑by‑step application tips.

View More