Digital Financial Assets: The Complete Overview

When we talk about digital financial assets, we’re referring to electronic representations of value that can be transferred, stored, or traded on distributed networks. digital financial assets, digital representations of value that can be transferred, stored, or traded on blockchain networks. Also known as crypto assets, they blend finance and technology to create new investment opportunities, enable border‑less payments, and power decentralized applications. Over the past decade these assets have moved from niche experiments to mainstream portfolio items, attracting retail investors, institutional funds, and even governments looking to modernize their monetary systems. Understanding what they are, how they work, and why they matter is the first step before you dive into the detailed guides below.

Key Concepts Shaping the Space

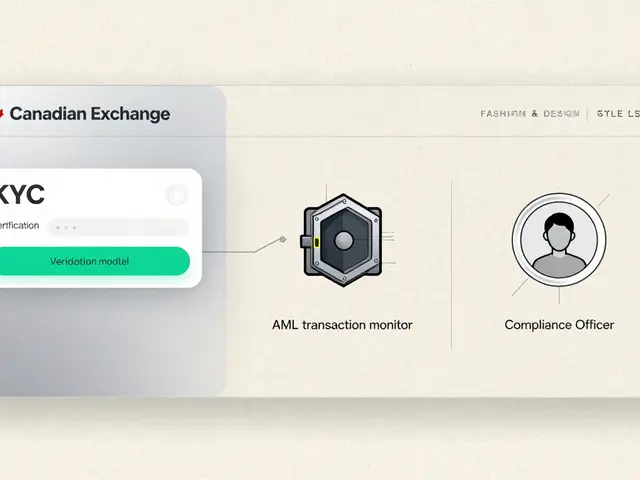

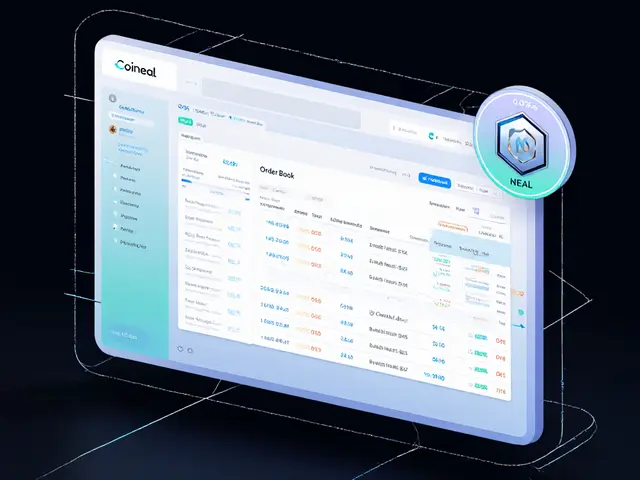

Cryptocurrency, a type of digital currency secured by cryptographic techniques is the most visible slice of digital financial assets. It comes in many flavors – from fixed‑supply coins like Bitcoin that use proof‑of‑work consensus, to inflationary tokens with programmable emission rates, and even stablecoins pegged to fiat currencies. blockchain, a decentralized ledger that records transactions across many computers provides the trust layer that makes cryptocurrency possible. Features such as immutable transaction records, smart‑contract capabilities, and varying scalability solutions (e.g., sharding, layer‑2 rollups) directly influence a coin’s speed, cost, and security. Because the blockchain guarantees transparency, crypto exchanges, online platforms that match buyers and sellers of digital assets can operate efficiently, offering order‑book depth, fee tiers, and custody options that cater to both day traders and long‑term holders. An exchange’s security model – multi‑sig wallets, cold storage ratios, and KYC/AML procedures – determines how safely users can trade. Another growth engine is the airdrop, a distribution method where projects give free tokens to eligible users. Airdrops raise awareness, seed liquidity, and reward early community members; they often require tasks like wallet verification, social media engagement, or holding a specific token. Together, these four pillars – cryptocurrency, blockchain, crypto exchange, and airdrop – create an ecosystem where digital financial assets can be created, exchanged, and adopted at scale.

The articles you’ll find below cover the full spectrum of this ecosystem. Want to know the tokenomics behind niche projects like Flourishing AI or Midnight Evergreen? Curious about how Norway’s mining ban or the UAE’s licensing framework will affect market dynamics? Need a step‑by‑step guide to claim the latest PandaSwap or Leonicorn Swap airdrops? Looking for unbiased reviews of exchanges such as Korbit, BitFriends, or IncrementSwap, including fee breakdowns and security assessments? We also dive into practical topics like liquid‑staking with Quicksilver, tax treatment of spot trades in the US, and strategies for miners coping with the 2024 Bitcoin halving. Whether you’re a beginner trying to grasp the basics of blockchain, an investor evaluating the risk of meme‑coins, or a developer exploring DeFi token models, the collection below gives you actionable insights you can apply right away. Explore the posts to deepen your knowledge of digital financial assets and stay ahead of the fast‑moving crypto landscape.

Bappebti Crypto Oversight & Licensing: What You Need to Know

Learn how Bappebti regulated crypto assets, the licensing steps it required, and what changed when oversight moved to OJK in 2025.

View More