Asset Seizure Crypto: How Authorities Freeze Digital Assets

When dealing with asset seizure crypto, the process where law enforcement or regulators take control of crypto holdings. Also known as crypto asset freeze, it kicks in when a court order, AML violation, or sanctions list targets a wallet or exchange account. The move can happen on a single address or across an entire platform, and it often starts with a request to the exchange that holds the funds.

Understanding crypto regulation, the set of rules that govern how digital assets are created, traded and reported is crucial because regulators decide when a seizure is legal. In the United States, the Treasury’s OFAC can block wallets linked to sanctioned parties, while the EU’s AML directives give local authorities power to freeze assets that appear in illicit activity. These rules shape the environment where seizures happen and tell exchanges what they must do when they get a freeze notice.

Law enforcement agencies, from the FBI to Europol, are the other key player. law enforcement, government bodies that investigate crime and enforce court orders use blockchain forensics tools to trace coins, identify mixers, and locate the final holder. When they find a trail, they issue a subpoena or a warrant that forces an exchange to hand over the assets. This partnership between forensic analysis and legal authority is the backbone of any crypto seizure operation.

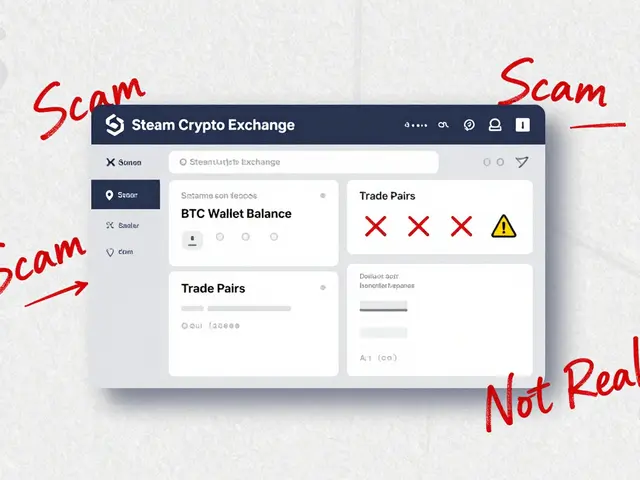

Most seizures hit exchanges that hold a VASP (Virtual Asset Service Provider) license. VASP licensing, the official permission for a platform to offer crypto services under regulatory oversight means the platform must keep detailed KYC records, monitor transactions, and respond quickly to seizure requests. In Nigeria, the ARIP fast‑track program makes it easier for crypto firms to get a license, but it also binds them to stricter reporting standards. When a VASP‑licensed exchange is served with a freeze order, it can lock the targeted wallets almost instantly, preventing the user from moving the funds.

Key Factors Behind Crypto Asset Seizures

Three main factors drive an asset seizure crypto event: compliance gaps, illicit use cases, and geopolitical pressure. Compliance gaps appear when an exchange fails to verify users properly, allowing criminals to move funds unnoticed. Illicit use cases include ransomware payments, darknet sales, or money‑laundering schemes—any activity that draws a law‑enforcement spotlight. Geopolitical pressure rises when sanctions are imposed on a country or a specific individual, prompting authorities to block any crypto linked to them. Together, these forces create a chain where regulation sets the rules, law enforcement finds the breach, and VASP‑licensed platforms execute the freeze.

For anyone holding crypto, the takeaway is simple: keep records, use reputable exchanges, and stay aware of the regulatory climate in your jurisdiction. Below you'll find a hand‑picked set of articles that walk through real‑world seizure cases, compliance checklists, and tools you can use to protect your assets or respond quickly if a freeze notice arrives.

Crypto Asset Forfeiture Rules in Nepal 2025

Learn how Nepal enforces its crypto ban through asset forfeiture, the legal framework, penalties, and practical steps to avoid severe criminal consequences.

View More